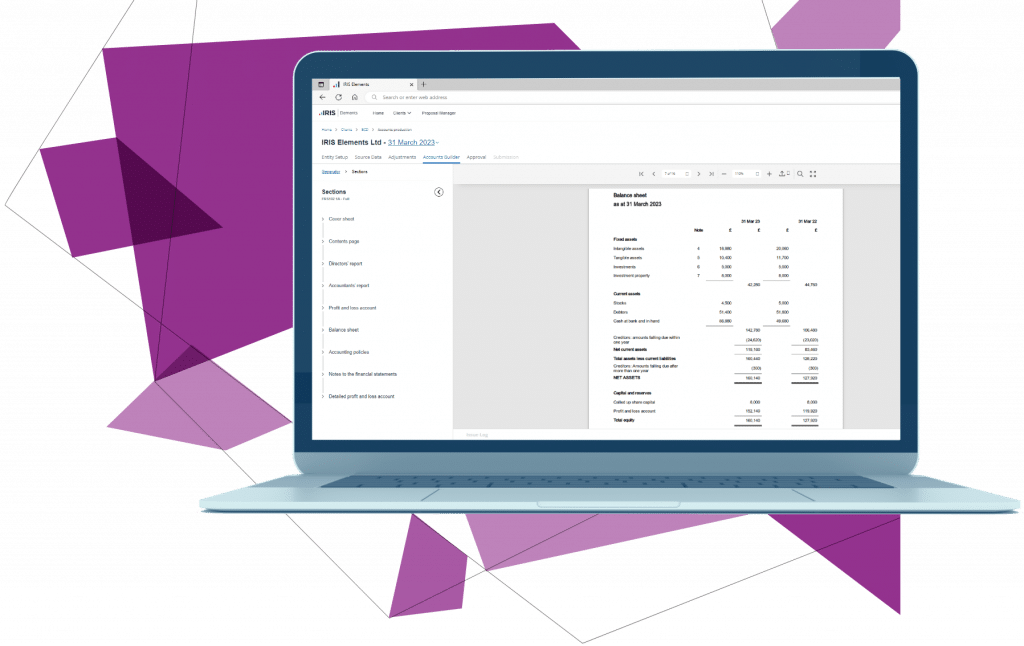

IRIS Elements Accounts Production

Streamlined Accounts

Production

Essentials plan for start-up & small practices,

or Professional plan for medium practices

From £3 per month

Trusted, Scalable Compliance

Prepare compliant accounts for sole traders, partnerships, and micro and small limited companies (FRS 105, FRS 102 Section 1A) as well as dormant limited company accounts. Integrate with IRIS Elements Tax and Companies House so that you can deliver peace of mind to your clients and right-first-time accounts to Companies House.

Choose a plan that’s right for you

-

Accounts Production Essentials

Small practices with simpler needs – if you have over 100 clients please contact us

from £3 per month *IRIS Elements Accounts Production – over 100 clients

Our Essentials plan for IRIS Elements Accounts Production has the capability for those practices with simple client needs.

- 100 or more clients: To help you get the right product fit for your practice we recommend you speak with one of our team to ensure that you have all the capabilities that you need to manage your client requirements.

- IRIS Elements Accounts Production Essentials: Prepare compliant accounts for sole traders, partnerships, and micro and small limited companies (FRS 105, FRS 102 Section 1A) as well as dormant limited company accounts. Integrate with IRIS Elements Tax and Companies House so that you can deliver peace of mind to your clients and right-first-time accounts to Companies House.

Contact us for pricing

Includes:

-

Sole Trader & Partnerships

-

Limited Company FRS105, FRS 102S1A & Dormant

-

Simple chart of accounts – fixed account descriptions

-

Simple trial balance entry

-

Direct electronic filing to Companies House

Optional add-ons:

-

IRIS Elements Tax

from £9 per month

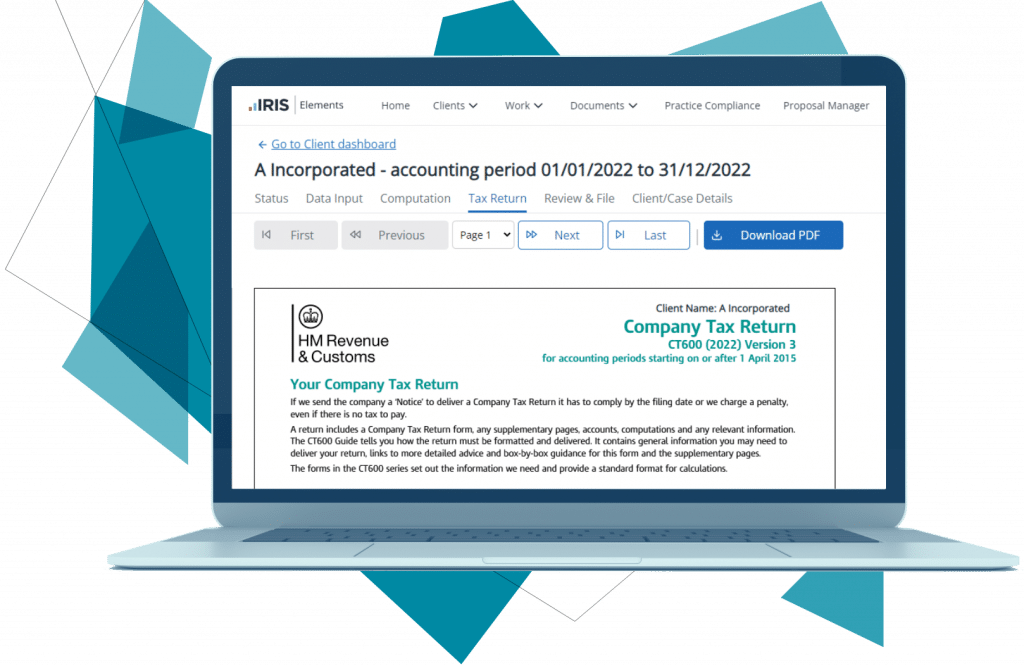

IRIS Elements Tax is an MTD cloud compliance solution perfect for a start–up or small practice (Essentials) with simple client needs and for medium practices (Professional) with more complex requirements. With Personal Tax, Partnership Tax, Corporation Tax, Trust Tax and VAT Filer all on one platform using one client list, efficiency will be at the heart of everything you do. We also offer more Elements products to help Manage Your Practice.

- Personal Tax: Easy preparation of tax returns and supplementary pages with inbuilt calculators and reports

- Partnership Tax: Easy allocation of profits to partners that can link to individual records

- Corporation Tax: Generate fully tagged iXBRL computations and submit them to HMRC

Contact us for pricing

-

IRIS Elements Professional Services

IRIS Elements Professional Services

A focused training webinar for all our Elements products, which is delivered by subject matter experts who have many years of experience. We also offer more Elements products to help Manage Your Practice.

- Bespoke training to fit your practice – tailored to your requirements

- Cover process, functionality and provide guidance on how to get the most out of our products

- Experienced professionals supporting accountancy practices

Contact us for pricing

-

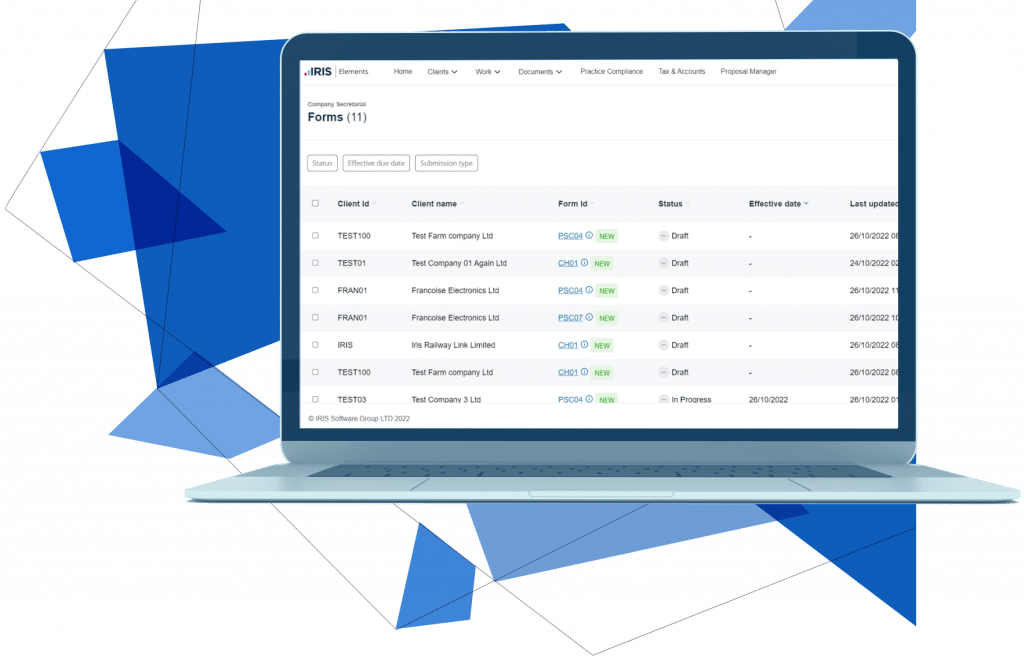

IRIS Elements Company Secretarial

IRIS Elements Company Secretarial

from £6 per client

IRIS Elements Company Secretarial allows you to easily create and submit to Companies House the most popular company secretarial forms, all in one place, while maintaining your client records. We also offer more Elements products to help Manage Your Practice.

- Forms such as the AP01 and CH01 are automatically created and stored

- Generate and submit Confirmation Statements (CS01) to Companies House in a few clicks

Contact us for pricing

-

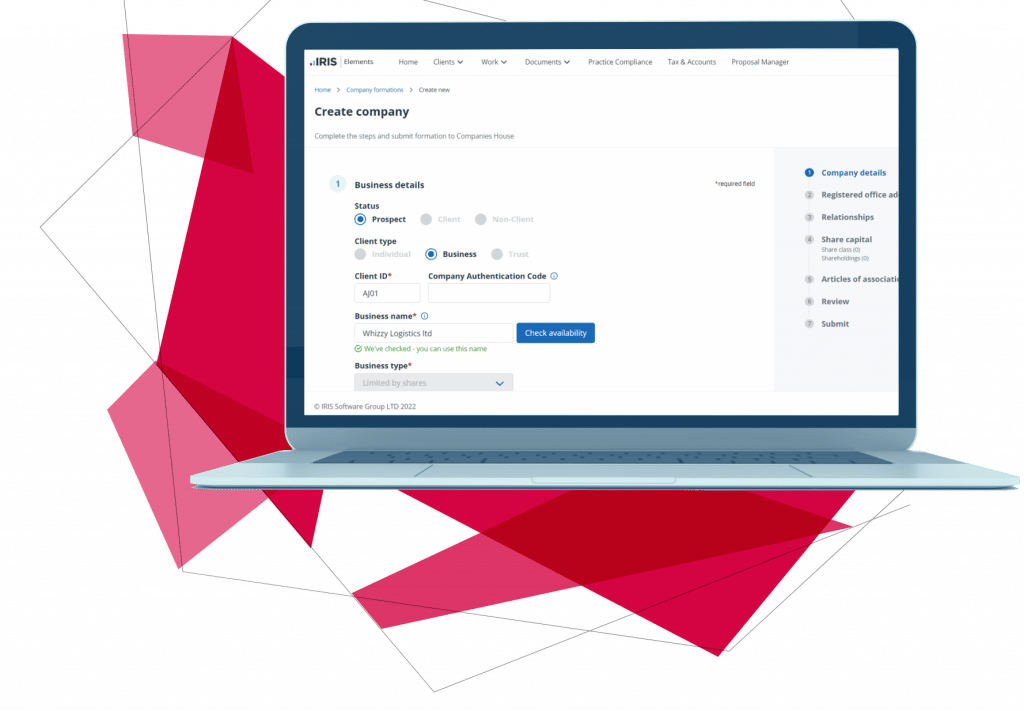

IRIS Elements Company Formations

IRIS Elements Company Formations

from £5.70 per formation

IRIS Elements Company Formations, an intuitive wizard for forming companies, is integrated into the Elements platform enabling newly formed companies to be shown in the central client list. We also offer more Elements products to help Manage Your Practice.

- A step-by-step wizard to form companies (limited by shares)

- Your newly formed company will be visible in client management, IRIS Elements Company Secretarial and IRIS Elements AML, allowing you to seamlessly manage your workflow

- Submit directly to Companies House and receive a response from them within 24hrs

Contact us for pricing

-

Accounts Production Professional

Medium sized practices with more complex needs and varying number of clients

Request pricing belowAccounts Production Professional

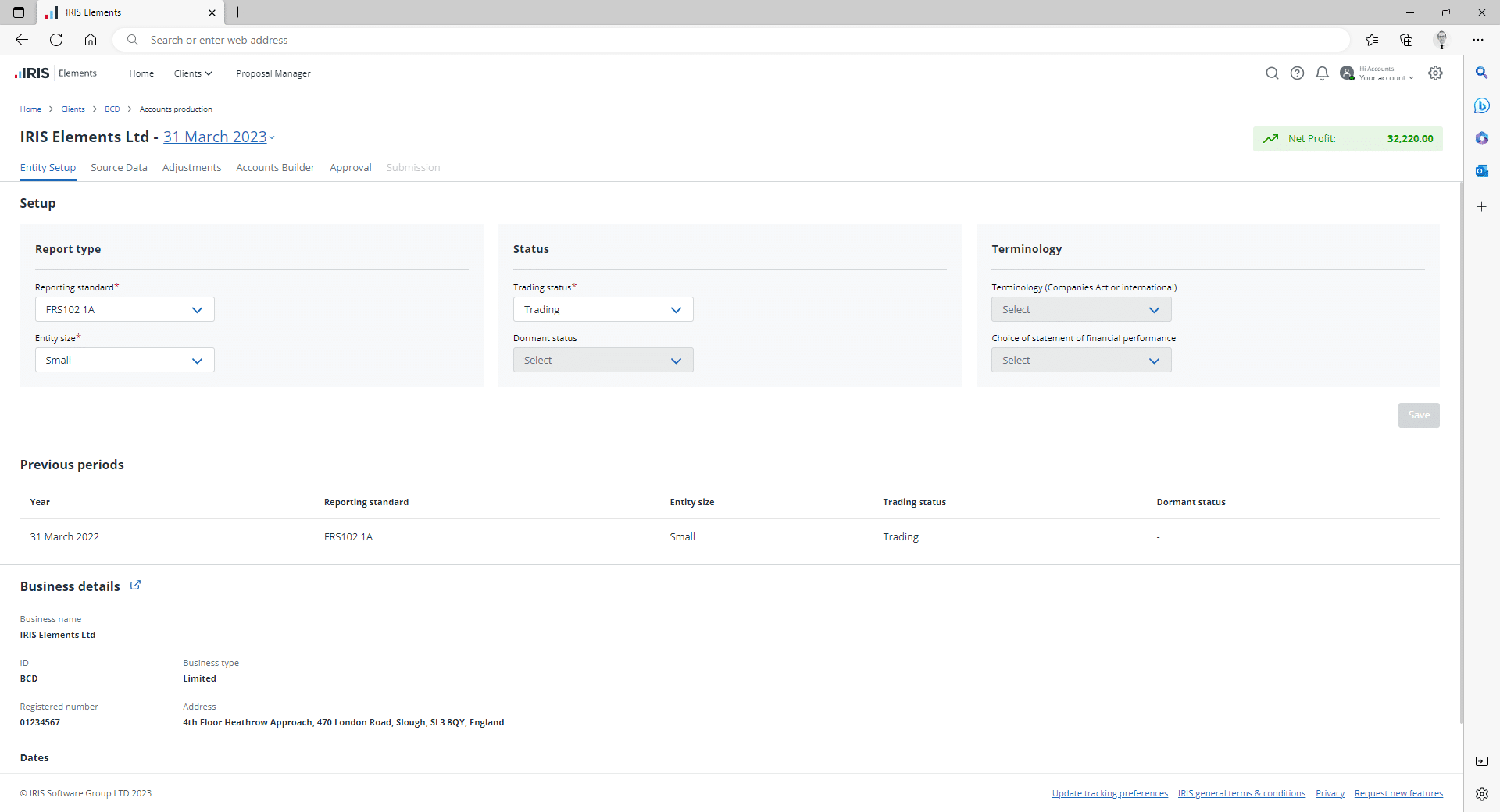

IRIS Elements Accounts Production Professional is perfect for medium practices with more complex requirements. Intuitive workflows, whether handling simple or complex matters, drive efficiencies across your account’s preparation. We also offer more Elements products to help Manage Your Practice.

- Comprehensive chart of accounts

- Flexible and editable account descriptions

- Exception reporting

Contact us for pricing

Includes:

-

Sole Trader & Partnerships

-

Limited Company FRS105, FRS 102S1A & Dormant

-

Comprehensive chart of accounts & flexible and editable account descriptions

-

Simple opening trial balance entry plus journal adjustments

-

Direct electronic filing to Companies House

-

Exception reporting

Optional add-ons:

-

IRIS Elements Tax

from £9 per month

IRIS Elements Tax is an MTD cloud compliance solution perfect for a start–up or small practice (Essentials) with simple client needs and for medium practices (Professional) with more complex requirements. With Personal Tax, Partnership Tax, Corporation Tax, Trust Tax and VAT Filer all on one platform using one client list, efficiency will be at the heart of everything you do. We also offer more Elements products to help Manage Your Practice.

- Personal Tax: Easy preparation of tax returns and supplementary pages with inbuilt calculators and reports

- Partnership Tax: Easy allocation of profits to partners that can link to individual records

- Corporation Tax: Generate fully tagged iXBRL computations and submit them to HMRC

Contact us for pricing

-

IRIS Elements Professional Services

IRIS Elements Professional Services

A focused training webinar for all our Elements products, which is delivered by subject matter experts who have many years of experience. We also offer more Elements products to help Manage Your Practice.

- Bespoke training to fit your practice – tailored to your requirements

- Cover process, functionality and provide guidance on how to get the most out of our products

- Experienced professionals supporting accountancy practices

Contact us for pricing

-

IRIS Elements Company Secretarial

IRIS Elements Company Secretarial

from £6 per client

IRIS Elements Company Secretarial allows you to easily create and submit to Companies House the most popular company secretarial forms, all in one place, while maintaining your client records. We also offer more Elements products to help Manage Your Practice.

- Forms such as the AP01 and CH01 are automatically created and stored

- Generate and submit Confirmation Statements (CS01) to Companies House in a few clicks

Contact us for pricing

-

IRIS Elements Company Formations

IRIS Elements Company Formations

from £5.70 per formation

IRIS Elements Company Formations, an intuitive wizard for forming companies, is integrated into the Elements platform enabling newly formed companies to be shown in the central client list. We also offer more Elements products to help Manage Your Practice.

- A step-by-step wizard to form companies (limited by shares)

- Your newly formed company will be visible in client management, IRIS Elements Company Secretarial and IRIS Elements AML, allowing you to seamlessly manage your workflow

- Submit directly to Companies House and receive a response from them within 24hrs

Contact us for pricing

Why choose IRIS Elements Accounts Production software?

-

Trusted

We’ve been chosen by 91 out of the Top 100 Accountancy firms in the UK and have a record of over 99% acceptance rate for accounts submissions to Companies House. Our trusted solutions are built from over 44 years of experience.

-

Efficient

Automation and intuitive workflows all combine to drive efficiency, accuracy and successful outcomes for your compliance.

-

Integrated

Create iXBRL financial statements for direct electronic submission to Companies House. Integrate with IRIS Elements Tax to calculate the tax and prepare the tax return.

-

Scalable

IRIS Elements grows with you. Add new capabilities when you need them, like AML and practice management, and harness a single view of all client data across your practice.

What’s Included?

-

Sole Traders, Partnerships and Limited Companies

Designed with your clients in mind, IRIS Elements provides the tools to produce compliant accounts for sole traders, partnerships and limited companies including micro entities, small companies or dormant companies.

-

Data Entry

Simply enter or import your client’s opening trial balance before entering your journal adjustments*, allowing you to keep a track of the changes made. Our comprehensive chart of accounts helps you to produce a set of accounts to match your client’s individuality.

* only available in the professional version

-

Integrations

Create iXBRL financial statements ready for direct electronic submission to Companies House, by importing or manually entering the initial trial balance, adding your own adjustments and corrections before completing the required information for the notes. Then you can share the data with IRIS Elements Tax.

-

FREE bookkeeping tool

IRIS Elements Cashbook comes FREE with IRIS Elements Accounts Production and helps your sole trader clients with bookkeeping. Not only does it include our market leading payment service IRIS Pay to collect your client payments efficiently, but it also has unlimited bank feeds, all supporting your digital client experience.

See what our customers are saying

Start using IRIS Elements Accounts Production for free

Try out Essentials today, then decide the best plan for you

FAQs

-

This information will be taken from the central client list, reducing time entering data as well as improving accuracy due to no duplication. This identical data will be shared within IRIS Elements Tax.

-

No, you can import a CSV file into the relevant year. Imports from bookkeeping packages will be available later this year.

-

Once the initial trial balance is entered via Source data, when using Professional you can post adjustments to complete the final trial balance.

-

When running the reports, it is clear when extra data is needed, for example the average number of employees. This level of exception reporting ensures your accounts are submitted successfully first time to Companies House.

-

Basic client data is identical between both Tax and Accounts Production and can be edited in the central client screens. Trial balance information will be shared with Tax where relevant. Accounts for companies can be generated in iXBRL to be attached to the CT600.

-

There is a basic approval process which updates the status of the accounts at each stage. There will be further improvements to this area as well as including the ability to send accounts to your client through a portal.