Processing an annual payroll scheme

Article ID

11713

Article Name

Processing an annual payroll scheme

Created Date

6th April 2018

Product

IRIS Bureau Payroll, IRIS Payroll Business

Problem

How can I process an annual payroll scheme? (ie employee(s) paid just once ion the tax year)

Resolution

There now two options for processing a payroll annually, company level (ie ALL employee paid annually) or employee level (ie. just that employee is paid annually)

Company Level

An Annual Scheme indicator is now available in Company Options.

The Annual Scheme function is designed for a company where all employees are to be paid just once a year, in the same single tax month, and the employer is only required to pay HMRC annually.

With this option ticked, Payroll will use the annual thresholds for Tax and NI when calculating the payroll.

To use this function:

- Go to “Company” > “Company Details”

- Tick the “Annual Scheme” option

- Click “OK” to save the change

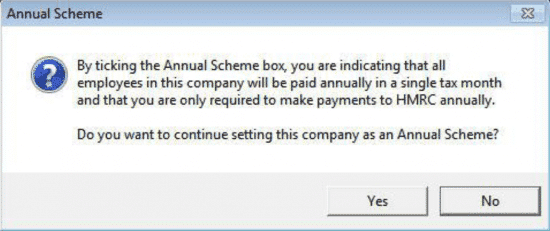

- If you have not yet paid any employees in this tax year, the following message will appear:

- Click “Yes” the “OK” to save the change.

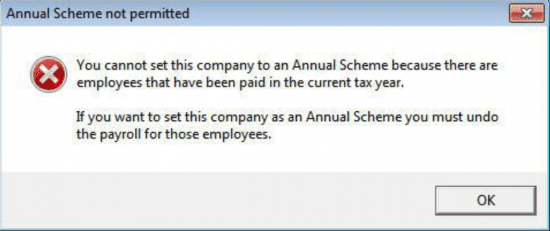

- If you have already paid employees in this company you will see the following message instead:

- You will be unable to set the Annual Scheme indicator if employee in the company have been paid in the current tax year.

- Once the Annual Scheme indicator is set, when running payroll, just select the appropriate pay period as normal. Payroll will use the annual thresholds for the calculations.

NOTE: When pay is annual payroll will not be able to calculate average earnings for statutory payments. When setting up statutory payments you will need to calculate and type in the average earnings manually.

Employee Level

A Pay Annually indicator is now available in Employee Details.

The Pay Annually function is designed to be used for Pension drawdown, which permits payments to be made to employees in different pay periods, and payments are made to HMRC more than once in the tax year.

To use this function:

- Open the ‘Employee’ menu, click on ‘Select Employee’ and from the list select the relevant employee

- Select the ‘Period’ tab and tick the ‘Pay Annually’ box

- Click ‘Save’

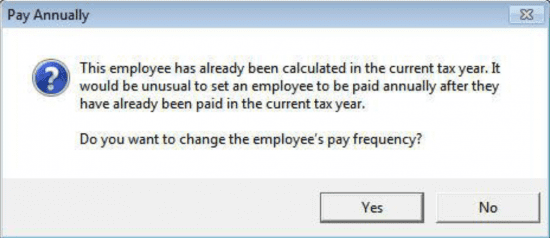

- If the employee has already been paid in the current tax year, this message will appear:

- Click ‘Yes’ to apply the changes or ‘No’ for the Pay Frequency to remain as it was

- Set the ‘Next Tax Pay Period’ to be the pay period you intend to pay the employee

- If you currently don’t know when you are to pay, select ‘Hold’ on the Period tab to prevent them appearing in the payroll.

- At the point you know when they are to be paid, de-select ‘Hold’, set the pay frequency and set the ‘Next Tax Pay Period’ to be the pay period you intend to pay them.

Regardless of the Next Tax Pay Period you select, payroll will still use the annual thresholds to calculate the employee’s pay when Pay Annually is ticked.

Moving into the new tax year (All employee paid annually)

Please Note: This method can also be used to bring a pay frequency to year end for any other reason, eg. all employees moved to monthly, leaving weekly payroll unused.

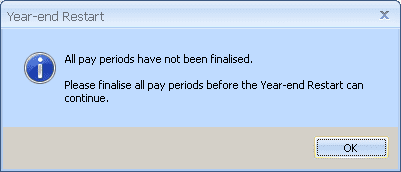

Once you have completed your single pay period of the tax year you will need to finalise all the remaining periods before the software will allow you to complete the year end restart. otherwise users will get the following message:

First make sure you have finalised the period you processed payment in, in the the normal manner.

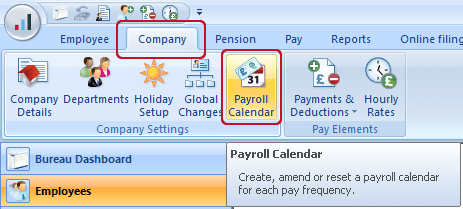

To quickly finalise all the remaining pay periods in the tax year go to “Company” > “Payroll Calendar“:

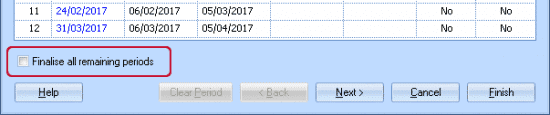

For each frequency you wish to close to year end, tick “Finalise all remaining periods“

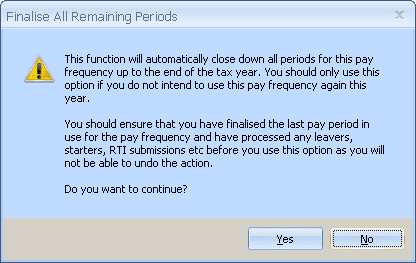

Click “Finish” and you will see the following message:

If you are happy you have completed all the tasks detailed in the message click “Yes” and click “Yes” again on the final confirmation prompt.

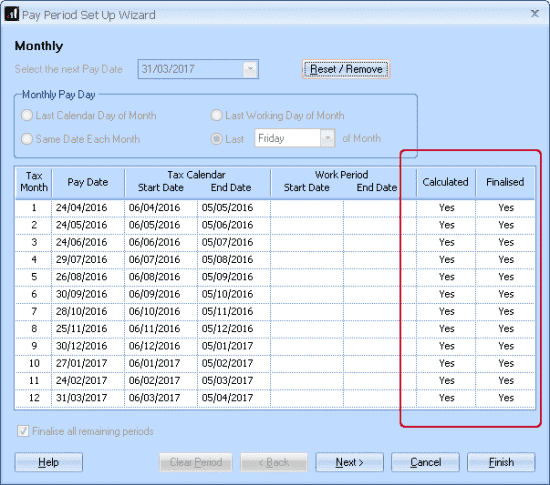

You should see that all the pay periods on this frequency are now marked as calculated and finalised through to the end of the tax year:

You can now move your payroll into the new tax year with the normal method, “Year-End” > “Year-End Restart“

Please Note: If you have multiple pay frequencies set up on the company, all of these need to be finalised to year end before you can perform a year end restart.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.