How and when a company's director would be exempt from automatic enrolment.

Article ID

11788

Article Name

How and when a company's director would be exempt from automatic enrolment.

Created Date

6th December 2017

Product

IRIS PAYE-Master, IRIS Payroll Business, IRIS Bureau Payroll, IRIS GP Payroll, IRIS Payroll Professional, Earnie, IRIS Earnie IQ

Problem

How and when a company's director would be exempt from automatic enrolment.

Resolution

Please note: This information was provided by The Pensions Regulator

https://www.thepensionsregulator.gov.uk/employers/What-if-I-dont-have-any-staff.aspx

If you don’t have any staff other than directors, you may not have any automatic enrolment duties. You won’t have any duties if the only people working for you are:

– you as the sole director, or

– a number of directors, none of whom has an employment contract, or

– a number of directors, only one of whom has an employment contract

– Automatic enrolment will apply if more than one director has a contract of employment.

You can find more information about employment contracts on the employment status section of the GOV.UK website. You can find more information about your duties if you’re a director in automatic enrolment enquiries. (The Pensions Regulator website – Opens in a new window)

What do you need to do?

If you receive a letter which includes your staging date and you believe that automatic enrolment duties don’t apply to you, please visit https://www.thepensionsregulator.gov.uk/employers/What-if-I-dont-have-any-staff.aspx and follow the instructions. You’ll need your letter code, PAYE reference and Companies House number (if you have one) to hand.

If your circumstances change so that automatic enrolment duties apply to you, you’ll need to inform us (the pension regulator) of this as soon as possible. This would happen if you took on a member of staff other than a director, or if at least two directors started working for you under contracts of employment.

What you need to do with your payroll software

If you do have a payroll company with employees who are exempt from AE simply set their “Worker Status” (found in the pension information in the employee details screen) to “Exclude from auto enrolment“.

Please do take care activating this option and only use when you have confirmed with the pension regulator or your pension provider the employee in question is exempt from AE.

You can find more information about your duties if you’re a director in

automatic enrolment enquiries. (The Pensions Regulator website – Opens in a new window)

Director exemption of duties detailed guidance

Please note:This information was provided by The Pensions Regulator

Compliance issue

The rules on how and when company directors are exempted from automatic enrolment are not always fully understood.

An individual who is a director of a company is not classed as a worker (and the company is therefore not subject to the employer duties in relation to this individual) unless:

1. the individual works for the company under a contract of employment

and

2. there is at least one other person working for the company under a contract of employment.

This exemption can apply to more than one director working for the same company – each director must be considered individually.

So, a director who is not working under an employment contract is never classed as a worker.

However, an individual who is not a director (who may or may not be considered as self-employed for tax purposes) could be assessed as a worker for the purposes of the automatic enrolment duties, if:

i. they provide work or services to the company personally, which means:

• the employer expects them to perform the work themselves, and

• they cannot sub-contract the work or send a substitute (unless they are unable to perform the work, eg due to sickness).

and:

ii. they are not undertaking the work as part of their own business, which means that most, or all, of the following statements are true: if the employer…

• has control over an individual’s method of work (eg hours worked);

• provides employee benefits;

• bears all the significant financial risks in carrying out the work (eg the worker is not financially responsible for faulty work);

• provides what is required for the individual to carry out the work.

This list is not exhaustive, an employer must take into account all relevant considerations and make a reasonable judgement.

So, the exemption depends on understanding the legal arrangements under which any particular individual works for the company. There are four possible types of contract mechanisms:

1. No contract. An individual may hold the office of director and carry out the statutory duties required by the Companies Act 2006 without having a contractual relationship with the company at all. A director in this position is never classed as a worker.

2. Contract to provide work or services to the company personally and they are undertaking the work as part of their own separate business. An individual in this position is never classed as a worker, whether they are a director or not.

3. Contract to provide work or services personally, but not as part of the individual’s own separate business. Ordinarily, an individual in this position is classed as a worker. But a director working under this kind of contract is never classed as a worker.

4. Contract of employment. Ordinarily, an individual in this position is a worker. A director working under this kind of contract is only classed as a worker if there is at least one other person also working for the company under a contract of employment.

Ordinarily, the employer duties begin to apply to a company on a staging date based on the number of individuals in the company’s largest PAYE scheme on 1 April 2012 and/or the PAYE reference. However, if as at 1 April 2012 a company had a PAYE scheme but did not have any workers (for example, because of the director exemption explained above), it is not an employer and this staging date does not apply.

If such a company then took on a worker before 1 October 2017, it would be classed as a ‘new employer’ and would get a staging date between May 2017 and February 2018 (depending on the date PAYE is first used to pay the worker). If the company took on a worker on or after 1 October 2017, the employer duties apply from the date PAYE is first used.

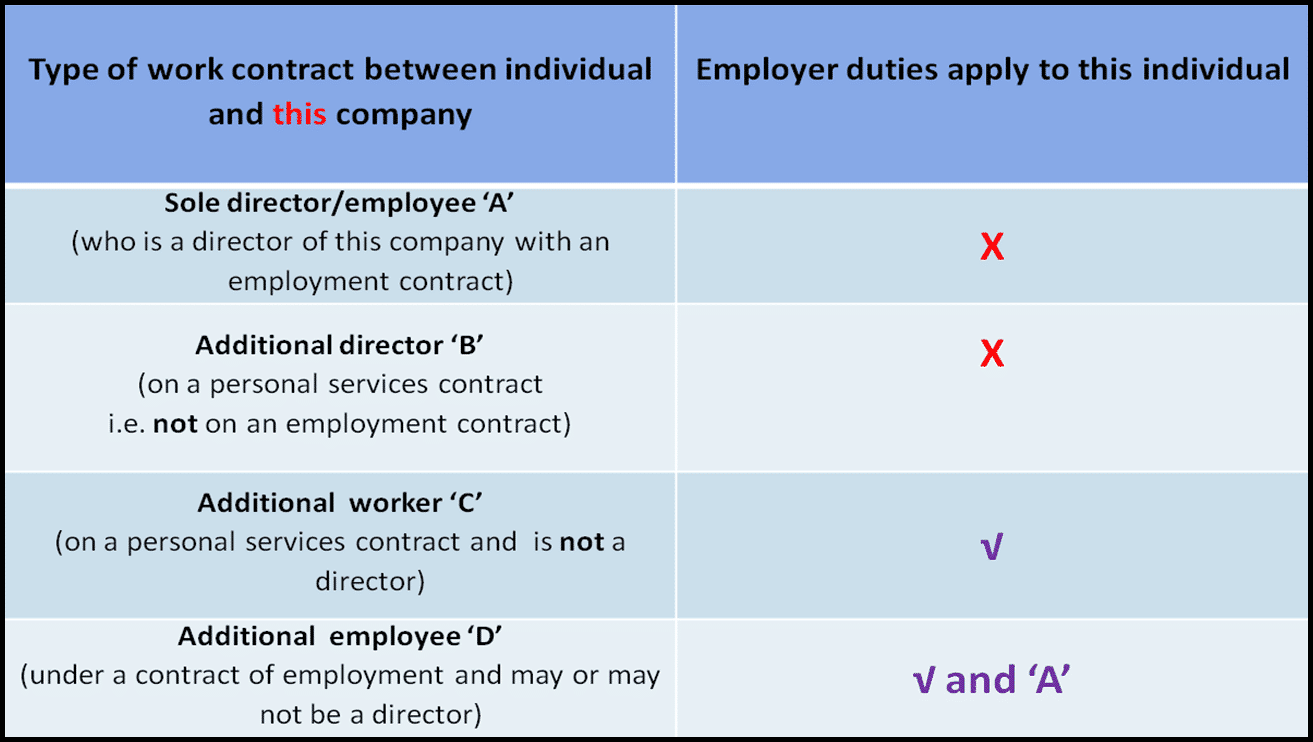

Example

A. An individual, ‘A’, is the director and sole employee of a company. ‘A’ has a contract of employment but is not classed as a worker because of the second limb of the director exemption (no one else working for the company under a contract of employment). The employer duties do not arise.

B. An additional director, ‘B’, begins working for the company under a personal services contract. ‘B’ is not classed as a worker because of the first limb of the director exemption (not working under a contract of employment). ‘A’ is still not classed as a worker because there is still no one else working for the company under a contract of employment.

C. The company then takes on a new member of staff, ‘C’, who is not a director. ‘C’ also works under a personal services contract, and (not being a director) is classed as a worker by virtue of that contract. The company has employer duties in respect of ‘C’, but not in respect of ‘A’ or ‘B’, who continue to be covered by the director exemption for the same reasons as before.

D. The company then takes on a new member of staff, ‘D’ under a contract of employment. The employer duties continue to apply in respect of ‘C’. Now that there is someone else working for the company under a contract of employment, the director exemption ceases to apply to ‘A’, and ‘A’ is now classed as a worker in respect of whom the employer duties apply. However, because ‘B’ continues to work under a personal services contract rather than a contract of employment, the director exemption continues to apply to ‘B’.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.