Flexible and Powerful

Payroll Solutions

Used by 280,000+ organisations

Paying 1 in 6 UK employees

Our payroll solutions ensure every pay run is a success

Whether you’re looking for payroll software to run your payroll in-house or looking to outsource your payroll to our experts; we’ve got a solution for you.

-

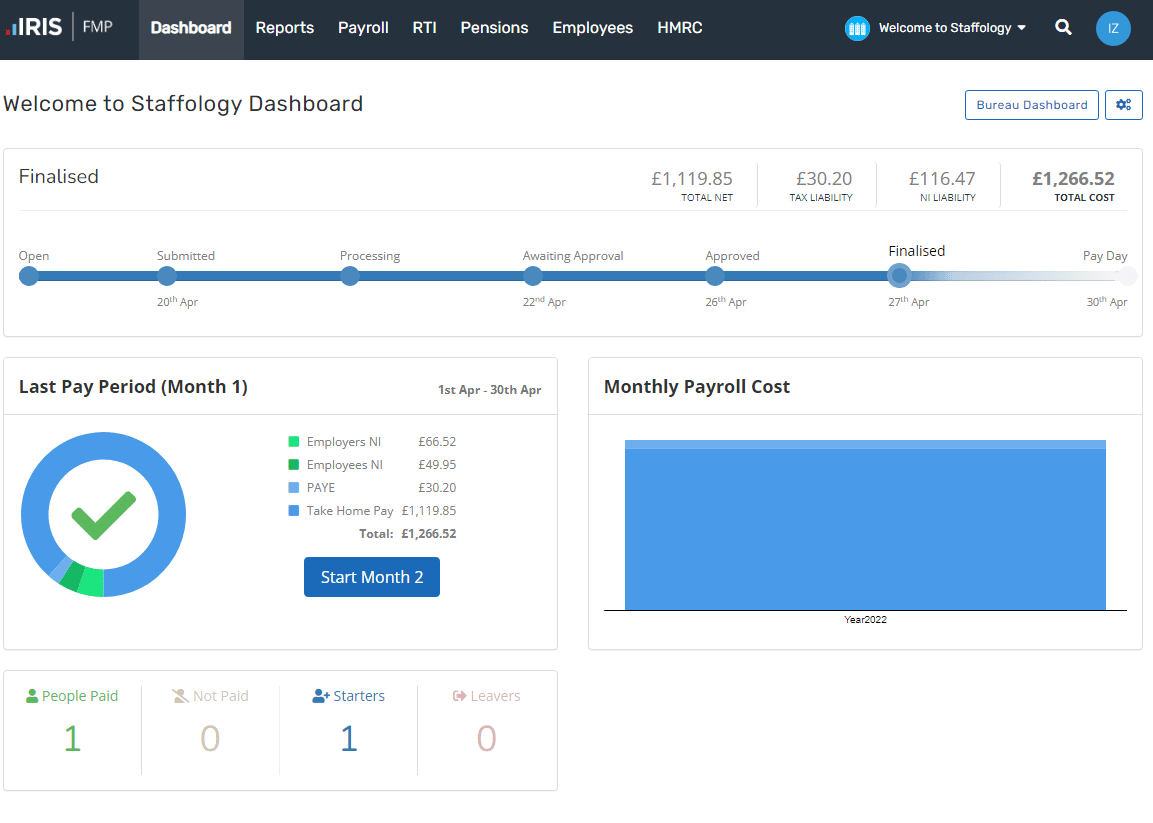

Payroll Software

Staffology payroll is for all businesses, from start-ups, accountants and bureaus to large businesses who want a complete solution for their payroll needs.

- Cloud-based, modern payroll software

- Seamless integrations to your existing systems

- Save time with automations

- Perfect for PAYE, CIS, Off-Payroll Working and Umbrella companies

-

Managed Payroll Service

If you’re looking for complete peace of mind, an outsourced payroll solution might be the right option for you and your business.

- Dedicated support from certified payroll professionals

- Guaranteed your payroll is accurate, secure, and compliant

- Easy-to-use Employer Portal that gives you full visibility

-

International Payroll Services

We have in-country payroll experts located across 135 countries to help ensure your international payroll is accurate and compliant.

- Experienced global payroll & HR specialists

- One dedicated single point of contact

- Combined international payroll & HR service

- One uniform service across different countries

“I wholeheartedly recommend Staffology payroll as it has reduced our repetitive payroll processing time by a one third.

Prior to using Staffology our payroll processing took 3 weeks and required 3 staff members on average. With the use of Staffology, we have one staff member working intermittently on payroll over 3 days.”

Jamil Raja – J.Raja & Company

Why choose IRIS Software for payroll?

-

Connected technology

Simple to use cloud-based payroll with extensive features and powerful APIs that help you to do payroll better and give a modern, digital connected experience

-

Quality services

We offer Managed Payroll solutions where our certified payroll professionals can provide in-depth knowledge from years of experience and training

-

Keeping you compliant

Our payroll software, people and processes are continuously updated to ensure you are up to date with the latest payroll legislation

-

Specialised expertise

We have a range of payroll solutions to cater for a wide range of sector specific payrolls and complex payroll requirements

Customer Success Stories

Our Awards

Ready to talk to one of our experts?

Fill out our quick form so we can make sure you speak to the right person.