Automatic Enrolment – Software & Resources

The IRIS Automatic Enrolment solution, the IRIS AE Suite™, has been adopted by over 18,500 organisations assessing over a million employees.

What are people saying that have already staged?

IRIS has developed a comprehensive Auto Enrolment software, the IRIS AE Suite™, which includes assessment, communications and electronic payslips and P60s. Watch the video to see how the IRIS AE Suite™ helps businesses comply with Auto Enrolment legislation.

What is Auto Enrolment?

The government have introduced new legislation to auto enrol all eligible employees in the UK into qualifying workplace pensions. The reason that they have done this is because as a society, our population is ageing, living longer and the ratio of people working to those retired is slowly decreasing. This means that in the future, there will be less people working to pay taxes and more people retired and needing support. The workplace pensions reform was brought in to ensure that people were better prepared for retirement and would have less of a dependance on the state.

So who does it apply to?

Those employees that need to be auto enrolled into workplace pensions will meet certain criteria:

- Not already in a qualifying pension scheme.

- Aged between 22 and state pension age.

- Earning over £10,000 per annum.

- Usual place of work is in the UK.

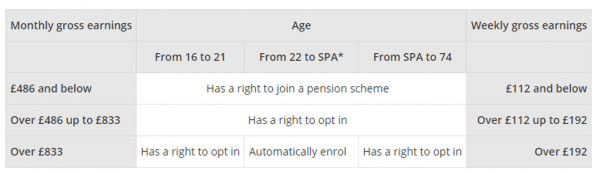

What about people that don’t fall into this criteria?

Legally, you must auto enrol those employees that fall under the aforementioned criteria. As for those employees that don’t fall within this criteria, some may opt-in to auto enrolment should they wish to.

The following are set out below:

IRIS On-Demand Webinars

Why not visit our On-Demand Webinar resource centre? This is a selection of our previous live webinars, recorded so that you don’t miss a thing.

Click the link below, choose what type of customer you are and select from the available On-Demand Webinars. Webinars included are based on legislation updates, product training and our Bite Sized Support sessions.

How our clients are taking advantage of the IRIS AE Suite™

Over 5,700 organisations use the IRIS AE Suite™ and are taking full advantage of the benefits that this can bring to their business including time saving, efficiency and simplification of processes. We have a multitude of resources that you can view in order to find out how businesses are using the IRIS AE Suite™.

Read the Case Studies

Understanding Automatic Enrolment

One of the most important steps to take in preparing for any major change to legislation, such as the workplace pensions reform is educating yourself. This is why we have developed our Understanding Automatic Enrolment training seminars. The aim of these seminars is to introduce you to the legislation surrounding automatic enrolment and what impact these changes will have on your business. Our expert trainers will walk you through the various stages of automatic enrolment you need to be aware of to make sure you can achieve compliance and avoid financial penalties.

Understanding automatic enrolment

Auto enrolment can sometimes feel like a minefield of facts and figures so at IRIS, we thought it would be a good idea to compile the information into a handy infographic!

The IRIS Auto Enrolment Glossary of Terms

When it comes to auto enrolment, the legislation is enough to confuse anyone. Add to this the multitude of differing terms and acronyms for you to remember and things seem to get even harder.

So, IRIS have put together a free Auto Enrolment Glossary of Terms guide that you can download and print off as a handy guide for all of your auto enrolment and payroll needs.