BLOGS

Is the pace of technology adoption accelerating?

The electric motor was developed in the latter half of the 19th century and should have made its presence felt in factories in the 1890’s. However it was not widely adopted until the 1920’s, so why the 30 year delay?

Steam engines were entrenched in factories. With drive shafts and belts powering machines factories were optimised for this type of power. Over time large inefficient steam engines were replaced by smaller, more efficient electric motors. Once electricity began powering machines factories were re-organised and a new industrial revolution was underway. New products began to emerge at a faster rate and this continued for the next 50 years or so. This transformation was only possible as business leaders began to visualise the possibilities of new technology. Many businesses (and some industries) failed, however those who recognised the possibilities went from success to success.

We are now seeing the beginnings of another revolution fuelled by the increased use of IT.

Software improving productivity

We face a similar change in our industry. Over the years, software adoption has increased resulting in improved productivity. We see clients using bookkeeping software to keep track of their business expenses improving their efficiency and in turn improving the productivity of the accountancy practice.

However practices still have clients maintaining paper records. These clients with their shoe boxes and carrier bags of receipts consume a greater share of your time and significantly impact the productivity of the practice. Eliminating this paper and ‘digitising’ these clients will help increase your efficiency.

Reimaging client interaction

While the piece-meal adoption of technology has improved matters there are bigger gains to be made. Reimaging the end to end interaction from client to accountant to HMRC/ Companies House presents a once in a generation opportunity to redefine the practice.

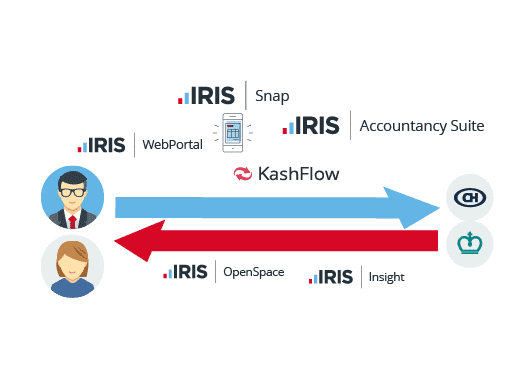

The ideal scenario is one where your clients provide their bookkeeping details digitally. The information flows seamlessly ‘through’ your practice via a client portal on your website, into your Practice Software. You create final accounts and accompanying tax returns sharing them with clients at the push of a button. Clients in turn approve the documents electronically. Once you receive the e-approval, the accounts and tax returns can be submitted to Companies House and HMRC respectively. A simple, seamless process eliminating paper documents, improving accuracy and reducing processing time.

IRIS Snap a new app lead service enables clients to capture their invoices and receipts on the go. The information is added to the clients KashFlow account, efficiently digitising the receipts and eliminating the annual ‘shoe box’ of receipts.

IRIS OpenSpace increases collaboration between you and your clients. This simple yet powerful cloud-based product integrates directly with our desktop products IRIS, PTP and Keytime. The integrated nature simplifies the workflows in a practice delivering tremendous productivity gains while the e-approval function makes the whole process as efficient as possible.

As the industrial revolution introduced new products the digital ‘revolution’ in accountancy will deliver new services. Clients are no longer content with tax and accounts compliance activities, they are looking for advice and support to help manage their businesses. Looking forward we can see business advisory services becoming a major revenue stream for many practices. IRIS Insight is the ideal platform to support practices offering services such as management reports, cashflow forecasts or ‘what-if’ modelling.

Transform your practice

Just as the manufacturing sector was transformed by the introduction of the electric motor so practices will be transformed by new technologies. Practices embracing technology in their working day will become more efficient. These efficiency gains allow them the chance to revisit how they work with clients, identify new opportunities and deliver new services becoming even more effective. This virtuous circle allows practices to develop smoother workflows, increase productivity and become more efficient.

New technologies always represent a challenge and the adoption of that technology presents a business opportunity for the enterprise. The electric motor took 30 years to be widely adopted and those businesses that were unsuccessful in the transition ultimately failed. The digital transformation currently underway presents a similar challenge - adopt or die.