Link IRIS Personal Tax to IRIS Payroll

This applies to:

IRIS Payroll for Accountants, IRIS Bureau Payroll & IRIS Payroll Professional

The link between IRIS Personal Tax and IRIS Payroll is quick, easy and will save time. The link is driven by IRIS Personal Tax and will pull information from your IRIS Payroll.

The first step is to setup the link between IRIS Personal Tax and IRIS Payroll:

1. From IRIS Accountancy Suite, Open System Maintenance, Click System and then Click IRIS Payroll for Accountants Link

2. From the drop down list select the payroll package installed on your machine (ie EARNIE).

Note: If there are no options in the drop down menu its likely that the registry entry does not exist.

For 32 bit versions of Windows

- For EARNIE please ensure the following entry exist [HKEY_LOCAL_MACHINE\SOFTWARE\IRIS Software Ltd\E32], create a newstring value called DataFilePath and set the entry to the installation path for IPP ie s:\IPP

- For Bureau Payroll please ensure the following entry exist[HKEY_LOCAL_MACHINE\SOFTWARE\IRIS Software Ltd\ IRIS Bureau Payroll], create a new string value called DataFilePath and set the entry to the installation path for IBP ie s:\IBP

For 64 bit versions of Windows

- For EARNIE please ensure the following entry exist [HKEY_LOCAL_MACHINE\SOFTWARE\Wow6432Node\IRIS Software Ltd\E32], create a newstring value called DataFilePath and set the entry to the installation path for IPP ie s:\IPP

- For Bureau Payroll please ensure the following entry exist [HKEY_LOCAL_MACHINE\SOFTWARE\Wow6432Node\IRIS Software Ltd\ IRIS Bureau Payroll], create a new string value called DataFilePath and set the entry to the installation path for IBP ie s:\IBP

To set up the link between a client in IRIS Personal Tax and a client in IRIS Payroll:

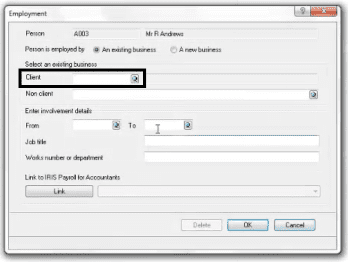

1. Open the Employee in IRIS Personal Tax and go into their employment section

2. To set up a new employment click set up a new employment

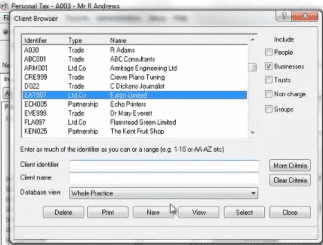

3. Select the employer by clicking the icon next to the client field, select the employer and click ok

4. Complete the relevant involvement details

5. Click on the Link button to create the link

You need to ensure that the PAYE-Reference number for the company and the National Insurance Number for the employee match in both IRIS Personal Tax and IRIS Payroll

The earnings and tax deducted figures will be brought across from IRIS Payroll, there is also a new column to indicate that these have been brought across.

Within the benefits section any Payments & Deductions used within IRIS Payroll will be imported.

PLEASE NOTE: This is a dynamic link, which means that any changes in IRIS Payroll will be reflected in IRIS Personal Tax automatically.

Once the tax return has been finalised, for example; printed out as a final return, or filled online the employment section will then be locked. This ensures any further changes within payroll are not automatically changed within IRIS Personal Tax.