IRIS Payroll, P11D, Bookkeeping & HR Support - Uplift AE pension Contributions

From the 6th April 2019 the minimum contributions for automatic enrolment pensions are increasing.

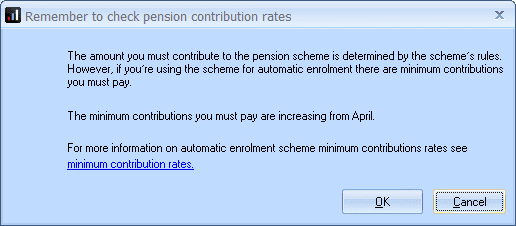

During the year end restart process you will see the following message:

After completing your year end restart to move into 19/20 tax year you must check your contributions before processing payroll.

How are the contributions changing?

Minimum contributions are changing in line with the table below:

| Date | Employer minimum contribution | Total minimum contribution |

| 06/04.2019 onwards | 3% | 8% (including 5% worker contribution) |

To comply with legislation you must meet or exceed the minimum contributions.

How do I update the contributions?

Please follow the video or written guides below to help ensure you are meeting the minimum contributions for automatic enrolment pensions.

IRIS PAYE-Master

Click here to download a printable PDF guide.

IRIS GP Payroll

Click here to download a printable PDF guide.

IRIS Payroll Professional

Click here to download a printable PDF guide.

IRIS Payroll Business

Click here to download a printable PDF guide.

IRIS Bureau Payroll

Click here to download a printable PDF guide.

Earnie

Click here to download a printable PDF guide.