PAYE End of Year Procedures – Overview

Article ID

11811

Article Name

PAYE End of Year Procedures – Overview

Created Date

24th March 2022

Problem

Completing your PAYE tax year end with RTI submissions.

Resolution

Overview of the process – for detailed steps refer to the product-specific guides below.

- Send your final FPS and/or EPS.

- Update your payroll software to the latest version

- Transfer your payroll into the new tax year

- Apply standard points uplift to tax codes (your payroll software may do this automatically)

- Continue with your payroll as usual.

- Issue P60s to your employees before 31st May (excluding leavers)

- Submit P11Ds (if required) by 6th July (this can’t be done through your payroll software)

For product specific end of year guides follow these links

These guides cover the year-end process in more detail than is covered here and are printable for easy reference.

- PAYE-Master (2022/23 Year End Guide)

- Payroll Business (2022/23 Year End Guide)

- Bureau Payroll (2022/23 Year End Guide)

- GP Payroll (2022/23 Year End Guide)

- Earnie (2022/23 Year End Guide)

- Earnie IQ (2022/23 Year End Guide)

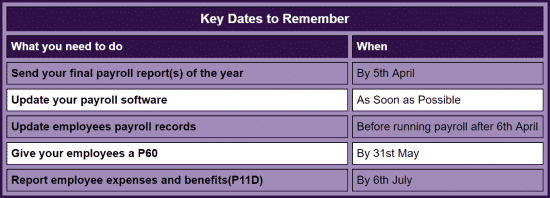

1. Sending your final submission to HMRC

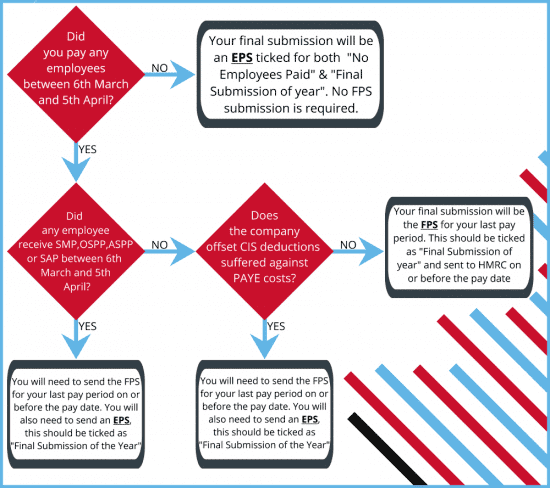

Your last RTI submission should be ticked to indicate “Final submission of tax year”.

This could be either a Full Payment Submission (FPS) or an Employer Payment Summary (EPS) depending on your payroll circumstances, it is important to understand this. The flowchart below should help you gain an understanding.

Week 53, 54 or 56 payments

If you are running weekly, 2-weekly or 4 weekly payrolls and your normal pay date falls on the 5th April you will have an additional period to process for 2021/22 tax year. Your final pay period of 2021/22 tax year will be week 53 (single weekly), week 54 (two weekly payroll) or week 56 (four weekly payroll). The final submission deadline rules still apply as described below.

For more information on processing Week 53,54 or 56 please click here.

FPS:

Your last full payment submission (FPS) should be with HMRC on or before the employee’s pay date as normal. If you are unable to send your submission on or before the pay date this will be recognised as a late submission by HMRC.

EPS:

If required send your final EPS to HMRC by the 19th April.

2. Update your payroll software

Before you can process payroll in the new tax year you will need to apply the end of year updates we will provide.

These updates are now available.

Depending on your payroll software it may be available via our auto update service, keep a look out for update prompts.

Alternatively, you can check to see if an update is available here: www.iris.co.uk/update

Please Note: You can install the update as soon as it is available for your software. The update will NOT affect any payrolls still open in the old tax year.

3. Move your payroll into the new tax year

This process depends on which payroll software you are using, please refer to the product specific guides below.

Please Note: We strongly recommend that you create a separate backup of your payroll data after you have completed your final payroll of the old tax year BEFORE you move into the new tax year.

Earnie IQ Users – We recommend you use the copy company option in the admin mode to ensure you have a separate company listing for the PAYE data for the old tax year before you move into the new tax year.

4. Update your employee records

Before running any payroll for the new tax year you need to ensure your employee tax codes are up to date.

There are no standard tax code uplifts for 22/23, however, HMRC may issue tax code notices for specific employees.

- P9T form for any employees who need a new tax code

- P9X form with general changes for employees whose tax code ends with an ‘L’

Depending on which of our payroll programs you are using, these may be delivered directly into your software for automatic processing. Refer to the product-specific year end guide in your software for further details.

Uplift AE Pension contributions

For the 2022/23 tax year, there is no uplift in minimum pension contributions.

6. Give employees a P60

P60 reports should be received by employees by the 31st May.

Any employee who was working for you on the 5th April should get a P60.

Leavers within the tax year (i.e. before the 5th April) will not get a P60, these employees should have already been provided with a P45 when they left your employment.

P60 reports can be produced onto pre-printed stationary or published online via OpenPayslips if you use that service. Some of our payroll software has the option to print the P60 as a plain paper report, this prints the entire form (values and formatting) onto plain A4 paper. Refer to the product-specific year end guide in your software for further details.

To produce P60 reports in the correct format for the tax year you will need to install the year end update before printing/publishing your P60’s.

7. Report expenses and benefits

These are reported to HMRC on a form P11D. The P11D is a statutory form required by HMRC from UK based employers detailing the cash equivalents of benefits and expenses that they have provided during the tax year to their directors and employees. These are NOT submitted via our payroll software and require specialist P11D software.

If P11D forms are due they should be with HMRC by 6th July.

Any Class 1A National Insurance due on the taxable expenses and benefits you’ve provided must be paid to HMRC by 22 July (or 19 July if you’re paying by post).

For a complete guide on the legislation changes for 2022/2023 tax year, click here.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.