Payroll Services

Paying your people and rewarding them for their hard work is as important to the business as it is to an employee. Managed Payroll Services take the stress away from time-consuming payroll processes and ensure every pay run is a success – with all the complexities taken care of.

Find some of our most popular payroll services below, alongside useful information around varying types of payroll.

What is Managed Payroll?

Managed Payroll is a service used by businesses of all sizes to offset the burden that complex payroll processes may have on an internal HR or payroll department. The Managed Payroll Services required by your business may differ from another. Depending on the size of your business, the type of recruitment strategy you run, and the geographical location of your employees – you will require a specific type of payroll service.

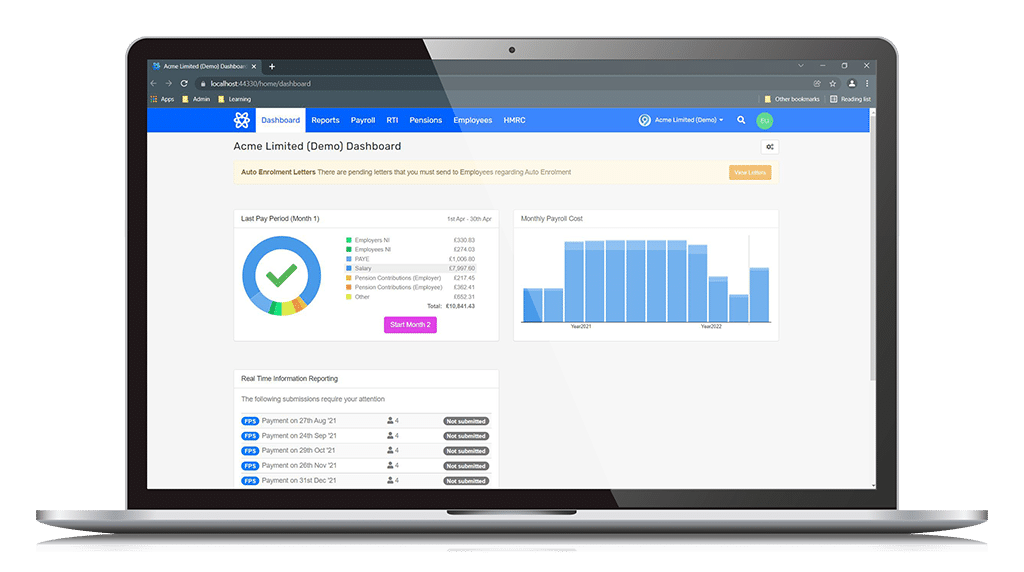

Many companies choose to handle their payroll in-house, using a range of payroll software solutions to enhance their ability to pay employees accurately and on-time. Though, even companies with mature processes and their own payroll departments may still outsource some of their more technical processes to professional payroll companies with payroll bureau systems.

Furthermore, if your business employs overseas workers, then your payroll system will need to be structured to meet the local legislation regulations of your employees workplace. This can be some of the most challenging and time-consuming tasks in payroll.

Thankfully, many types of managed payroll services exist to aid with all the above.

Managed Payroll Services from IRIS

-

Domestic Outsourced Payroll

Our Fully Managed Payroll team offer domestic payroll services tailored to suit any business need or complexity. UK Payroll services from proven industry experts.

- Local Payroll Experts

- Trusted Knowledge of Domestic Payroll

- Bespoke Pricing

- Large businesses

- Small businesses

-

Global Payroll Services

Businesses looking to recruit employees outside the UK can rely upon our International Managed Payroll service. Our experienced team simplify local legislation to ease your global payroll process.

- Navigate Difficult Local Legislation

- Outsource All or Portion of Payroll

- Save Valuable Time

- Large businesses

- Small businesses

Domestic (UK) Payroll Outsourcing Services

A common misconception is that managed payroll services are all-or-nothing.

IRIS Software Group offers payroll services tailored to suit any business need or complexity. Your business can choose to outsource either all or part of its payroll process – giving you peace of mind that your people department is supported ahead of mission-critical tasks.

International Payroll Outsourcing Services

Employing overseas? Businesses looking to recruit employees outside the United Kingdom can rely upon IRIS FMP Global, a trusted International Managed Payroll Service with years of experience.

Outsource all or part of your global payroll processes and trust that IRIS will navigate the difficult world of local legislation when paying overseas employees – saving you valuable time.

Types of Managed Payroll Services

As described above, there are many types of managed payroll service that exist in order to suit any business size and employment strategy. You may not know all of the payroll structures that exist, but below are a selection of the most popular payroll services available today.

-

Managed Payroll Services UK

Domestic Managed Payroll Services offer UK-based businesses the opportunity to outsource their payroll, allowing business leaders to put more of their valuable time towards critical decisions.

IRIS offers Fully Managed Payroll services to support businesses looking to outsource either all or part of their payroll system.

No matter how mature or complex your payroll process, IRIS has been at the heart of managed payroll for years and is one of the most trusted businesses in the UK.

-

International Payroll Services

An International Payroll Service – otherwise known as a Globally Managed Payroll Service – is an advanced payroll service offered by payroll outsourcing companies.

Global payroll outsourcing allows one business to more comfortably navigate the world of hiring and paying its employees who have full-time residence within a different country.

IRIS offer an International Payroll Service – FMP Global – for such companies. Our service can handle either all of your domestic and international payroll process or just the international portion.

By choosing IRIS FMP Global, you will be investing in peace of mind – knowing that all the local legislation of your employees country of residence is factored in during payroll.

-

Small Business Payroll Service

A payroll service for small businesses is great for small business leaders without the human resource to tackle difficult payroll processes.

With fewer people to rely upon with their time, small business leaders often outsource their payroll to managed payroll services.

Not only do Managed Payroll Services take the pressure off of an already stretched team, but can act as a source of knowledge for trusted payroll structures.

Let IRIS Payroll Services for Small Business scale and grow with your business. Enquire about our managed services today.

-

Payroll Bureau Services

A payroll bureau service is a type of managed payroll service, offered by third-party payroll agencies to manage all or part of a business’s payroll function. They are designed to relieve businesses of the time-consuming and often complex task of processing payroll, ensuring that employees are paid accurately and on time while also complying with tax and employment regulations.

IRIS are one of the most trusted payroll brands in the UK – now expanding to the Americas – and offer Payroll Bureau Services.

These services take the burden of employee payroll, tax calculations, and HMRC compliance off your plate. With Payroll Bureau Services by IRIS, your People Department can rest assured that payroll is handled accurately and on-time, every time.

Choosing IRIS means you can free up time and resources previously spent on managing complex payroll processes. Our experienced team keeps abreast of ever-evolving tax laws, ensuring your payroll stays compliant without you having to navigate the intricacies.

-

CIS Payroll Services

Unlocking the full potential of your construction business while staying compliant with HMRC regulations is now easier than ever with Managed CIS Payroll Services, from IRIS.

Construction Industry Scheme Payroll is a mission critical element within the UK construction sector. IRIS CIS Payroll Managed Services ensures your business leaders focus more time on core construction work, while we handle the intricate tax compliance and back-office processes.

Our team of experts will seamlessly manage either all or part of your CIS Payroll System. Deductions, tax submissions, and record-keeping are executed.

Eliminate the hassle of deciphering complex tax & payroll regulation.Invest in peace-of-mind, by entrusting your Managed CIS Payroll to IRIS. With efficiency, and a sterling reputation in the construction industry, let us handle the complexities, so you can build your success.

Choose our CIS Payroll Managed Services today for a smoother, more profitable construction business.

Customer stories

Blog posts

Guides

Need something else?

-

Payroll Software

Discover Payroll SoftwareWant to take your payroll processes in-house? Modernise your current payroll process with industry-leading payroll software.

-

HR Consulting

Discover HR ConsultingAlongside Managed Payroll, IRIS also offers full-scale consultancy and software support for Human Resource. HR Consulting by IRIS.