Personal Tax- Expense types for UK Land and Property appear in Schedules Of Data/SA100 UKP2?

Article ID

personal-tax-expense-types-for-uk-land-and-property-appear-in-schedules-of-data

Article Name

Personal Tax- Expense types for UK Land and Property appear in Schedules Of Data/SA100 UKP2?

Created Date

9th May 2023

Problem

IRIS Personal Tax- How do certain Expense types for UK Land and Property appear in Schedules Of Data?

Resolution

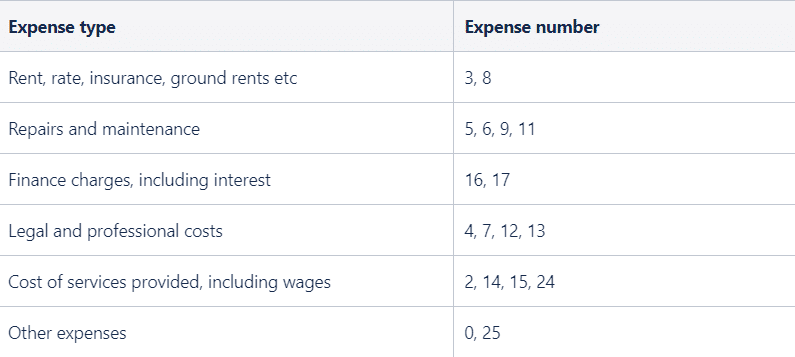

When you have multiple expense types for a UK property and you run the ‘Schedules of data’ report – these expense types are automatically placed into 6 categories and totals the expenses. The PROPERTY INCOME TOTAL is then auto calculated and then applied into the relevant boxes on the SA100 UKP2 page boxes 24 to 29 ( See the 6 boxes the image below)

The table show how each type is placed into which category.

For example: If you have a Type 3 ‘Ground rents’ and Type 8 ‘Insurance’ they will show on the Schedules/SA100 as a combined entry under Box 24 ‘Rent, rate, insurance, ground rents etc’.

Links to UKP2 page boxes – Rent 24, Repairs 25, finance charges 26, legal 27, COS 28 and Other 29

Additional Expense Types 1= box 24, 10=box 35, 21=box 36, 22=box 33, 23=box 33.1, 26=box 33.2, 27=box 34.1

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.