Business Tax- 2024 SME R&D, entry for R&D Expenditure not populating the rest of the boxes

Article ID

business-tax-sme-research-and-development-entry-for-rd-expenditure-not-populating-the-rest-of-the-boxes

Article Name

Business Tax- 2024 SME R&D, entry for R&D Expenditure not populating the rest of the boxes

Created Date

8th November 2024

Problem

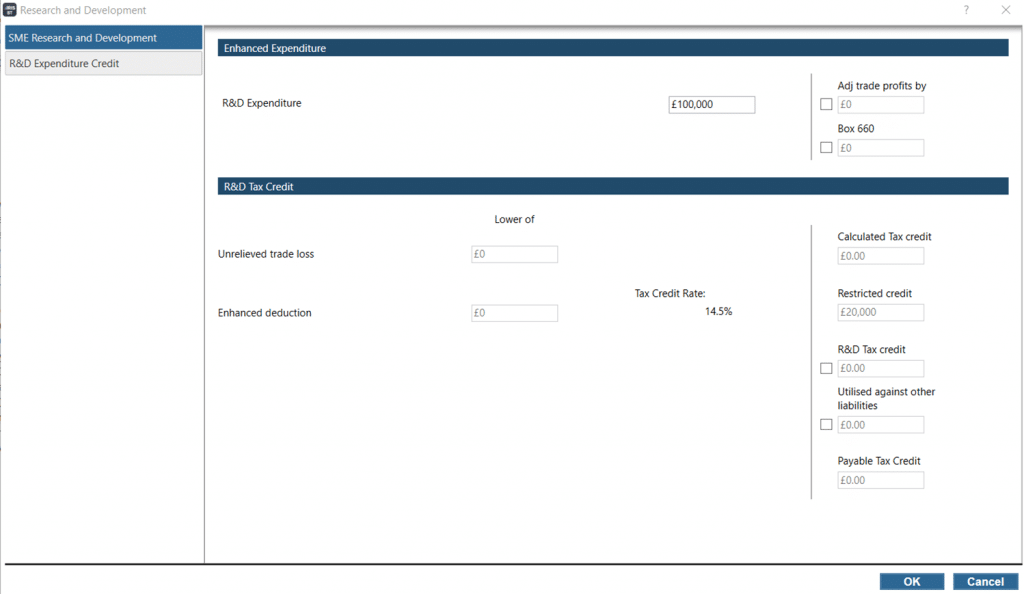

IRIS Business Tax- SME Research and Development, entry for R&D Expenditure not populating the rest of the boxes

Resolution

For example: In 2024- Data Entry | Research and Development CT600L | SME Research and Development – enter £XXX R&D Expenditure – but the expected automated figures are not being generated for the ‘Adj Trade Profits by’ or ‘Box CT600’ etc and the expected Tax credit etc is not given.

Update to the latest IRIS version to fix this (it was initially released as a HOTFIX back in 2024). We apologize for any inconvenience.

If the company loss is not being picked up and thus no credit given- then run the Tax Comp and check the company loss is shown, then go to Edit/losses and check is the current year losses is shown here too, now restart IRIS and load BT and go back to the R&D SME screen and check if it has picked up the company losses. If the loss is still not being picked up then this is fixed in the latest IRIS version.

There is also a issue where previously seen tick boxes on the SME screen are missing- please read this KB

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.