Bracing for impact – how finance professionals must prepare for FRS 102’s lease amendments

Updated 6th January 2026 | 9 min read Published 6th January 2026

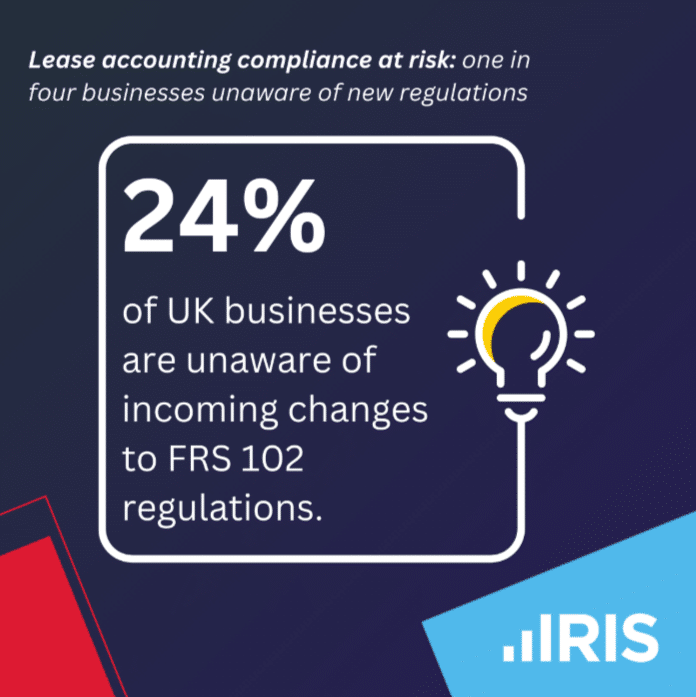

It’s slipped under most people’s radars, but we underestimate January’s changes to FRS 102 at our peril.

The changes are significant, and getting lease accounting wrong can have serious repercussions. This includes possible audit failures, misstatements, poor financial decisions, covenant breaches, reputational risk and business-halting inefficiencies.

So, how much progress is being made by businesses to meet this challenge? Just as importantly, what do they need to do by January?

What’s happening to leases under FRS 102 from January 2026? A quick reminder…

The changes to FRS 102 will transform the way companies in the UK and the Republic of Ireland treat leases. The intent is to align reporting more closely with the international accounting standard, IFRS 16.

This will affect most leases, impacting about 3.4 million businesses in the process.

The biggest change is that nearly all leases must be reflected on the balance sheet as both right-of-use assets and lease liabilities. Straight-line lease costs will be a thing of the past. Instead, reporting will be more complex. Companies will now record depreciation on leased assets and interest on lease liabilities – this means we can expect profit and loss statements to look very different.

The effect this change will have on your business metrics

What you report to stakeholders will change.

Your EBITDA will likely increase. This is because lease costs, which will become reclassified as depreciation and interest, will not be factored into this calculation.

On the other hand, reported net debt will rise with the addition of lease liabilities.

Understanding exactly where we are with FRS 102 and what needs to be done

If you wanted some eye-opening insights and expert commentary, the best place to be was at our recent webinar (watch it on demand here).

Called FRS 102 Lease Accounting Compliance and Beyond, I was lucky enough to be joined by:

- Sarah Hughes, Accounting Advisory Partner, CFO Solutions, Grant Thornton UK

- Fran de Gioia, Lease Accounting Solution Specialist, Office of the CFO, IRIS Software Group

In this webinar, we established:

- How many finance professionals have started adapting lease accounting in line with the amended FRS 102

- What the wider impacts are for businesses

- The importance of controlling stakeholder expectations

- Hidden issues the new FRS 102 brings about

- The possible opportunities the changes bring

- Why spreadsheets are not up to the job

The important takeaway – with very little time, most businesses haven’t prepared

During the webinar, we asked nearly 200 finance professionals if they had started preparations for the new FRS 102 amendments. Of those who responded, only 3% had fully implemented the changes.

About 41% had not started, and 38% were in the early stages.

So, what should these 79% of finance specialists brace themselves for?

What are the wider impacts of the FRS 102 changes for your business?

Earlier, we saw how FRS 102’s amendments will affect your metrics from 2026. This means possible consequences for any debt covenants and bonus schemes that rely on these figures. It also means early engagement with lenders and HR teams is essential if you want to avoid unexpected breaches or disputes.

It’s a major change, which means you must adjust expectations

The amendments will put your business’s change management skills to the test. Firstly, teams will have to work together on leases like never before. Finance, IT, procurement and operations must collaborate to identify all leases and update systems. They must also make sure that their judgments and estimates are consistent.

During our webinar, Sarah Hughes from Grant Thornton said, “The changes are far-reaching. You’ve got to identify whether you actually have a lease. You’ve got to set up systems to allow you to comply with the standard, and you’ve got to start thinking through all of these judgments and estimates that you just haven’t had to think about in the past.”

Meanwhile, good communication with stakeholders will make a huge difference. Investors, lenders and internal teams will need to know why the numbers landing on their desk are going to look different.

Fran De Gioia, from IRIS Software Group, said, “Engage with your lenders early and manage the narrative within your investors. The data that you are forced to abstract for compliance is your greatest tool for managing market perception.”

Why lease changes will mean more accounting work

Getting ahead of the changes is important, and this is a key lesson learnt from the adoption of IFRS 16. Sarah Hughes said, “The situation with FRS 102 is very, very similar – it’s about starting early. It’s so important you don’t underestimate how difficult it is to get the information you need. It isn’t as easy as it sounds.”

Finance teams must stay on the ball once they have adapted to the updated standard. Modifications to lease terms, payments or scope – often due to renegotiation, termination or restructuring – require careful review to decide whether you count the resulting agreement as a new lease or adjust an existing one. The way these changes are recorded depends on their nature, and misclassification risks you running into compliance issues.

The new devil hidden in the detail – services and leases

One challenge will be identifying leases hidden in service agreements. If a contract names an asset, gives control over its use, and passes on its benefits, it may qualify as a lease – for example, buying electricity from a dedicated solar farm.

This problem can also happen the other way around: many contracts combine asset leasing with services like maintenance or support.

Failing to treat each part separately will have consequences because your reporting will not be accurate.

What auditors will want

Auditors will have high expectations. They will want a clear paper trail of accounting policies, judgements and estimates. They’ll also want to see how leases were identified and recorded.

Sarah Hughes from Grant Thornton said, “Auditors will be looking at the documentation for key accounting policies and the key judgments that you’ve made. They’ll be looking for consistent application across companies and groups.

“So it’s really important to standardise the process and data points.”

How to seize an opportunity – the strategic upside of FRS 102’s changes

With this amended accounting standard comes some good news.

Because you are consolidating all lease information across property, fleet, IT and other assets, you will gain greater visibility into your business’s lease obligations.

In our webinar poll, 42% of finance professionals considered this the biggest gain of FRS 102’s changes.

This enthusiasm for better data makes a lot of sense. It means you can develop more effective procurement strategies. You will be able to approach suppliers with a comprehensive view of lease spend, negotiate better terms, and avoid costly defaults or automatic renewals.

Chances are, your managers will thank you, too. All this data means leaders can make informed decisions for strategic planning.

Of course, achieving this only looks likely if you have the right tools.

Why finance professionals seem to be moving away from spreadsheets

We spoke to finance professionals earlier in 2025, and now – much closer to the January 2026 changes.

One thing has become clear: dedicated software is now the rising star. A much larger proportion of respondents (now 40%) think this is the way forward. These tools automate complex FRS 102 calculations – like present value, expense splitting and dual-track accounting.

It’s not the first time we’ve seen this shift. Fran De Gioia from IRIS Software Group recalls how businesses implementing IFRS 16 quickly discovered spreadsheets could not handle the complexity. He said, “During the implementation of IFRS 16, most companies initially relied on complex spreadsheets and manual processes, but these failed immediately once they had to deal with lease modifications.

“Every single rent review change in scope or renewal option triggers a complex mandatory remeasurement. This quickly turned into a chaotic, recurring month-end nightmare.”

So, if you’re thinking about sticking to spreadsheets, it’s worth asking: is all the extra time, risk and effort worth it?

Get all the insights – watch the full webinar

A blog post can barely scratch the surface of what was – thanks to Sarah and Fran – 50 minutes of top-quality intelligence on all the changes to FRS 102.

So watch the webinar to find out much more, because with leases, it’s going to be all about the details.

Watch it on demand:

Click here