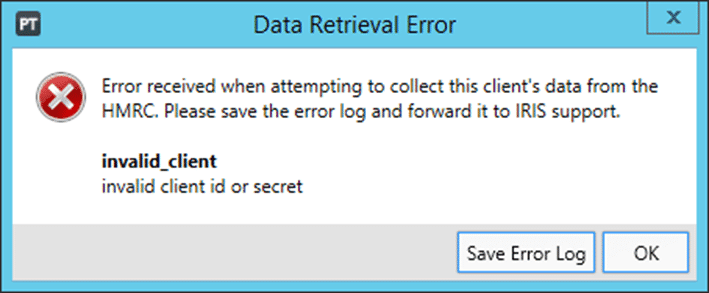

Personal Tax- HMRC Data retrieval ‘Invalid_Grant’, ‘ID is Invalid’ or ‘Invalid_Client ID or secret’

Article ID

ias-12568

Article Name

Personal Tax- HMRC Data retrieval ‘Invalid_Grant’, ‘ID is Invalid’ or ‘Invalid_Client ID or secret’

Created Date

18th September 2017

Problem

Personal Tax: Users receive 'Invalid_Grant' or 'Invalid_Client ID or secret' error when attempting to use retrieve HMRC data feature

Resolution

Where error states the ‘user ID is invalid‘ OR ‘Invalid_Client ID or secret’, our Development team has checked the error log content and you will need to contact HMRC support to look into this – please ask for a senior. (The ‘Secret’ warning normally means you are entering the incorrect credentials when you were signing in on the HMRC login screen- as the warning is created by HMRC.)

You need to be on the latest IRIS version (Help and About). So first update to latest version.

If you still have issue after updating to latest version then HMRC has a random issue on their server, which caused all existing authorisation tokens to become invalid OR they have issues with your HMRC login ID and possibly the security questions you answered with.

1.Therefore you will need to remove any existing authorisation in your software and reset it. Go to Setup and choose Authorised Agents – You can have authorizations setup at Practice Level (one for all staff) or at an individual staff level

2. You will need to reset whichever already exists (called ‘Pre-population’ in IAS) by clicking on it and clicking the ‘Reset agent credentials’ button You can switch to use Practice level if you just want to go through the authorisation process once, to re-authorise you need to.

3. Go back to the Main Personal Tax screen and choose ‘Retrieve HMRC Data’ (on any client) on the top right and this will start the authorisation process with HMRC again. Note : The HMRC authorisation process includes an identity check for security reasons. This is based upon your personal information (not the clients) and must be completed in order to gain access to your client’s data. Now try and retrieve data again. If you enter incorrect security answers, it may immediately block you from proceeding.

4. If the same error happens again – ask ANOTHER PT user to login instead on a different pc (but not with a shared agent login – if you have different logins) and answer the security questions. If it works for them, its your unique login which is causing this. If all PT users and all PCs get the same issue (OR you only ever login with 1 agent ID) it can be caused by a environmental issue (which you tech team need to look into your existing anti-virus/security setup on the pcs/servers) or its more likely coming from HMRC and you will need to contact them and speak to a senior.

5. If all users/pcs are affected, HMRC state its correct on their side, you have checked your environment (step 4) and your agent credentials are not being saved in the Authorised Agents screen then report this to IRIS Support – stating this KB address and you have gone through every step and now asked to do step 5 and quote this line ‘PT invalid client id or secret- all users and workstations affected’

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.