Personal Tax- How are capital losses offset against capital gains and edit it?

Article ID

ias-10326

Article Name

Personal Tax- How are capital losses offset against capital gains and edit it?

Created Date

9th February 2012

Problem

IRIS Personal Tax- How are capital losses offset against capital gains and how to edit this? Also if you have any Foreign Tax credit relief claims.

Resolution

IRIS PT automatically offsets the current year gains against current year losses or brought forward losses.

The losses usage are set in the most beneficial way automatically by IRIS. You only have the option to amend the asset acquisition /disposal date which then changes the way the loss is used. You have to add a note under Capital Additional Information to explain this date change of the asset.

I have CG losses b/forward and my CG gain is only utilising some of the losses (not using all against gain) Why? In this example for 2024/2025, PT will first utilise the losses UP to the limit of the CG Exemption £3000, so it will restrict the loss usage until there is £3000 CG gain left to be used, then it applies the £3000 exemption. This ensures the bare minimum loss is used up and you gain the full exemption for the year. Eg Gain of £3999 and you have b/f losses £2000, PT will apply a loss usage of only £999, that leaves the rest for the exemption to be applied. This cant be overridden.

I have two disposals: why is the loss used on one asset and not the other. The losses usage are set in the most beneficial way automatically by IRIS and the offset order cannot be amended unless you edit the acquisition /disposal date. Also check if one asset is ticked Residential and the other asset is not – if this is correct then PT will always apply the loss usage to the higher tax rate property e.g used against the Residential asset and this cannot be changed even by editing dates. If you disagree with the loss allocation then read below on how to manually edit it.

Need Foreign Tax credit relief to be used against gains? you need to edit the CG tax calculation (reduce the amount)– For example: A gain has Foreign tax credit relief and you want to amend the allocation of loss between gains.

I have EIS Relief claim AND current year CG losses to offset against CG gain? The total CG loss relief may show as being restricted by the EIS relief. This is because you are telling the PT system that out of ALL the losses – some of it is part of a EIS relief claim eg 20K CG loss, you add in 7K EIS relief- it will show as 13K loss relief and 7K EIS relief. You can decide to go to the Edit | losses and other information and remove the amounts from ‘this year’s losses’ and ‘Losses relating to SEIS & EIS relief’ Once removed, this now offsets the whole CG loss against the ‘in year CG gain’ OR you keep it as it is.

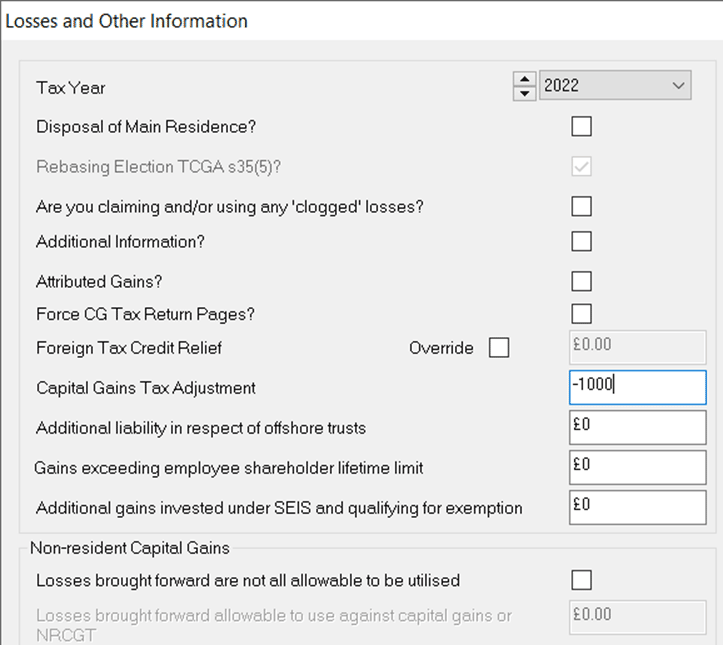

Edit the CG tax value: Go to Edit | Capital assets | Edit | losses and other info | Capital gains adjustment as a e.g: negative value (this will reduce the CG tax calc). Also put a note in as ‘Additional info’ explaining why you adjusted the CG tax.

Edit the CG tax rate %: If editing of disposal dates etc make no changes to the rate then you cannot edit the CG % rate on the Capital Gains computation, you can only edit the final CG tax value.

NOTE: You may not be able to claim BOTH the Foreign tax credit relief and a Capital gains adjustment as it can cause a 3001 6492 rejection from HMRC. Untick the Foreign tax credit relief claim and make the relevant entry in the adjustment box.

PT rules in the 2010/2011 period – How It offsets in the order below :

1) The gains made on and after 23/06/2010 that DO NOT qualify for entrepreneurs relief

2) The gains made on and before 22/06/2010

3) Then the gains made on and after 23/06/2010 that DO qualify for entrepreneurs relief For example: There are brought forward losses in 2011 which are greater than the current year gains. PT will first offset the losses with the gain that has the latest acquisition date. It will keep on offsetting up to the last £10,100 gain which will be offset against annual exemption. The remainder of the losses will be carried forward.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.