How do I process a salary sacrifice deduction?

Article ID

11221

Article Name

How do I process a salary sacrifice deduction?

Created Date

20th November 2019

Problem

I need to set up a salary sacrifice deduction for an employee. E.g. for childcare vouchers or Cycle to work scheme, give as you earn scheme etc.

For further legislation information about salary sacrifice schemes, check gov.uk here.

Please Note: Salary Sacrifice pensions are not covered in this KB. Non AE Pensions are configured from "Company"|"Payments & Deductions"|"Configure Pensions". For AE Pensions use the configuration tool found in "Pension"|"Auto Enrol Config Tool", see KB here for details.

Resolution

Salary sacrifice deductions are gross pay deductions that give the employee relief on tax and NI contributions.

Commonly these are used for childcare voucher schemes, cycle to work schemes, give as you earn etc.

If you are unfamiliar with salary sacrifice deductions we recommend you read this short guide first:

To set up the deduction

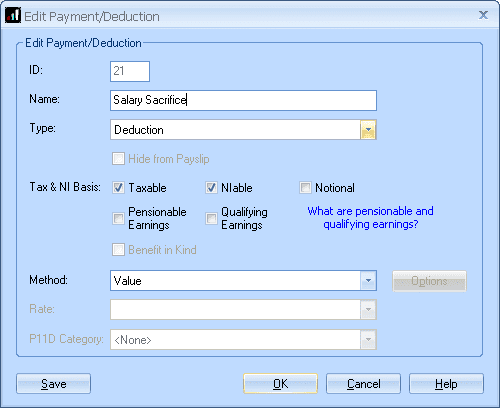

Go to “Company” > “Payments & Deductions” > “Configure Payments & Deductions“

Click “Add New” along the bottom of the next window.

Complete the “Name” this is how the deduction will show on the employees’ payslip, give the deduction an appropriate name.

Set the “Type” to “Deduction“.

Tick the “Taxable” and “NIable” check boxes.

Set the “Method” to “Value“.

Click “Save” and “OK” and then “Close“

Apply to an employee

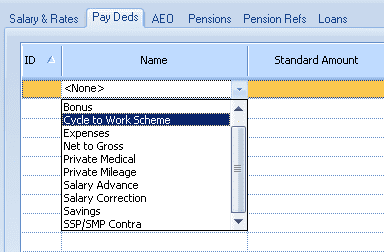

Double click on their name to open their details.

Go to “Pay Elements” > “Pay Deds“

Click on the line with the name <None>, open the drop-down menu and select the new deduction:

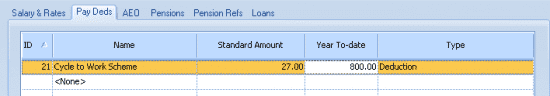

In the standard amount column type the amount you want to take each period.

If there is a fixed amount to be paid type this in the “Year-To-Date” column. E.g. If the employee has £800 to pay on the cycle to work scheme type 800.00 into the “ear-To-Date” column.

Click “Save” and “Close“

The next time you process pay for this employee the deduction will reduce their gross pay.

NOTE: The employee’s gross pay is reduced as part of a salary sacrifice scheme. This means that any benefits which are based on the employee’s gross earnings may be affected, such as pensions, tax credits and maternity pay. If the salary sacrifice takes an employee’s earnings below the LEL, for example, she may not be entitled to SMP. Also, any personal financial arrangements which are based on the employee’s gross pay, such as mortgage offers or other loans, may be affected.

Please Note: Salary Sacrifice pensions are not covered in this KB. Non AE Pensions are configured from “Company“|”Payments & Deductions“|”Configure Pensions“. For AE Pensions use the configuration tool found in “Pension”|”Auto Enrol Config Tool”, see KB here for details.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.