How to process Statutory Sick Pay (SSP)

Article ID

11232

Article Name

How to process Statutory Sick Pay (SSP)

Created Date

1st May 2019

Problem

How to process Statutory Sick Pay (SSP)

Resolution

There are 3 methods you can use when paying SSP in PAYE-Master:

• Manually based on a value

• Manually based a number of days absent

• Automatically using the absence diary

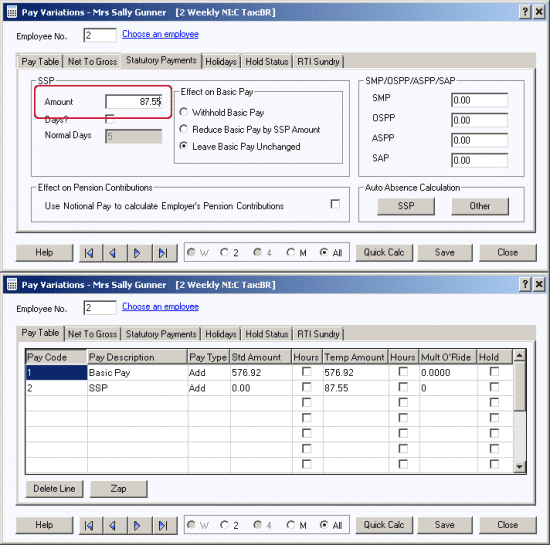

Manually based on a value

Go to “Pay” > “Variations“. For the appropriate employee open the “Statutory Payments” tab

Simply type the value of SSP you want to pay the employee in the “Amount” field.

You can also choose one of the options for the “Effect on Basic Pay“:

Withhold Basic Pay – Will stop any Basic Pay for the employee and just pay the SSP

Reduce Basic Pay by SSP amount – The employee receives the same total pay which is made up of the SSP and a reduced Basic Pay.

Leave Basic Pay Unchanged – The employee receives their normal Basic Pay AND the SSP amount

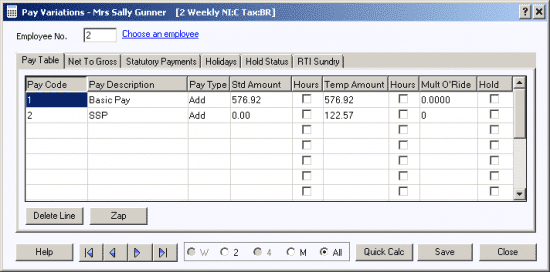

When you return to the “Pay Table” tab you will see the SSP entry as a temporary amount.

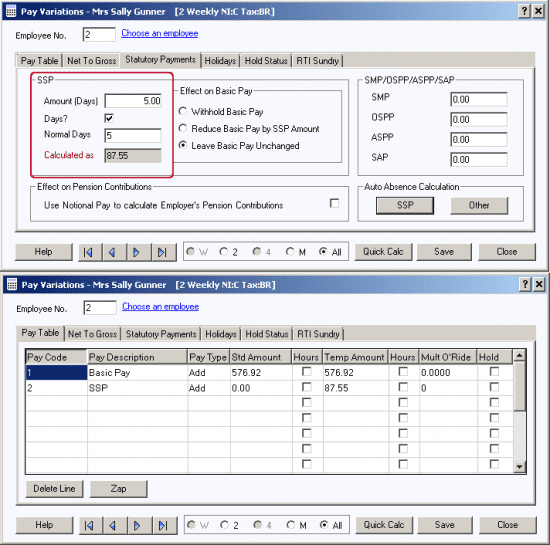

Manually based on a number of days

Go to “Pay” > “Variations“. For the appropriate employee open the “Statutory Payments” tab

Tick the “Days?” box. In the “Amount (Days)” field type in how many days absence you want to pay the employee SSP for. In the “Normal Days” field type in how many days the employee normally works per week (Regardless of your pay frequency, SSP is always calculated against a weekly working pattern).

NOTE: The system will not adjust for waiting days using this method and will pay the employee for the number of days you specify.

When you return to the “Pay Table” tab you will see the SSP entry as a temporary amount.

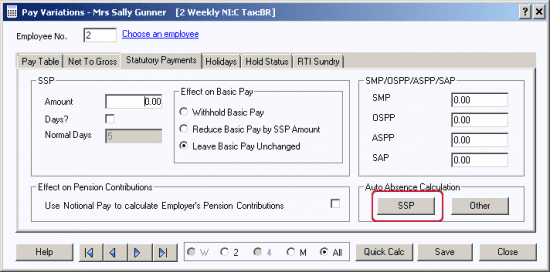

Automatically using the absence diary

Go to “Pay” > “Variations“. For the appropriate employee open the “Statutory Payments” tab. Click the “SSP” button under “Auto Absence Calculation“:

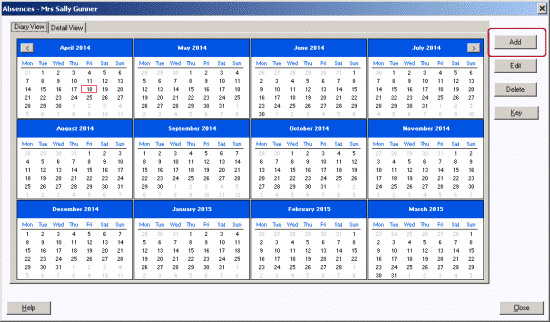

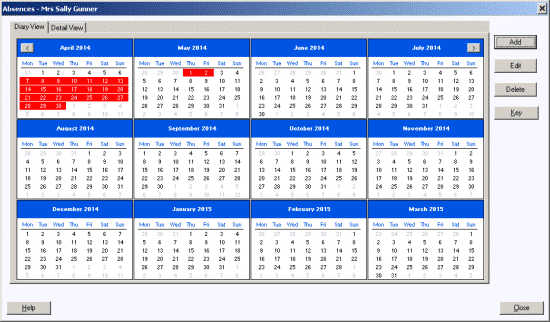

This will open the calendar view, click the “Add” button:

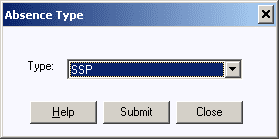

From the drop down, select SSP and click “Submit”

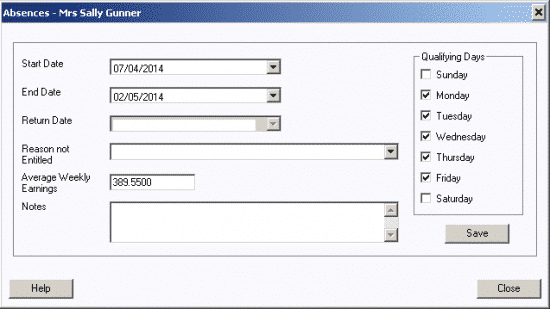

Enter the date range of the employee absence. Under “Qualifying Days” tick the days you consider to be normal working days for the employee.

When using the auto absence options the system will check to see if there is a linked period of incapacity. If there is no linked period PAYE-Master will discount the first three days as waiting day and will not pay SSP for that period. If the absence is linked to a previous absence PAYE-Master will not apply the waiting days. Any absence of 3 working days or less isn’t classed as a period of incapacity and no SSP will be paid.

If there is not enough pay history for the employee PAYE-Master may not be able to calculate the “Average Weekly Earnings“. This may prompt the system into thinking the employee isn’t paid enough to qualify for SSP. If necessary you can alter the value of average weekly earnings yourself.

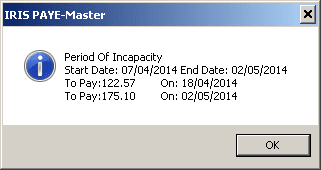

Click “Save” and you will see a breakdown of the payment due for this absence:

Click “OK” and you’ll see the absence filled in on the calendar:

Click “Close” and you’ll be taken back to the variations screen. You will see the SSP entry on the “Pay Table” tab.

Phased Return To Work

If you agree a phased return to work or altered hours after a period of sickness, pay SSP for the days that your employee is sick in the normal way. Any day for which SSP is paid will count towards the maximum entitlement of 28 weeks.

Your employee’s absence must form a Period of Incapacity for Work (PIW), ie. 4 or more consecutive qualifying day, before SSP is paid. Remember, that is Statutory Sick Pay. You are not limited in what you decide to pay to the employee as salary/hourly rates.

For more details please refer to:

https://www.gov.uk/guidance/statutory-sick-pay-employee-fitness-to-work

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.