Adjusting an Employees Final Payslip & Payments After Leaving

Article ID

11278

Article Name

Adjusting an Employees Final Payslip & Payments After Leaving

Created Date

10th August 2018

Problem

How to adjust an employees final payslip, reactivate a leaver or make an additional payment after leaving once an employee has had their leave date sent on FPS.

Resolution

If you are recalculating an employee’s final pay BEFORE finalising BEFORE sending FPS:

• Just alter the pay information in “Pay” | “Variations“, re calculate and carry on with payroll as normal.

If you are recalculating an employee’s final pay BEFORE finalising AFTER sending FPS:

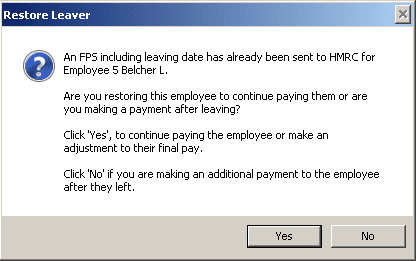

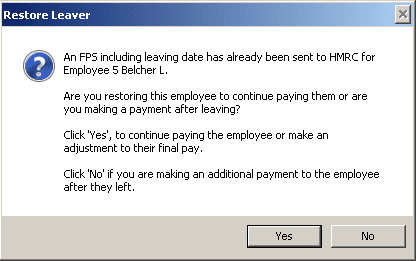

• Go into the affected employee details and delete the “Leave Date” on the “General” tab. Click “Save” and you’ll see the following message:

• Click “Yes“. Then “Save” and “Close” the employee details.

• Click ‘Pay’ | ‘Variations’ | ‘Enter Variations’

• Click ‘Choose’ an employee then select the relevant employee

• Enter the required adjustments to the employee’s current pay period and click ‘Save’ then ‘Close’

• Click ‘Calculate’

• Click ‘OK’ to confirm calculation of payroll

• Go back into the employee details and re enter the “Leave Date” on the “General” tab. You will most likely need to re print the employees p45.

• Re send the FPS for the pay period. If you are still before the pay date for the period, just send as normal. If this has become a late submission select option “H-Correction to earlier submission“.

If you want to resuming paying an employee permanently AFTER sending FPS (eg the employee has returned to work with the company OR the wrong employee was set as a leaver):

• Go into the affected employee details and delete the “Leave Date” on the “General” tab. Click “Save” and you’ll see the following message:

• Click “Yes“. Then “Save” and “Close” the employee details. The employee is now available to pay again moving forward.

If you are making an additional payment after the employee’s leave date:

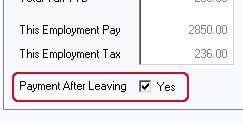

• Select the employee and on the “Starter/Leaver” tab tick ‘Payment After Leaving’:

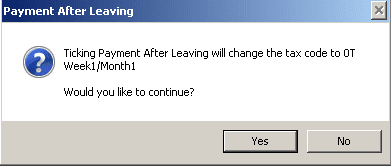

• The following message will be displayed:

• Click ‘Yes’ to continue then ‘Save’ and ‘Close’

• Click ‘Pay’ | ‘Variations’ | ‘Enter Variations’

• Click ‘Choose’ an employee then select the relevant employee

• Enter the required adjustments to the employee’s current pay period and click ‘Save’ then ‘Close’

• Click ‘Calculate’

• Click ‘OK’ to confirm calculation of payroll

• Proceed with your payroll as normal. When you send the FPS HMRC will receive details of the additional payment and, if necessary, adjust the employee tax at their new employment. You should not produce a new P45 for the employee.

HMRC now allow you to remove the leave date for a leaver, in the current year, and continue to pay the employee where the leaving date has already been submitted via an FPS.

This function would generally be used in the scenario where you have made the wrong employee a leaver and already submitted the FPS.

When you restore a leaver, a message will be displayed giving you the options to:

Continue paying the employee or make an adjustment to their final pay

or

Make an additional payment to the employee after they have left

NOTE: If the employee has worked elsewhere in between being reported as a leaver and returning to your employment you should set them up with a new employee record like you would with any other new starter.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.