Reason for late reporting

Article ID

11585

Article Name

Reason for late reporting

Created Date

1st January 2019

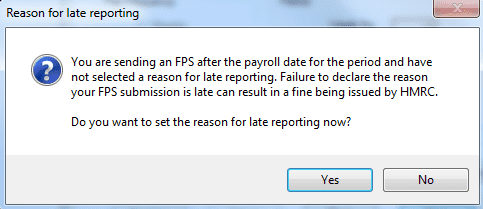

Problem

When trying to send an FPS you receive a prompt to complete a reason for late reporting.

Resolution

The HMRC require that FPS submissions are received on or before the pay date. You are seeing this message because the pay date for the period you are sending is before the current date.

That is the PAY DATE used (as shown on the payslips) is after the SYSTEM DATE on your PC (ie. today’s date). If your submission is being sent to HMRC AFTER the pay date it is a late submission and you are required to select a reason why it is late. IF YOU DO NOT SELECT A VALID REASON YOU MAY BE FINED BY THE HMRC.

NOTE: The pay date in use should be the date the employees actually receive the payment. This is not when you are paying the employees for or when you process the payroll.

If the pay date in use on your system is not when the employees receive the payment, you are running your payroll in error and you should correct your payroll calendar ASAP.

If you are sending your FPS submission late you need to select a valid reason to avoid a fine from HMRC. These options are:

• A – Notional Payment: Payment to Expat by third party or overseas employer

You’re an overseas employer paying an expat employee, or you pay them through a third party

In this situation, you would need to make your FPS submission by the 19th of the tax month AFTER making the payment.

• B – Notional Payment: Employment Related Security

You pay your employee in shares at less than market value

In this situation, you would usually have to submit your FPS by the 19th of the tax month you gave them the shares. For complex situations contact HMRC for guidance

• C – Notional Payment: Other

You make any other non-cash payment (for example, vouchers or credit tokens) to your employee

In this situation, you would need to make your FPS submission by the 19th of the tax month AFTER making the payment.

• D – Payment subject to Class 1 NICs but P11D/P9D for tax

You pay your employee an expense or benefit through payroll where you must pay NICs, but not Income Tax. This depends on the type of benefit, for details on expenses and benefits check with HMRC here.

In this situation, you would need to make your FPS submission within 14 days of the end of the tax month

• E – Micro Employer using temporary ‘on or before’ relaxation – Please note, this option has now been retired by the HMRC and from the 2016/2017 tax year you will no longer be able to select this option as a reason for late reporting.

HMRC let you report monthly instead of weekly because you were an existing employer on 5 April 2014 and had fewer than 10 employees on 6 April 2015

Until 5 April 2016, you can choose to report monthly on or before the last payday in the tax month

• F – No working sheet required; Impractical to report

You pay your employee based on their work on the day (for example, harvest workers paid based on how much they pick)

In this situation, you would need to make your FPS submission within 7 days of paying your employee

• G – Reasonable excuse

A reasonable excuse is classed as something outside your control that stopped you meeting the deadline, for example, service availability issues with HMRC gateway. HMRC would not accept the following as a reasonable excuse; you relied on someone else to send your return and they didn’t; you found the process too difficult or you were unaware of the legislation. This is not an exclusive list and the judgement is at the discretion of HMRC.

In this situation send the FPS as soon as possible.

• H – Correction to earlier submission

You have realised that a previous FPS contained incorrect information

In this situation, you would need to make an additional submission reporting the correct payment details. Send by the 19th of the tax month after your original FPS for HMRC to show the correction in that month’s PAYE bill. Corrections can still be sent later than the 19th of the following tax month but you may need to contact HMRC online services to see the change reflected in your PAYE bill.

If you meet the criteria specified above, send the FPS within the revised deadlines and select the correct option when sending your FPS you will more than likely avoid a penalty from HMRC. This, though, is at the discretion of HMRC. You should contact HMRC directly to discuss the reasons for late reporting and any potential penalties.

If HMRC issues a penalty you disagree with you can appeal the decision. Check HMRC details on appeals here.

Please Note: There is no provision in the specification for RTI as issued by HMRC to include a description to accompany the reason for late submission. The judgement as to whether to issue a fine or not is at the discretion of HMRC. The only course of action is to select one of the options listed above. If you are unsure about which option would apply to your situation please contact the HMRC helpdesk on 0300 200 3200

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.