Small Employer Relief

Article ID

11593

Article Name

Small Employer Relief

Created Date

20th November 2019

Problem

How do I activate small employer relief?

Resolution

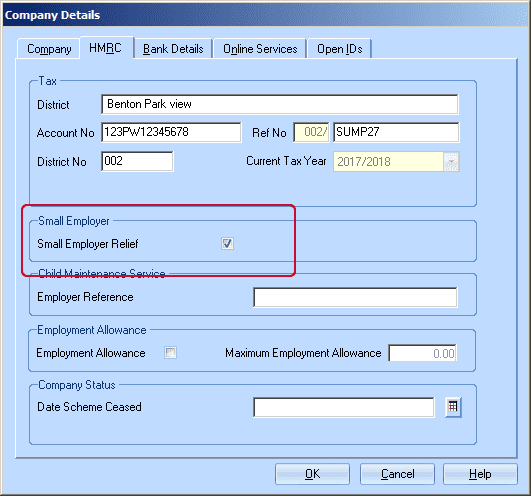

To switch on small employer relief go to:

“Company” > “Company Details” > “HMRC” and tick the box to activate:

If the company is entitled to Small Employer Relief (i.e. if the total NI for the previous tax year did not exceed the Small Employer’s Relief Threshold, £45,000 at time of writing), ticking this box ensures that IRIS Payroll automatically includes 100% reclaimed plus 3% compensation on SMP, SAP and SPP (correct for 20/21).

This setting is applied when you do month end processing. Check here for more details on month end processing.

The Small Employer’s Relief Threshold is included in the Tax & NI Rates report. You can print this by clicking on the HMRC tab on the Ribbon then clicking Tax & NI Rates.

If you have activated the option late:

If you have turned on small employer relief part-way through the tax year, you may find that there are periods where the correct recovery/compensation hasn’t been applied. For these periods you need to go back and redo month end processing. You will not need to undo/redo any payroll.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.