Processing student loan deductions.

Article ID

11814

Article Name

Processing student loan deductions.

Created Date

22nd September 2020

Problem

How do I start student loan deductions for an employee?

Resolution

Starting Student Loan Deductions

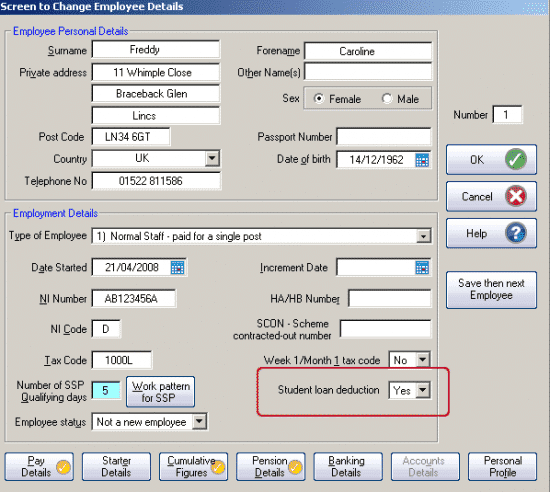

To enable student loans deductions you need to set the student loan option to “Yes” within the employee details screen:

GP Payroll will automatically calculate the amount to be deducted in the next payroll calculation.

Student Loan Plan Type

As of the 2016/17 tax year, there is now an option of which student loan plan type the employee should be set to. The difference in the plan types is the threshold at which deduction will begin. The threshold for plan type 1 for 20/21 is £19,390. The threshold for plan type 2 for 20/21 is £26,575. BOTH plan types calculate deduction at 9% of the NIC liable pay. When you receive the SL1 from HMRC it will specify which plan type to use.

Please Note: There is no provision on the p45 form to indicate which plan type an employee should be on. When you add a new starter to the system, the employee needs to confirm the following;

• Did they live in Scotland or Northern Ireland when they started the course? OR

• Did they live in England or Wales and started the course before 1 September 2012?

If so, set them to plan type 1.

• Did they live in England or Wales and started the course on or after 1 September 2012.

If so, set them to plan type 2.

If your employee cannot confirm these details, ask them to contact the Student Loan Company (SLC). If they’re still unable to confirm their plan type, start making deductions using plan type 1 until you receive further instructions from HMRC.

Stopping a Student Loan

When you receive the SL2 message from the HMRC, return to the screen above and set the student loan option to “No“.

Please note: Student loans will not be deducted if the employee’s earnings are below the Student Loan Threshold. For tax year 20/21 this is £19,390.00 (type 1) or £26,575.00 (type 2) . Student loans contributions are then 9% of all NIable pay over this amount. The deducted amount is always rounded down to the whole pound value.

Example calculation (Plan type 1):

The employee is paid £1800.00 NIable pay for the month.

Monthly Student Loan Threshold = 19390 ÷ 12 = £1615.83

Employee Pay subject to Student Loan = £1800.00 – £1615.83 = £184.17

9% of £184.17 = £16.58, rounded down to the whole pound, employee contribution is £16

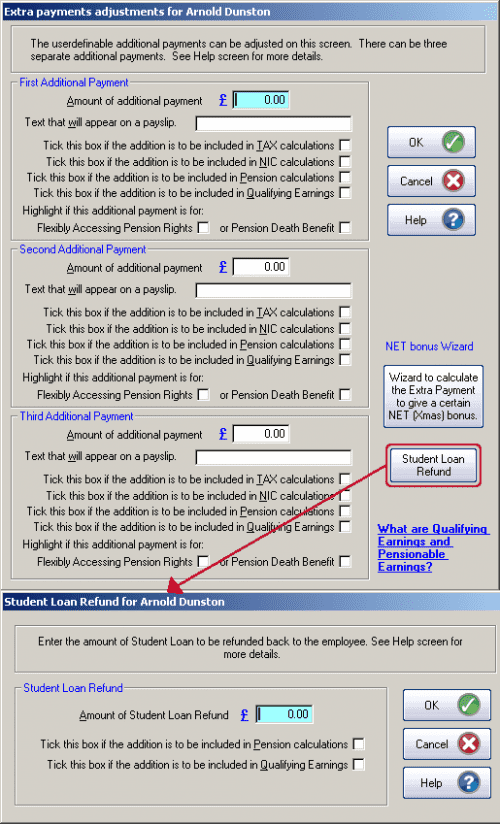

Refunding Student Loan

To action a Student Loan Refund go to Payroll Calculation | Temporary Adjustments | Extra Payments | Extra payments adjustments | Student Loan/Postgraduate Student Loan Refund screen. Click this button to open the Student Loan Refund screen where you can enter the refund amount to be processed.

Processing the Student Loan Refund will automatically reduce the Total Student Loan value until it reaches the minimum of 0.00. From this screen you can also choose if you require the addition to be:

• Included in Pension calculations

• Included in Qualifying Earnings

There may be occasions when you need to refund more than the year-to-date value, for example, if you are refunding student loan deducted in the previous tax year. If you attempt to refund an amount greater than the year-to-date value a message will be displayed asking if you want to continue.

Please note: The Employer’s Payment Record (P32) and your FPS will reflect any Student Loan Refund. However, if you refund a Student Loan in the current tax year and also include an amount taken in a previous tax year, we would advise that you send an EYU to correct the previous year’s Student Loan to-date value.

Postgraduate Student Loan

From April 2019, Postgraduate Loans (PGL) are due to be repaid through PAYE. The repayment threshold has been set at £21,000 and loans will be repaid at a rate of 6%. Similar to current Student Loan start (SL1) and stop (SL2) notices, Postgraduate Loan start (PGL1) and stop (PGL2) notices will be downloaded with other HMRC Messages. Postgraduate Loan start and stop notices will be included in the same count as Student Loans.

From April 2019 an employee may be liable to repay a Student Loan and a Postgraduate Loan concurrently as these are separate loan products.

How the student loan repayments are calculated

Postgraduate loans will not be deducted if the employee’s earnings are below the Postgraduate Loan Threshold. For tax year 20/21 this is £21,000. Postgraduate loans contributions are then 6% of all NIable pay over this amount. The deducted amount is always rounded down to the whole pound value.

Example calculation:

The employee is paid £1850.00 NIable pay for the month.

Monthly Student Loan Threshold = 21,000 ÷ 12 = £1750.00

Employee Pay subject to Student Loan = £1850.00 – £1750.00 = £100.00

6% of £100 = £6, rounded down to the whole pound, employee contribution is £6

Postgraduate Student Loan Refund

On the Payroll Calculation | Temporary Adjustments | Extra Payments | Extra payments adjustments screen, the Student Loan Refund button has been renamed Student Loan/Postgraduate Student Loan Refund.

A new section has been added to the refund screen, Postgraduate Student Loan Refund. Here you can enter the amount to be refunded and also select if the refund is to be included in Pension calculations and/or Qualifying Earnings.

Student loan deductions are included in the PAYE costs for the employer on the month end summary (p32) report. These values get added onto the other PAYE liabilities for the company and are paid to HMRC directly along with the tax and NI due. You do not need to send payments to any other body.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.