Employer NI Saving: Salary Sacrifice National Insurance Saving

Article ID

12065

Article Name

Employer NI Saving: Salary Sacrifice National Insurance Saving

Created Date

1st January 2019

Problem

Used with a Salary Sacrifice Pension, a pension contribution deducted from the employee before tax and NI are calculated. This reduces the NI cost for both the employee and employer. In some salary sacrifice pension schemes, some of the employers NI saving are paid into the pension pot for the employee using the "employee NI saving" display item.

We have added the facility to include all or part of the employer NI saving, which is caused by the salary sacrifice, in the pension contributions. The user can determine the percentage at which the NI saving is calculated.

This is a display item only and will not affect the employee pay, this is for reporting purposes only.

Resolution

To create the employer NI saving contribution:

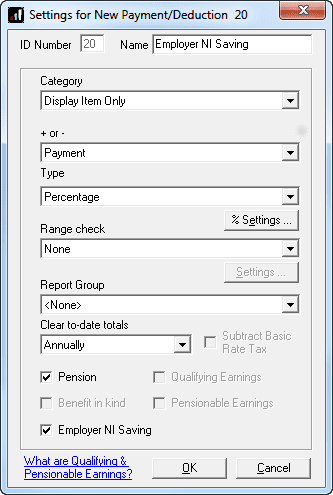

• Go to “Company” | “Alter Payments/Deductions” Click “Add new” and then “No” to the wizard

• Enter a Name

• Category – Display item only

• Select either payment or deduction (will just set which side of the payslip item will show on)

• Type – Percentage

• Tick Pension

• Tick Employer NI saving

• Click OK

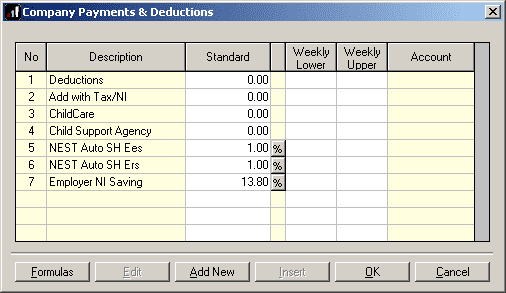

• In the “Standard” enter the % value to be calculated

Please Note: The value shown above is for illustrative purposes only. If you are unsure what value you should use please get confirmation from the pension provider.

• Once created, add the new item to the details in the “Pay/Deds” tab for those employees with a salary sacrifice pension. The software will then calculate the correct amounts during payroll run.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.