Calculating Directors National Insurance in GP Payroll

Article ID

12075

Article Name

Calculating Directors National Insurance in GP Payroll

Created Date

27th February 2019

Problem

How to calculate national insurance using director rules.

Resolution

Directors’ NI Calculation

The ability to calculate Directors’ NI has been added to GP Payroll. This is due to a number of GP Practices being run as limited companies, rather than partnerships, and will allow a practice to indicate to HMRC which individuals are directors.

While a normal employee will have their NI free allowance split evenly over the tax year, directors get ALL of the NI allowance up front and will not pay contributions until their NIable earnings for the year reach the Primary Threshold (PT). This is £8,632 for 19/20.

Once their earnings reach the PT they will pay 12% (assuming they are on NI rate A) on all their earnings until they reach the upper earnings limit (UEL). This is £50,000 for 19/20.

Once the NIable pay for the year exceeds the UEL the director will continue to pay 2% on all their NIable earnings.

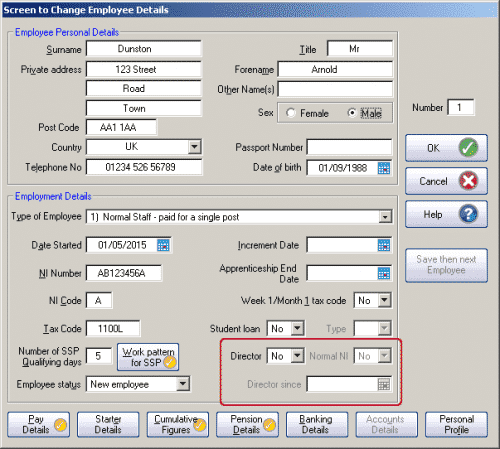

Marking an employee as a director

This option can be found in the employee details. These fields will be visible for all employees except 7) Partner – not in PAYE

• Director drop-down (Yes or No options)

• Normal NI ¹ drop-down (Yes or No options)

• Director since ¹ date field (this requires completion if Director is set to Yes)

¹These fields will only be enabled if Director is set to Yes

Once an employee has been set as a director the next FPS sent will inform HMRC of the director status along with whether set to Normal NI and the Director since tax period.

Normal NI Option

Using the normal NI option the software will ignore the director rules for calculation until the final month of the tax year. When you process the final month GP Payroll then automatically perform a retrospective NI adjustment to ensure they comply with the directors’ rule for the tax year.

When using the normal NI option the FPS will still indicate the employee as a director for HMRC.

This is at the discretion of the director. If they would prefer the normal NI calculation to be applied set Normal NI to Yes.

Please Note: If a Director has been paid using Director (annual) National Insurance thresholds, they must continue to pay National Insurance using the annual thresholds for the full year, even if they cease to be a director during the tax year.

Director since Option

Setting the date the employee became a director will have the effect of pro-rating annual NI allowance for the period of the year remaining. E.g. Employee becomes a director on the 1st September, this equates to tax week 22. There are 31 weeks remaining in the tax year (including week 22 which would be calculated on the director rules) So their allowance would become (£8632÷ 52)*31 = £5146. This new director would start to pay NI contributions once their pay reaches £5146.01 since being appointed a director.

Correcting Errors with Directors NI

If you have calculated payroll since setting the Director indicator to Yes and then change the Normal NI indicator from its current setting you will need to:

• Use Correct Errors to delete the payslip(s)

• Set the Normal NI indicator as required

• Recalculate the payroll

If you have an instance where the Director status is set to Yes and the Director since date falls within a period already calculated you will need to:

• Use Correct Errors | Wrong NIC Code/Recalculate for director | To recalculate the payroll with a different NIC Code.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.