Automatic re-enrolment for AE Pensions

Article ID

12086

Article Name

Automatic re-enrolment for AE Pensions

Created Date

14th August 2018

Problem

What is re-enrolment?

Resolution

Re-enrolment

Re-enrolment occurs approximately 3 years after the company’s staging date and then every 3 years after that. At the company’s re-enrolment date eligible jobholders that previously opted out or ceased contributions, more than a year before that date, must be assessed to work out if you need to put them back into your pension scheme.

Re-enrolment follows the same process as the automatic enrolment assessment, however postponement is not permitted.

• The re-enrolment date can fall anywhere within a 6 month window which falls 3 months either side of the third anniversary of the staging date

• Eligible jobholders need to be re-enrolled on the chosen re-enrolment date

• Eligible jobholders MUST receive written communications within 6 weeks of the re-enrolment date to explain how re-enrolment applies to them

• Postponement CANNOT be used for re-enrolment

• You do not need to inform TPR of the re-enrolment date

• You MUST complete the declaration of compliance

Each time re-enrolment occurs, you are required to complete the declaration of compliance. This is an essential part of the process, if you do not complete this, TPR are likely to audit you.

Examples of Re-Enrolment

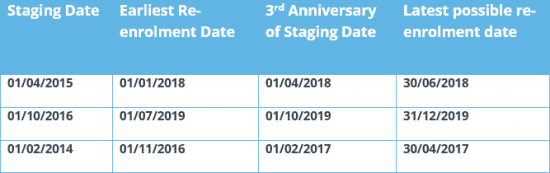

The re-enrolment date must fall within the Re-enrolment window – this is 3 years after the Staging Date (+ or – 3 months)

In example 1 in the table above, the Re-enrolment window is from 01/04/2018 and 30/06/2018.

In the second example the Re-enrolment window is from 01/07/2019 and 31/12/2019.

The third example has a Re-enrolment window from 01/11/2016 and 30/04/2017.

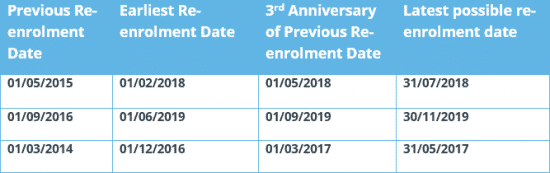

The re-enrolment date must fall within the Re-enrolment window – this is 3 years after the previous Re-enrolment Date (+ or – 3 months)

In example 1 in the table above, the Re-enrolment window is from 01/02/2018 and 31/07/2018.

In the second example the Re-enrolment window is from 01/06/2019 and 30/11/2019.

The third example has a Re-enrolment window from 01/12/2016 and 31/05/2017.

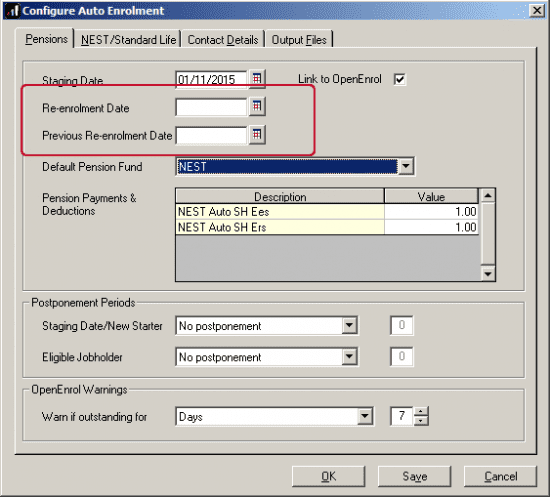

Configuring your re-enrolment date

To cater for Re-enrolment, two new fields have been added to the Configure Automatic Enrolment screen; Re-enrolment Date and Previous Re-enrolment Date.

These can be found in your software, go to Go to “Pension” | “ Configure Auto Enrolment“

Exception: IRIS GP Payroll users can find the option in “Setup/Options” | “4-Practice Pension Details” | “Auto Enrolment Details“

You will need to complete the “Re-enrolment Date” field here. You can set your Re-enrolment Date to be any time within the re-enrolment window, which is three months before and three months after the third anniversary of your staging date.

If the re-enrolment employee is an eligible jobholder they will be automatically enrolled into the default pension scheme or the one specified in their employee details. The only difference is that the re-enrolment employee cannot be postponed.

For Re-enrolment a new letter type L1R will be published to IRIS OpenEnrol. This letter informs the employee about their enrolment not re-enrolment, as per the pension regulators guidance.

Additional:

• If the re-enrolment employee is an eligible jobholder within the pay reference period when re-enrolment occurs, they will be automatically enrolled

• If the individual is not an eligible jobholder within the relevant pay reference period, no further action will be taken until the next re-enrolment date

Re-enrolment Date & Previous Enrolment Date

• If the Staging Date field is blank, the Re-enrolment Date and Previous Re-enrolment Date fields will be disabled

• If you run the year-end restart process, more than 3 months after re-enrolment date, the software will automatically move the Re-enrolment Date to the Previous Re-enrolment Date field

• When logging into a company, if the re-enrolment window end date is approaching, a warning will be given that the Re-enrolment Date field is blank

• If the last day of the Pay Reference Period is on or after the last possible day of the Reenrolment window and a Re-enrolment Date is not entered, the payroll will stop running

Declaration of Compliance

Employers are required to submit a new declaration of compliance at the re-enrolment date. The Declaration of Compliance report has been amended and if a re-enrolment or previous re-enrolment date is entered, this date will be used instead of the staging date to produce the details required.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.