System Failure. The submission of the document has failed due to an internal system error; Empty Error Response from Government Gateway; An error occurred while attempting to communicate with the Government Gateway

Article ID

12169

Article Name

System Failure. The submission of the document has failed due to an internal system error; Empty Error Response from Government Gateway; An error occurred while attempting to communicate with the Government Gateway

Created Date

18th December 2018

Problem

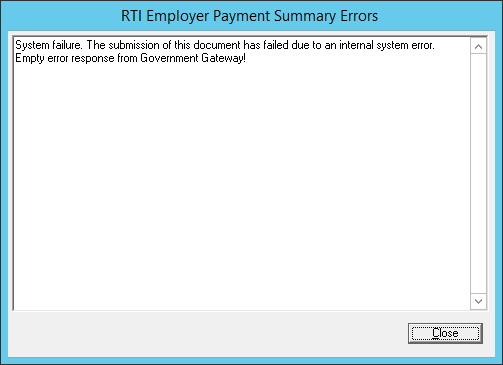

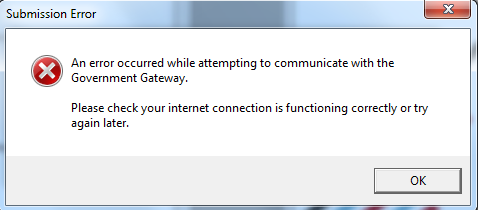

When trying to submit any RTI submission user reports the following error(s):

Please Note: While we endeavour to support all customer queries, in this situation, there is little else we can advise. Ultimately this is an HMRC issue that IRIS has no direct control over. We will make every effort to keep you up to date with service issues and technical problems relating to the government gateway via the IRIS knowledge base or the live messaging system in your product. Any queries relating to the service availability of the government gateway should be directed at HMRC.

Check HMRC Service availability here.

HMRC online services helpdesk: 0300 200 3600

Resolution

This error indicates HMRC gateway service is experiencing problems receiving, processing or responding to your RTI submission, not a problem with your payroll software

I have had to cancel my submission, what do I need to do now?

• Do not resend your submission, wait for HMRC gateway to resume normal service. Check here for service status updates.

• After normal service resumes, the registered email contact should receive an acknowledgement from HMRC. If this is forthcoming there is nothing else you need to send. If no acknowledgement arrives you will need to check the submission status with HMRC directly. Contact HMRC online services on 0300 200 3600 for confirmation. If HMRC cannot confirm the submission has been received please resend the affected submission from your payroll software as soon as possible. If prompted to complete a reason for late filing, select option G-Reasonable excuse.

Once you have received the acknowledgement or have otherwise confirmed the submission status with HMRC online services, it is good practice to check the RTI audit log in your payroll software. You will see one of three status options; failed, cancelled or pending.

My submission is showing as failed or cancelled in the audit log, what do I do?

Providing you have received HMRC acknowledgement any warnings about missing submissions from your payroll software can be ignored. Please make sure you keep the HMRC acknowledgement as proof of your submission.

My submission is showing as pending in the audit log, what do I do?

In this scenario, when normal service is resumed, you should attempt to complete the pending submission. If you complete a pending submission it will update the software audit log with the correct submission status. HMRC will not see this as a late submission. It is merely confirming the submission was received by HMRC at the first attempt. Please see your software RTI guide for details on completing pending submissions.

Where do I find the RTI submission audit log?

PAYE-Master:

From the menu item “RTI Online Services” go to “Audit” > “View“

GP Payroll:

From the main menu go to “RTI Submissions” > “View Log“

Bureau Payroll & Payroll Business:

On the menu ribbon go to “Online Filing” > “View Audit“

Earnie & Earnie IQ

From the menu item “Online Services” go to “Audit” > “View”

Please Note: While we endeavour to support all customer queries, in this situation, there is little else we can advise. Ultimately this is an HMRC issue that IRIS has no direct control over. We will make every effort to keep you up to date with service issues and technical problems relating to the government gateway via the IRIS KnowledgeBase or the live messaging system in your product. Any queries relating to the service availability of the government gateway should be directed at HMRC.

Check HMRC Service availability here.

HMRC online services helpdesk: 0300 200 3600

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.