NHS Employers Pension Contribution 19/20 Incorrect

Article ID

12201

Article Name

NHS Employers Pension Contribution 19/20 Incorrect

Created Date

17th April 2019

Problem

An issue has come to light were GP Payroll is setting the incorrect value for England/Wales & Northen Ireland employer NHS pension contributions once payroll has been moved into the 19/20 tax year.

Update 16/04/2019: The rates for Northern Ireland have been corrected with the release of v2019.1.26. Please update your software to this version as soon as possible. Alternatively, if you are unwilling or unable to update your software please follow the instruction below to manually correct the employers' pension contribution rate.

The rates for England/Wales have been corrected with the release of v2019.1.25. Please update your software to this version as soon as possible. Alternatively, if you are unwilling or unable to update your software please follow the instruction below to manually correct the employers' pension contribution rate.

We have now had confirmation from NHS Scotland, their employer’s contribution for 19/20 is to be set at 20.9%, this is correct in the software and will be applied once you move into the 19/20 tax year. There is nothing you need to change in your payroll software if you are using the Scotland NHS pension option.

Resolution

GP Payroll is setting the employers pension contribution for England/Wales at 20.68% & 22.5% for NHS Northern Ireland for the 19/20 tax year.

Unfortunately, we received communication from the pension agency late that the employers should only contribute 14.38% for England/Wales & 16.3% for Northern Ireland.

To correct this problem:

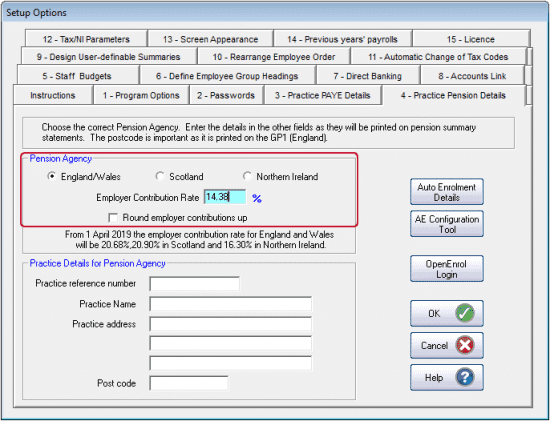

If you are using England/Wales NHS pension option, after you have performed year-end for 18/19 tax year and moved your payroll into 19/20 go to Setup/Options | 4-Practice Pension Details and amend the rate to 14.38%.

Click OK to save the change and continue with your payroll as normal.

Update: We have now had confirmation from NHS Scotland, their employer’s contribution for 19/20 is to be set at 20.9%, this is correct in the software and will be applied once you move into the 19/20 tax year. There is nothing you need to change in your payroll software if you are using the Scotland NHS pension option.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.