Business Tax- Capital Allowances Computation, Additions entered on fixed asset screens do not agree with total additions per trial balance.

Article ID

business-tax-capital-allowances-additions-entered-on-fixed-asset-screens-do-not-agree-with-total-additions-per-trial-balance

Article Name

Business Tax- Capital Allowances Computation, Additions entered on fixed asset screens do not agree with total additions per trial balance.

Created Date

8th February 2024

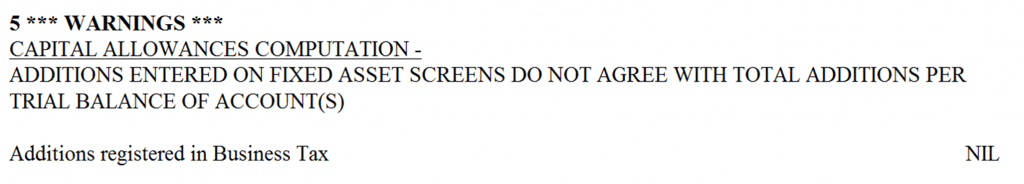

Problem

IRIS Business Tax- Capital Allowances Computation, Additions entered on fixed asset screens do not agree with total additions per trial balance.

Resolution

This is an automated message from AP/BT which appears on the BT tax comp.

1. Go to AP and BT and run checks on your assets – if the calculations are correct in both BT and AP then please follow the steps to suppress the warning:

2. Go to Edit – Corporate tax comp options

3. Tick ‘Suppress capital allowances additions warning’, the warning will not appear.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.