Business Tax- Total of loans repaid, released, written off is higher then total of loans made during period & Error A25D ‘today’

Article ID

business-tax-total-of-loans-repaid-released-written-off-is-higher-then-total-of-loans-made-during-period-a25dtoday

Article Name

Business Tax- Total of loans repaid, released, written off is higher then total of loans made during period & Error A25D ‘today’

Created Date

15th June 2023

Problem

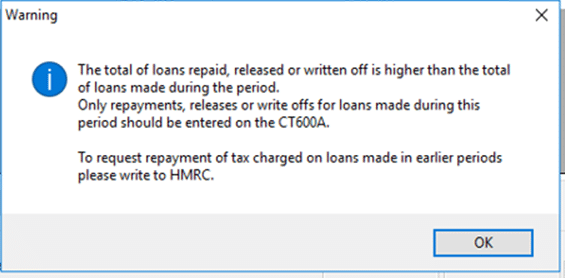

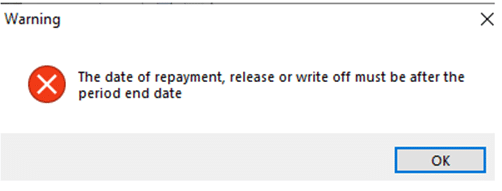

IRIS Business Tax- CT600A Total of loans repaid, released, written off is higher then total of loans made during period OR must be after the period end date

Resolution

This also applies if you are trying to repay a loan brought forward but when you enter any date of repayment it shows: ‘The date of repayment must be after the period end date’

1.Load the company and relevant period

2. Go to Data Entry | Loans to Participators

3. Override the values to zero value or to the new remaining value. (If its a B/forward value then reduce it manually)

4. Go to Data Entry | Summary – tick ‘For earlier period’ within the Repayment Claim section edit notes and explain why you removed/reduced the figures

5. If you need the CT600A form to appear as well- Data Entry and Summary – on right side tick the YES button for the CT600A. The notes you made on step 5 will show on the Tax Comp and not on the CT600A.

If you get error – ‘Box A25D must not be later than today’. This is a HMRC online filing validation that prevents the return from being filed with a ‘future’ date (eg the repaid/released date is in the future). Basically, the loan needs to have been paid off before the return is submitted. You will need to delay submission until after a later date eg if the loan was repaid 01/08/2025- then submit it 31 August and 31 December respectively.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.