Personal Tax: Fill in Foreign Dividends Boxes 6, 7 Page TR3 OR Other Dividends Box 5?

Article ID

personal-tax-fill-in-foreign-dividends-boxes-6-7-page-tr3

Article Name

Personal Tax: Fill in Foreign Dividends Boxes 6, 7 Page TR3 OR Other Dividends Box 5?

Created Date

9th November 2021

Product

Problem

IRIS Personal Tax: How to fill in Foreign Dividends Boxes 6, 7 on Page TR3 and Other Dividends box 5?

Resolution

TR3 Box 5 – Go to Dividends, Capital assets, Shareholdings and create the share, ensure the UNIT TRUST option is ticked (on Top right) then go to Dividends, tick CASH and enter the value there. This will complete box 5.

TR3 Box 6 and 7 – HMRC rule set up for Foreign income: Users cannot claim ‘Foreign Tax Credit Relief’ (FTCR) on Foreign dividends – and expect it to be shown on page TR3 boxes 6 etc.

If you claim ‘FTCR’ on the dividends, then it needs to go on to the Foreign pages (and not TR3 box 6 etc).

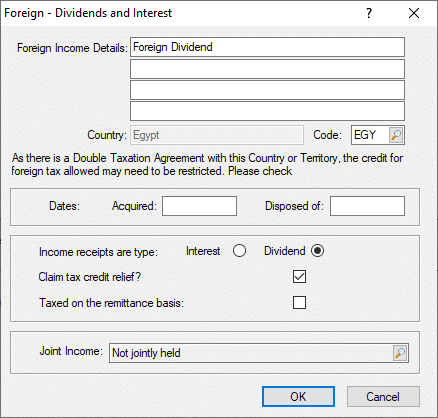

If you have a Foreign dividend entry – You can test this by:

- Foreign

- Dividends and Interest

- Open the dividend entry on the top half

- Untick the the ‘Claim Tax credit relief’ box and then check page TR3.

- If the client really has a ‘Claim Tax credit relief’ then re-tick it and it will only show on the Foreign pages.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.