Personal Tax- HMRC Special ID53,54,55,57 etc

Article ID

personal-tax-hmrc-special-id535455-etc

Article Name

Personal Tax- HMRC Special ID53,54,55,57 etc

Created Date

24th September 2024

Product

Problem

IRIS Personal Tax- HMRC Special ID53,54,55 etc this mainly affects the 2023/2024 year

Resolution

This list of HMRC Special IDs are unique for each year and this list has some specific to 2023/2024. New ID codes not yet on the list below can be added on per year by HMRC.

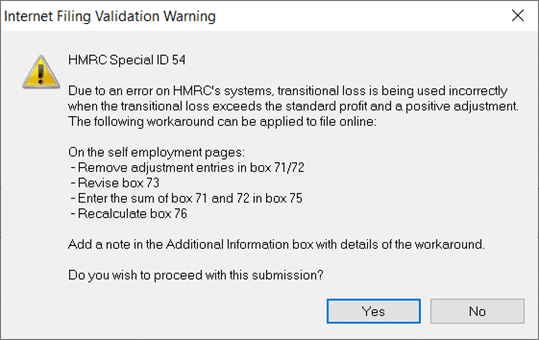

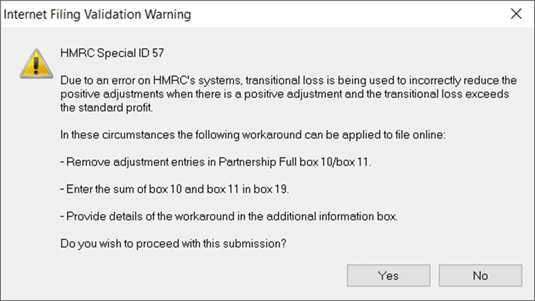

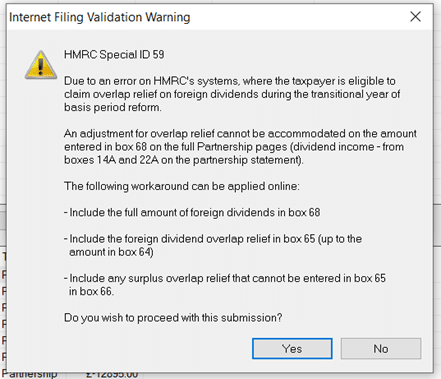

These HMRC Special IDs may appear when you generate a tax return/tax comp. Read the message which explains what is happening and what to do next – some you have to submit by paper to HMRC, some have workarounds provided on the explanation. Do note if the HMRC specific instructions do not apply to your client then generate, say YES to warning and submit online.

What are HMRC Special IDs? HMRC have made tax calculations which has affected IRIS PT and Trust Tax. Until HMRC fix these issues from their side then IRIS PT cannot be corrected either and they have added in these IDs to explain why.

When the Special IDs appear? HMRC may find a ID issue at any stage of a tax year and in the past. They will make a correction at any point so you may note a difference of a tax calculation from the start of the year and then checking later in the same year etc, this is because HMRC have applied corrections to fix these IDs.

If I ignore the Special ID and submit online? The submission may be accepted by HMRC BUT you/your client may get a HMRC rejection letter sent back later OR you will get a new 3001 error warning and until you follow the ID advise you cannot submit it. We recommend you follow the guidance provided by the HMRC pop up warning ONLY IF they apply to your client (if they do not apply then ignore and submit as per normal).

Examples for the 2023/2024 period

HMRC special ID46 – affects 2023/2024- this needs a paper return submission to HMRC as there is no workaround

HMRC special ID53 – affects 2023/2024 – Period reform and use the workaround listed by HMRC

HMRC special ID54 – affects 2023/2024 – Period reform and use the workaround listed by HMRC

HMRC special ID55 – affects 2023/2024 – Period reform and use the workaround listed by HMRC

HMRC special ID56 – affects 2023/2024 – Period reform and use the workaround listed by HMRC

HMRC special ID57 – affects 2023/2024 – Period reform and use the workaround listed. One of the reported issues of this ID57 is a ‘Loss is being used against other income’ BUT on the SA100 etc it shows a loss value being carried forward as well. Please follow the guidance on the HMRC pop up.

HMRC special ID59 – affects 2023/2024 – Period reform and use the workaround listed by HMRC. However IF there is no ‘overlap relief/from foreign dividends’ then click YES to the warning (to ignore it) and submit online. (An example: If there is a value under Box 68 FP5 Partnership- this is because Box 68 is a combined total for Dividends from UK and ‘Foreign’. This may trigger the ID59 because it assumes there is a Foreign entry as well)

HMRC special ID138

HMRC special ID7 – Trusts – use the workaround listed by HMRC

HMRC special ID8 – Trusts – use the workaround listed by HMRC

HMRC special ID9 – Trusts – use the workaround listed by HMRC

HMRC special ID10 – Trusts – use the workaround listed by HMRC

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.