Personal Tax- Residence Question Remittance Basis Charge claim £30,000?

Article ID

personal-tax-residence-question-remittance-basis-charge-claim

Article Name

Personal Tax- Residence Question Remittance Basis Charge claim £30,000?

Created Date

23rd January 2023

Problem

IRIS Personal Tax- Residence Question Remittance Basis Charge claim - when do i declare it?

Resolution

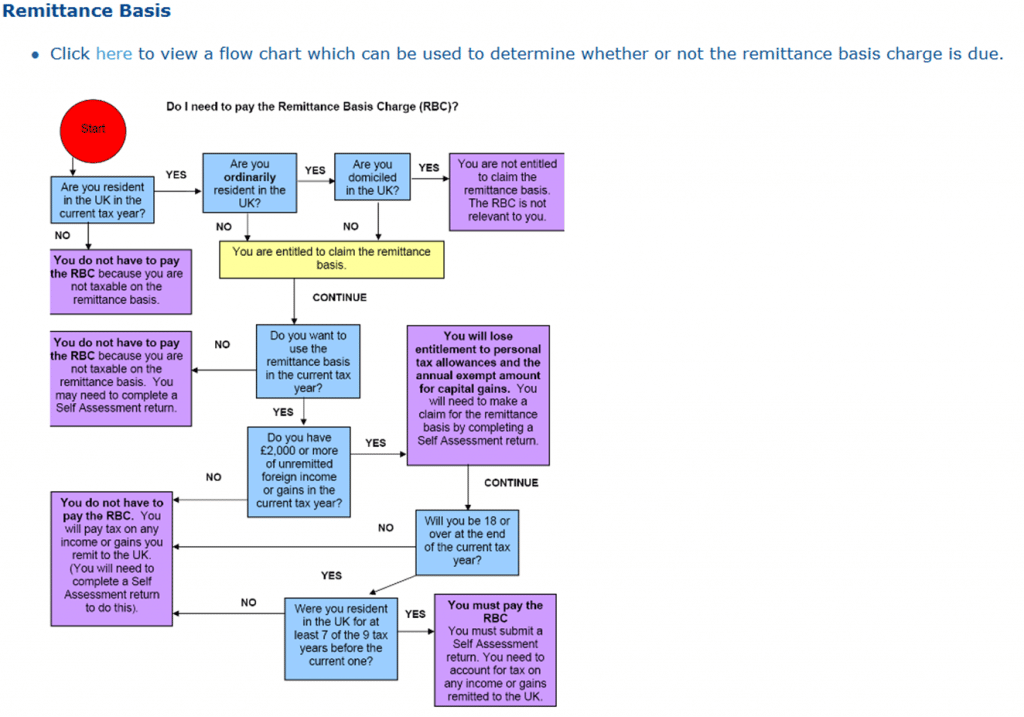

When can I declare the Remittance Basis charge £30,000 under the Resident Questionnaire.

Load Client and go to Reliefs, Misc, Resident Questionnaire, Remittance Basis tab and select the relevant options. read the flow chart at the bottom to see if you need to declare the charge.

- Tick ‘Claiming Remittance basis’

- Tick the relevant boxes

- The boxes ‘Amount of nominated income’ and ‘Amount of nominated capital gains’ (appear in Box 34 and 35 RR3 page) – entries in here MAY trigger the £30,000 charge to show on the Tax Comp. Those boxes follow HMRC rules so if you need guidance on what to enter then contact HMRC Support.

- The £30,000 charge will only show on the Tax comp and Tax due Box 1 TC1 page.

- If you follow the steps above but the 30K charge is still missing, then read the flowchart below and also review all your entries as some may be blocking the charge by design. If you need further advise then contact HMRC Support.

Use the ? on the top right of the Remittance Basis tab for further HMRC rules.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.