Personal Tax- SA108 gains SEIS,SEED Enterprise Scheme(EIS), must not exceed £50,000, £100,000, £200,000 etc

Article ID

personal-tax-sa108-gains-seed-enterprise-must-not-exceed-50000-100000-200000

Article Name

Personal Tax- SA108 gains SEIS,SEED Enterprise Scheme(EIS), must not exceed £50,000, £100,000, £200,000 etc

Created Date

12th January 2024

Problem

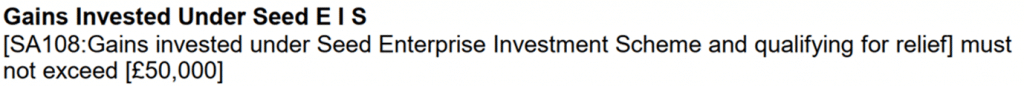

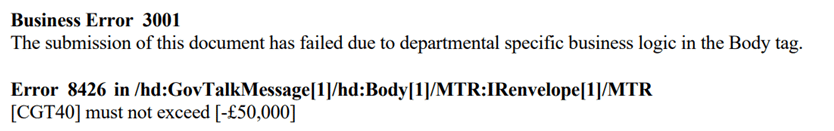

IRIS Personal Tax- SA108 gains SEIS, SEED Enterprise, must not exceed £50,000 (Box 40, 3001 8426)

Resolution

The rules below on this KB is for the 2022 HMRC (50K limit): The relief limit may change per YEAR eg 100K, 200K etc.

The SEIS Relief value for the 2022 year is £50,000, which is the limit set by HMRC for Asset Disposals. (if its a Deferral then read the four options below)

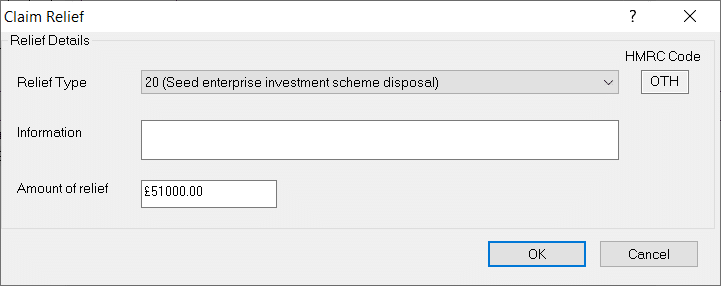

a. Check all your Share/Other capital gains and look for a relief with a Type 20 SEED Disposal. This value cannot exceed £50,000.

b. Check Capital Assets, Edit, Losses and other Info, if a entry is made under ‘Additional Gains invested under SEIS exemption’ which populates the Unlisted shares CGT40 SEIS box and overrides an existing relief (if any). This value cannot exceed £50,000 as it counts as a Type 20 SEED Disposal Relief. Remove this entry and add it as relevant Relief type against the Share/OCG.

We can advise four options;

1. Change it from SEED Disposal relief type 20 into a SEED Deferral relief type 19 (which will accept a HIGHER entry)

2. Review the other relief types/options on the list instead of Type 20

3. Reduce/remove the value.

4. If your still unsure then you need to contact a tax advisor or HMRC support for advise.

You may also get a error 3001 8426 – then check the steps above:

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.