Personal/Business Tax- ‘Business used Traditional accounting rather then cash basis’ not ticking box SEF/SES 8/10 or Partnership pages 3.9

Article ID

pt-bt-business-used-traditional-accounting-rather-then-cash-basis-not-ticking-box-sef-ses-8-10-or-partnership-pages

Article Name

Personal/Business Tax- ‘Business used Traditional accounting rather then cash basis’ not ticking box SEF/SES 8/10 or Partnership pages 3.9

Created Date

9th April 2025

Problem

PT/BT- 'Business used Traditional accounting rather then cash basis' not ticking box SEF/SES 8/10 or Partnership pages 3.9 box

Resolution

This is a known defect in IRIS version 25.1.0 for year 2025. Please update to 25.1.4.42 Service Pack release for this to be fixed.

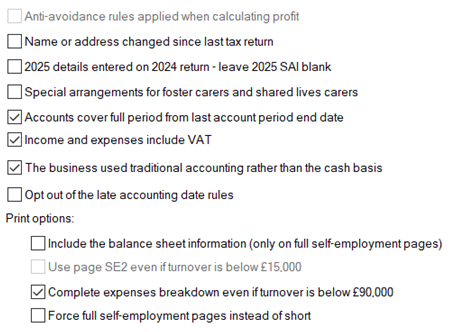

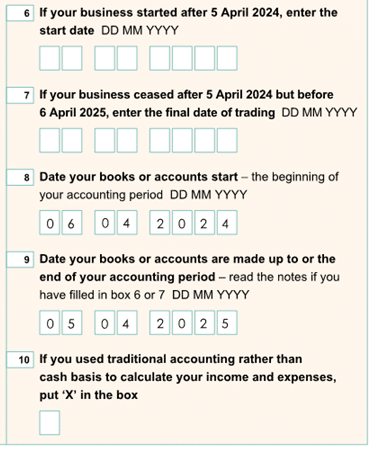

In Personal Tax: For a Sole Trader, open the relevant Trade period, Business Details tab, if you tick the Sole trade option ‘Business used Traditional accounting rather then cash basis’, however it is not ticking the box SEF/SES 8/10 on SA100.

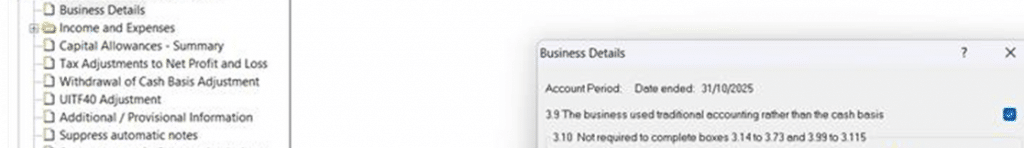

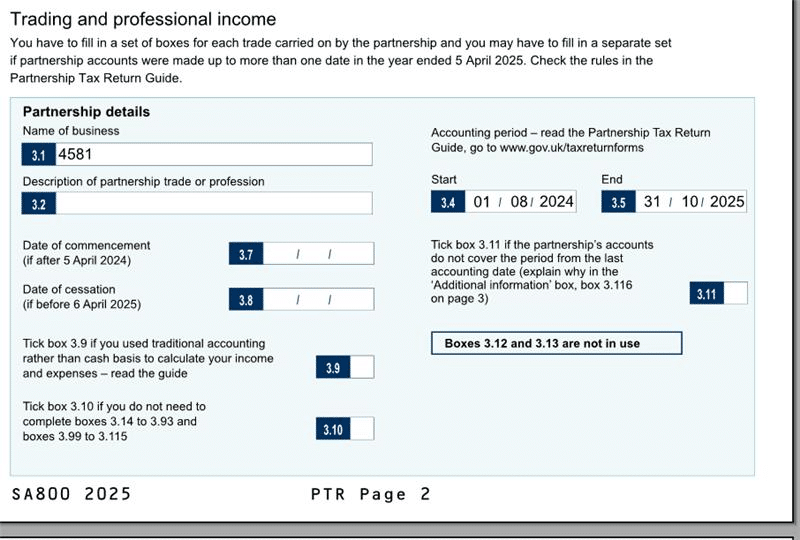

In Business Tax: For Partnership, go to Business details, tick box 3.9 – however it is not ticking the box 3.9 on page PTR page 2.

Workaround: In PT/BT add an additional note to explain the relevant box on the tax return should be ticked.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.