How do I set up an existing director mid year?

Article ID

10272

Article Name

How do I set up an existing director mid year?

Created Date

6th April 2018

Product

IRIS Bureau Payroll, IRIS Payroll Business

Problem

How do I set up an existing director mid year?

Resolution

In the Employee’s Record card, ‘Tax & Ni’ tab there is a ‘Director?’ tick box.

When you tick the box, the following question is asked: “Please Enter the Tax Week number that this person was made a Director”. You must enter the tax week number that the employee was appointed a director. Even for monthly paid directors you should still enter the week number.

This will set the start point for the director’s pro-rata year.

If the employee should have been a Director from a previous period an NI adjustment will need to be carried out.

Performing an NI Adjustment

Please Note: Before running an NI adjustment we strongly recommend creating a back up.

To perform an NI Adjustment go to the “Employee tab” and click on “NI Adjustment“

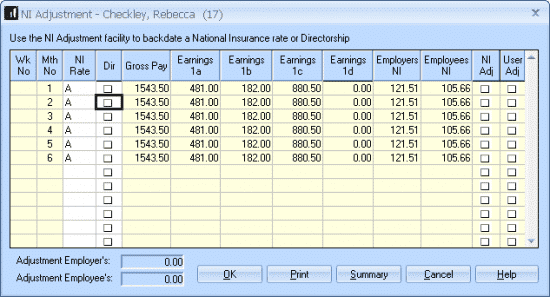

You will see a table of the employees NI calculations per pay period for the tax year. Tick the “Dir” box for the period the employee should have been a director:

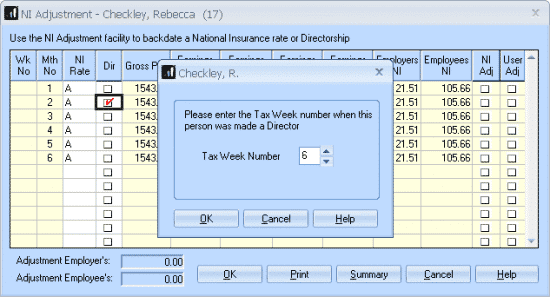

If it’s a monthly payroll you will then need to confirm the tax week you want to apply this change from:

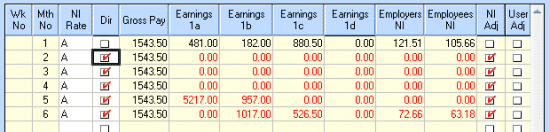

When you click “OK” you will see the values turn red as the system recalculates the employees NI using directors rules:

When you next calculate pay for this person any required adjustment in their NI contributions will be applied. You may see a higher NI deduction or even a refund depending on the employee circumstances.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.