How do I change an employees NI rate

Article ID

11192

Article Name

How do I change an employees NI rate

Created Date

1st January 2019

Product

IRIS PAYE-Master

Problem

How do a process a change of National Insurance rate for an employee eg A:Normal to C: Pensioner

Resolution

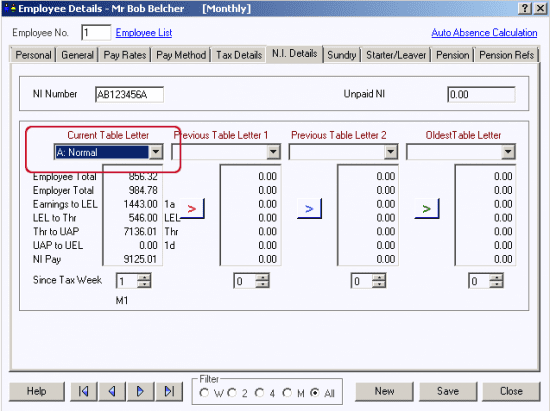

Open the NI details tab for the employee in question.

Please Note: Depending on the method used and the timing of your NI rate change you may see the employee pay more NI or potentially get an NI refund. Please check through the details below to ensure you have used the correct method. If the correct method has been used any additional NI or refunds will be calculated correctly.

NI rate has been wrong since the start of the tax year

If the new NI letter should have been applied from the beginning of the year, leave the existing NI values in the Current column and simply change the NI letter at the top of that column.

When the payroll is next calculated the NI values will be recalculated retrospectively and the NI record amended appropriately when you next finalise.

NI rate should have been applied part way through the year.

If the new NI letter should have been applied part way through the year and the original NI letter was correctly used for the earlier part of the year, then:

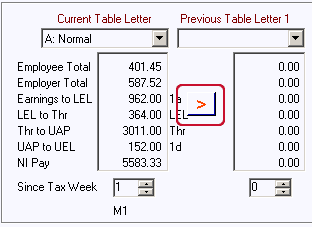

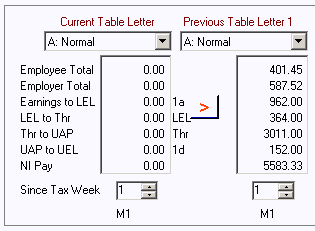

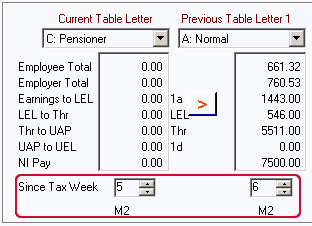

Switch the Current values to Previous Table Letter 1 (using the red transfer arrow):

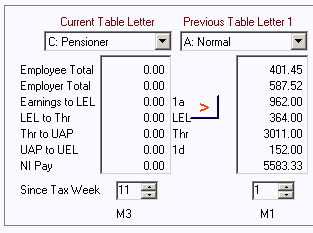

Change the Current NI letter to the new one:

Change the Since Tax Week at the bottom of the current table letter to reflect the week number from which the new NI letter applies, or should have been applied. (Even if paid monthly you must specify the tax week number, not the month number.)

Note: Due to the complex nature of retrospective NI calculations, it is not possible to perform Net to Gross pay calculations in the same pay period as a retrospective NI calculation.

Retrospective NI calc for a director.

Follow the steps under the section “NI rate should have been applied part way through the year.” above and additionally:

We need to determine the NI Pay value on which the old NI table letter should have been applied and split the total NI Pay between the old and the new table letters, amending the NI Pay field in each NI table letter column. The appropriate NI Pay figure can be determined from the copy payslip for the last pay period where the old letter should have been applicable. Do not change any values other than the NI Pay field.

When the payroll is next calculated the NI values will be recalculated retrospectively and the NI record amended appropriately when you next Finalise.

Note: Due to the complex nature of retrospective NI calculations, it is not possible to perform Net to Gross pay calculations in the same pay period as a retrospective NI calculation.

Potential Problems

NI Start weeks Inconsistent

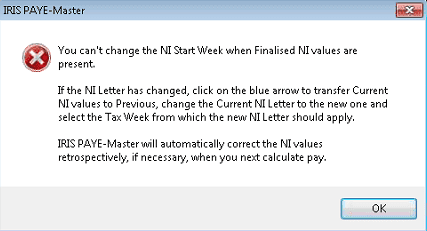

When trying to save the changes the user sees the error:

This is caused when the “Since Tax Week” options haven’t been set correctly. ie:

Correct the since tax week options and the record will save correctly.

You can’t change the NI start week when finalised NI values are present.

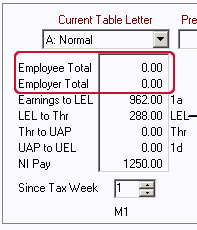

When trying to save the change of NI rate user gets the message:

This is likely because the employee has no EE’s / ER’s contributions:

The user will need to close the record and say No when asked to save changes.

Go back into the employee and just change the current table letter NI rate, since tax week remains at 1.

In situations where the NI rate changes but there have not been any NI contributions (EE’s or ER’s), you do not need to split the earnings over previous tables.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.