How do I process a leaver?

Article ID

11237

Article Name

How do I process a leaver?

Created Date

6th April 2018

Product

IRIS Bureau Payroll, IRIS Payroll Business

Problem

I have a leaver in my company, how do I report this to HMRC under RTI?

Resolution

Under RTI you no longer need to send a separate p45 document to the HMRC, all the leavers details go along with the regular FPS submission you make whenever you run a payroll. You still produce a p45 for the employee.

In terms of the payroll cycle the process would be:

- Enter Variations

- Calculate Payroll

- Produce reports (Summaries, Payslips, Pensions, etc.)

- Create BACS payments file (if applicable)

- Mark employees as leavers (and produce P45’s)

- Send Full Payment Submission (FPS)

- Finalise period

To set an employee as a leaver

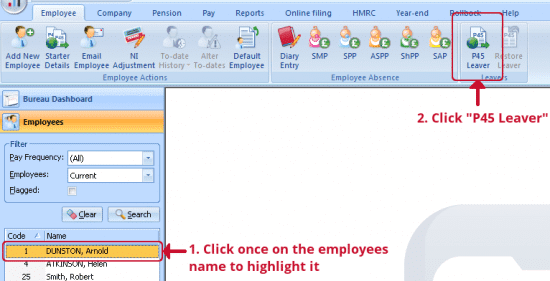

Highlight the name of the leaver in the list down the left-hand side of your screen and click the “p45 leaver” button from the employee tab.

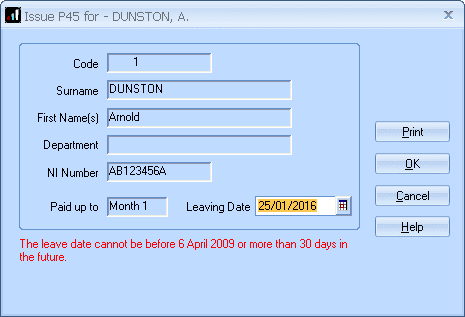

Enter the employees leave date. Click “Print” to produce the P45 Part 1a, 2 & 3 for the employee to take to their next place of work. Click “OK” to finish the process and set this employee as a leaver.

You should now see the leaver name turn red in the list. The system recognises they are a leaver and will send the relevant leaving information on the next FPS.

Do I make an employee a leaver before or after I have sent the FPS?

You make an employee a leaver after you have done the payroll and ran BACS, but before the FPS. That way they are marked as a leaver on the FPS along with their final payment. If you make an employee a leaver after sending the FPS, they will appear in the next pay period’s FPS. Depending on when the leaver was last paid HMRC could then recognise this as a late submission.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.