Paying holiday pay

Article ID

11639

Article Name

Paying holiday pay

Created Date

6th April 2018

Product

IRIS Payroll Business, IRIS Bureau Payroll

Problem

How to process holiday pay

Resolution

Configuring holiday pay rates and allowances

Before you can process holiday pay you need to configure the employee holiday rate and allowances.

For full details on configuring holidays click here.

Paying Holiday Pay

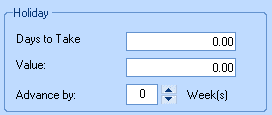

Holiday pay is assigned to employees on the variations window:

Days to Take – If you have configured the employees holiday information in their record card you can just type in a number of days holiday you wish to pay. The system will calculate the value of the payment and reduce the employee holiday allowance remaining accordingly.

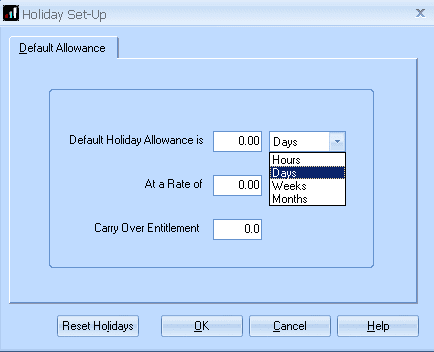

PLEASE NOTE: This will be shown on screen as Hours to take, Days to take, Weeks to take or Months to take depending on how the company level holiday options have been configured. To check this go to “Company” > “Holiday Setup“:

Value – Alternatively you can type a value to pay in here.

Advance by – Use this option if you wish to pay an employee with more than one period of tax/NI allowances. For example, you may wish to pay a weekly member of staff for one normal week and, for the following period, one week holiday. Set advance by to one (this week + one additional week) to spread the tax/NI calc over two weeks.

PLEASE NOTE: The advance by option will show as Week(s) or Month(s) depending on the pay frequency of the employee.

NOTE: You will not be able to pay this employee for the duration of the advanced periods used.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.