How to advance payroll (paying for more than one payroll period)

Article ID

11791

Article Name

How to advance payroll (paying for more than one payroll period)

Created Date

6th April 2017

Product

IRIS PAYE-Master

Problem

How can I pay an employee for more than one pay period?

Resolution

Normally this would only apply to a weekly payroll but periods can be advanced on any pay frequency in the same way.

Occasionally you may wish to pay employees for a period(s) in advance, ie during shut-down over Christmas you may want to pay employee for several weeks at once.

In this situation we need to “advance” the tax weeks so the employees do not overpay tax & NI.

Go to “Pay” > “Variations” > “Enter Variations”

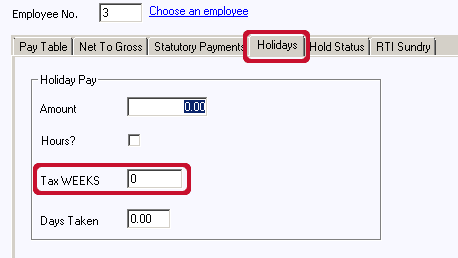

The option to advance is on the “Holidays” tab:

In the box “Tax WEEKS” type in the number of additional weeks you wish the calculation to run over. ie. If you type 1 into this box the system will apply 2 weeks of allowances to the calculation (current week + 1 additional week). If you type 2 into this box the system will apply 3 weeks worth of allowances to the calculation (current week + 2 additional weeks).

Go to “Pay Table”. In here you want to record as temp amounts what you wish the total pay across all periods to be (ie. 2x normal weekly pay).

Save the variations and repeat for each employee you want to advance. Once saved continue with your payroll as normal.

Resuming Payroll: If, in the advanced pay frequency, there are some employees still to pay (ie. some employee have not been advanced) then just continue with payroll as normal. The employees already advanced will not be included in your calculations.

If ALL the employees in the given pay frequency have been advanced leaving no one else to pay you will need to “Calculate” and “Finalise” the empty pay periods until you are up to the pay period you want to resume payments.

PLEASE NOTE: When you are finalising the empty pay periods the software will still prompt you to complete an FPS submission. If no employees are receiving pay in that period because all employees have been advanced you do not need to send an FPS, in fact the submission would fail if you attempted to send it. For this purpose you can ignore these warnings until you are paying your staff again.

IMPORTANT NOTE: When you are advancing payroll in this manner there a few things to be aware of:

• Because you are using the tax/NI allowances in advance PAYE-Master will not let you pay these employees again until you come to the end of the advanced period.

• When sending RTI submissions the values of payment for advanced employees will show on the last period they where advance to.

• Payslips for advanced employees will show the period number as the period they where advance to.

• Attachments of earnings will not process multiple amounts of the deduction, these deductions would need manually amending to cover the multiple pay periods.

• Automatic absence calculations (SMP, SSP, etc.) will not multiply across advanced periods. If an employee has an automatic absence calculation running on their record we recommend you do not advance them, but generate individual payslips for each period. You can still process and pay these periods ahead of time. Otherwise you would need to stop the automatic absence calculation and manually manage the remainder of the absence payments.

• When exporting automatic enrolment pension data select the number of the first period covered in this payment. For example, you are paying week 38 and advancing two weeks to week 40, select week 38 when exporting pension data.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.