Payslips published to OpenPayslips appear backwards (mirrored)

Article ID

11825

Article Name

Payslips published to OpenPayslips appear backwards (mirrored)

Created Date

6th April 2017

Product

IRIS OpenPayslips, IRIS Payroll Business, IRIS Bureau Payroll, IRIS Payroll Professional, Earnie

Problem

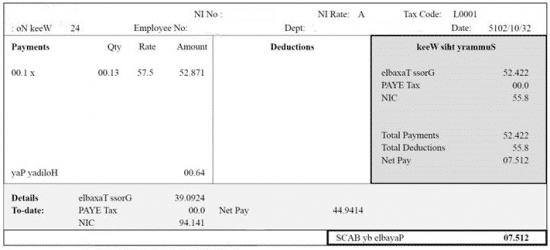

When viewing payslips after publishing to the OpenPayslips service they appear mirrored:

Resolution

This is caused by a conflict with Crystal Decisions, a third party piece of software we use when producing reports.

To correct this problem you need to reinstall the Crystal Decisions component.

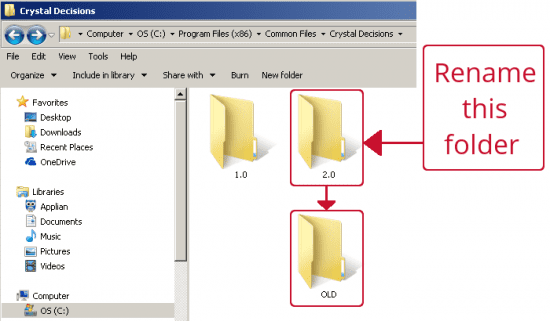

First, browse to the location:

C:\Program Files (x86)\Common Files\Crystal Decisions

or C:\Program Files\Common Files\Crystal Decisions if you use a 32-bit version of Windows

In here you should see a folder called “2.0” right click on this and rename to any other text:

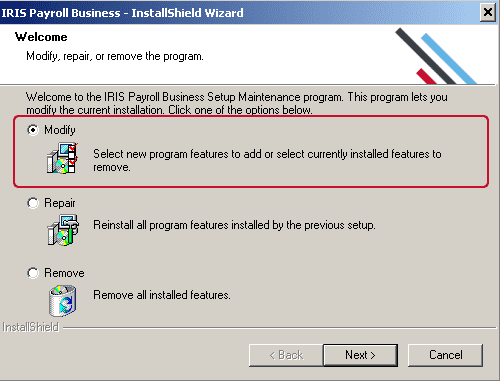

With the folder renamed next we need to reinstall the Crystal Decisions component. This is included with the installers for our payroll software, click here and download the latest version of your program.

Once the download is complete run the file and work through the installation wizard until you reach this point:

Choose the option Modify and click “Next“

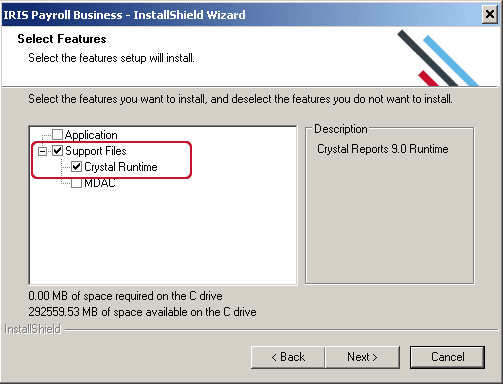

On the next screen make sure just “Support Files” and “Crystal Runtime” are ticked. Untick anything else.

Work through the rest of the wizard until it’s complete. Your payslips will now publish correctly.

PLEASE NOTE: If you do not see the options “Modify“, “Repair” or “Remove” as above it will mean the version of payroll you have downloaded is more up to date than the one currently installed on your system. If this is the case it is worthwhile running a complete install. This will correct your payslips problem and update your payroll software to the latest version in one go. Alternatively, you could select the option for “Custom” install and just select the “Crystal Runtime” similar to the screen shot above.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.