How to set up a salary sacrifice deduction E.g. Childcare Vouchers

Article ID

11935

Article Name

How to set up a salary sacrifice deduction E.g. Childcare Vouchers

Created Date

6th April 2018

Product

IRIS GP Payroll

Problem

How to set up a salary sacrifice deduction.

GP Payroll handles Childcare vouchers as an individual pay element. Other salary sacrifice scheme are configured as "Extra Deductions". The steps for both are detailed below.

For further legislation information about salary sacrifice schemes, check gov.uk here.

Exceptions: A salary sacrifice pension scheme would be configured from the pension options.

Resolution

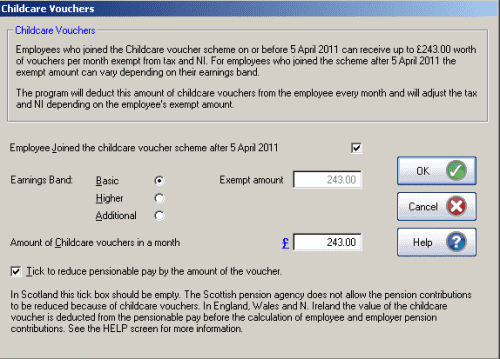

To set up Childcare deduction

- Click “Change Employee Details” and select the appropriate employee from the list.

- Click “Pay Details” and then “Childcare Vouchers“

- Select the earnings band for the employee based on their tax rate, Basic (20% tax), Higher (40% tax) or additional (45% tax) to set the “Exempt Amount“

- Type in the amount you want to deduct each pay period.

- If you are unsure,you will need to confirm with the pension provider if the salary sacrifice scheme should reduce the pensionable earnings for the employee, if so, tick the box.

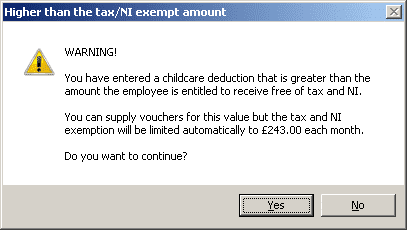

- If the amount to deduct is higher than the exempt amount set by the earning band selected you will see this warning:

You can still process the deduction at this higher value if you/the employee wishes, but they will only get tax and NI relief up to the exempt amount set by the earnings band.

- Click “OK“

- The next time you process payroll the deduction will be taken from the employee.

- To stop Childcare voucher deductions, return to “Pay Details” > “Childcare Vouchers” and set the “Amount of Childcare vouchers in a month” to £0.00

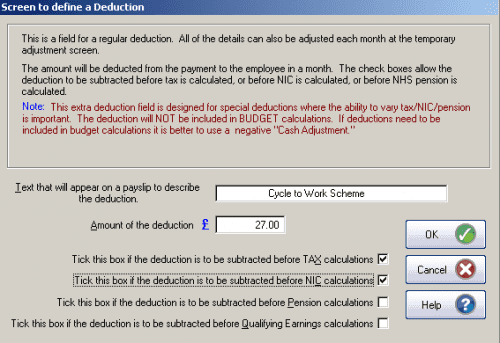

To set up any other salary sacrifice deduction

- Click “Change Employee Details” and select the appropriate employee from the list.

- Click “Pay Details” and then “User defined Deductions“

- Click “Add“

- Type in the description you want to show on the payslips e.g. Cycle to Work Scheme

- Type in the amount you want to deduct each pay period.

- Tick both boxes to indicate the deduction is made before the tax and NI calculation

- You will need to confirm with the pension provider if the salary sacrifice scheme should reduce the pensionable or qualifying earnings for the employee, if so, tick the boxes here.

- Click “OK“

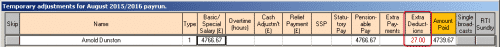

- The next time you process payroll the deduction will be taken from the employee:

Please Note: You cannot set a total amount for the deduction to pay back. You will need to remember to stop the deduction when the employee has made all the payments.

Employees should consider carefully the effect, or potential effect, that a reduction in their pay may have on:

- their future right to the original (higher) cash salary

- any pension scheme being contributed to

- entitlement to Working Tax Credit (WTC) or Child Tax Credit (CTC)

- entitlement to State Pension or other benefits such as Statutory Maternity Pay (SMP)

For further legislation information about salary sacrifice schemes, check gov.uk here.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.