Operating Appendix 5: Net of foreign tax credit relief

Article ID

12189

Article Name

Operating Appendix 5: Net of foreign tax credit relief

Created Date

1st November 2018

Problem

If an employee is working overseas HMRC may allow you to apply appendix 5 to reduce the amount of UK PAYE tax the employee will pay to offset any overseas tax which may be due.

For full details on Appendix 5 please see the HMRC guidance:

Resolution

In order to comply with Appendix 5 you need to reduce the amount of tax the system will calculate based on the employee earnings, this can be achieved using the Tax/NI override option found in the tools menu.

Please Note: Before proceeding with this the company needs the relevant authorisation from HMRC.

IRIS Payroll Professional & Earnie Users must first turn the Tax/NI override option on.

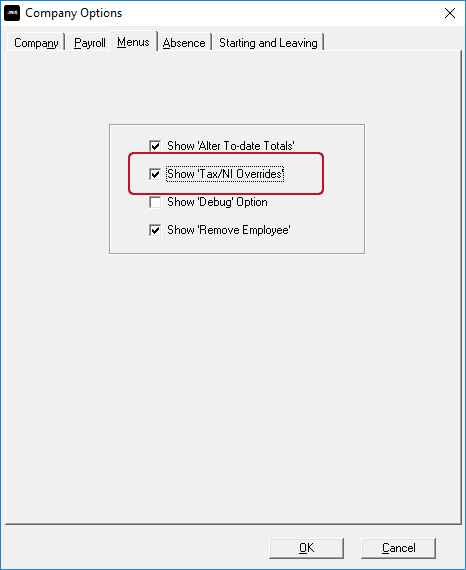

Go to “Company” | “Alter Company Options” | “Menus”

Tick the option “Show Tax/NI Overrides” and click “OK”

Please Note: Earnie IQ user do not need to do this, the option is already activated in that software.

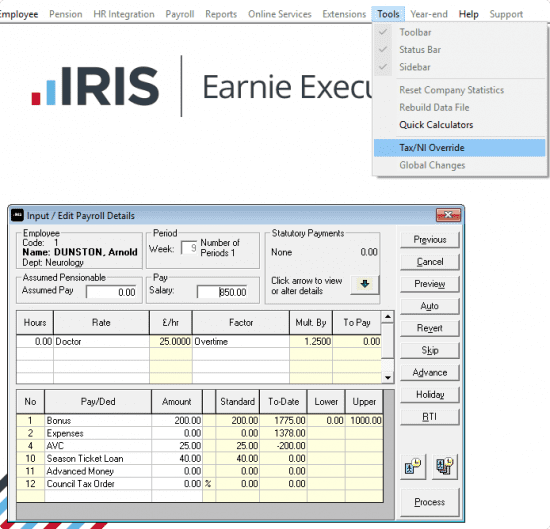

With the option turned on you can access the functionality from “Tools” | “Tax/NI Override”

You must have the pay variations screens open for the option to be activated

For the affected employee configure ALL the pay elements that will make up their pay before going into the Tax/NI Override.

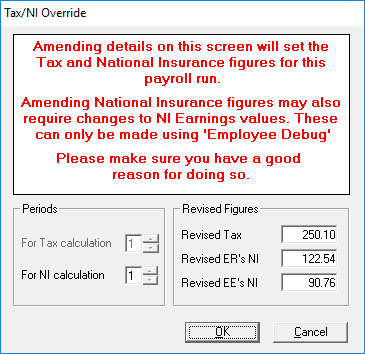

To allow for foreign tax relief all you need to do is reduce the value in the “Revised Tax” field by the amount of tax paid abroad.

The software will then take the value of the tax deduction as shown on this screen once you click OK.

You should not alter any of the other values on this screen.

Please Note: Before proceeding with this the company needs the relevant authorisation from HMRC.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.