Business Tax- Claim Creative Enhanced Expenditure credit 540,665 and 885

Article ID

business-tax-claim-creative-enhanced-expenditure-credit

Article Name

Business Tax- Claim Creative Enhanced Expenditure credit 540,665 and 885

Created Date

9th November 2021

Product

Problem

IRIS Business Tax: How to claim Creative Enhanced Expenditure credit boxes 540,665 and 885

Resolution

HMRC Post 2024/2025 rules – Certain Film/TV/Video game credits are now moved to the new Audio visual and video games ‘Expenditure credit regime’ instead of using the older Pre 2024/25 rules.

Below are the Pre 2024/2025 rules

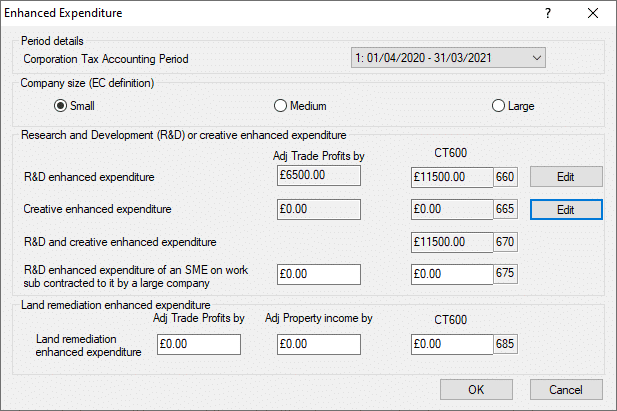

- Load the client and select the relevant period

- Enhanced Expenditure

- Creative enhanced expenditure – Click ‘Edit’

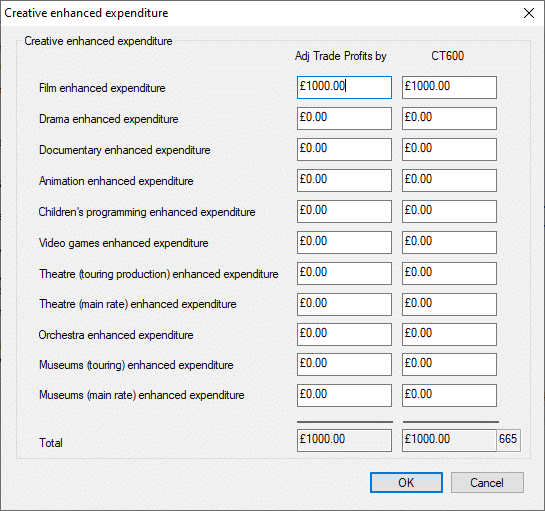

4. Fill in the relevant row with the expenditure value on both boxes and OK. This fills in boxes 665 and 670.

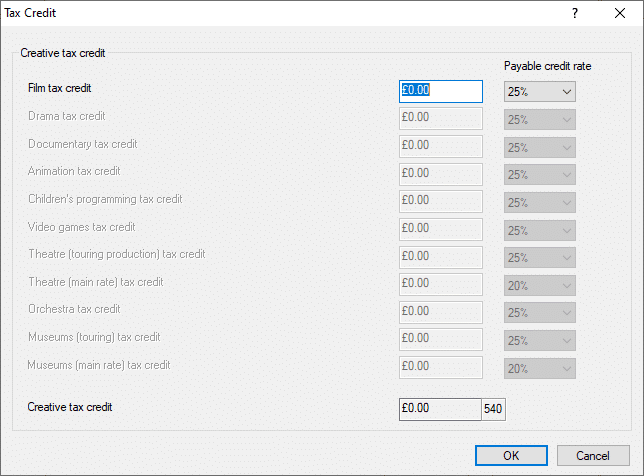

5. How to claim the Creative credit – Data entry, Calculation and Tax Reconciliation and next to ‘Creative Tax Credit’ box 540 and Edit. The row you had filled in earlier and IF the company is loss making AND you have the relevant periods – the box will be available and enter in the Creative tax credit value and OK. This fills in box 540 and on the Tax return Box 885.

IF this row ‘is greyed out’ then the company is not loss making and you cannot claim Creative credit.

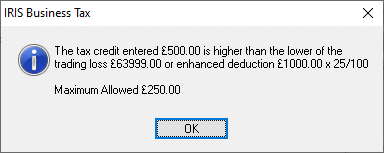

6. If you get a warning like this when entering the credit, then BT has auto-calculated what maximum credit claim can be used (it checks this against the enhanced expenditure value) and it will auto correct it. You cannot make a claim if it is above the allowed %.

7. From 2022 onwards HMRC have updated the Creative Tax credit rates to 45/50% (with the IRIS update 22.2.0). IRIS BT will also allow users to enter values to be entered as PRE and POST entries if your period straddles the HMRC date as it has to use the old 2021 rates and new 2022 rates. Do note the CT600 Tax return will not show any pre and post values, it will always show the total calculation.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.