P11D and PT- Car Engine size ‘CC’ and car benefit % calculation

Article ID

p11d-car-engine-size-cc-and-car-benefit-calculation

Article Name

P11D and PT- Car Engine size ‘CC’ and car benefit % calculation

Created Date

31st May 2022

Problem

IRIS P11D and PT- Car Engine size 'CC' and car benefit % calculation query - why is the % calc different to what you expected

Resolution

The Car benefit % value is calculated using these factors:

a. Car Registration Date (as it uses either the HMRC NEDC or WLTP tables from HMRC)

b. Fuel Type The ‘FUEL TYPE’ of the car may give different % rates – edit it to review the different % rates.

c. CO2 emissions /Approved zero emissions OR Engine Size. Check the values you entered in the two boxes: ‘CO2 emissions’ and ‘Approved Zero emissions’. These two entries OR Engine size correlate to the appropriate % rate (cross reference your entries with the HMRC table).

d. Check your looking at the correct HMRC period/year table- as each period/year may have different HMRC % rate tables.

e. Check the date in the field ‘Car availability- date car acquired’ – this can affect the final car benefit calculation at the bottom (remove/edit the date to see the change).

If you cannot apply the % rate you want after the checks then contact HMRC Support or raise a IRIS Community case with these details: What year your on, what’s the cars fuel type, what ‘CO2 emissions’, ‘Approved Zero emissions’ etc values you used and what the % rate you expected to show and what incorrect % rate you are getting instead.

NOTE: If a Electric Van zero emission using 2024/25 HMRC rules at 0% of £XXXX which is £0. Then enter this Van under Benefits (not car) as Type 15 Van and use a £0 value. If you want to check then contact the HMRC Support line.

The IRIS P11D/PT car benefit screen follows the % table for engine size from this HMRC link (So please double check your entries in the P11D – this is a common issue):

and this is the HMRC table used for each year

The P11D uses the HMRC table to calculate the % – https://www.gov.uk/guidance/company-car-benefit-the-appropriate-percentage-480-appendix-2

Read this KB link as well – https://www.iris.co.uk/support/knowledgebase/kb/p11d-car-make-model-missing-and-co2-engine-size-issue/

The Help ? option on the top right of the car benefit screen for engine size uses an old table and this will be updated. Please use the link above to find the correct % calculation.

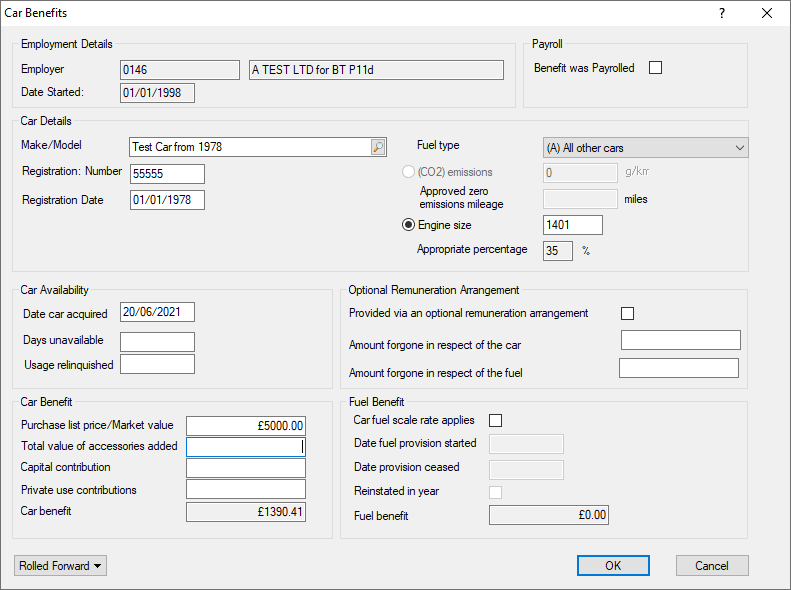

Below example uses the ENGINE SIZE to calc the % of 35% – if you edit the size (and also the approved zero/CO2 emissions- the % will change based on the HMRC rules)

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.