P11D and PT- Car make/model missing and CO2/engine size issue

Article ID

p11d-car-make-model-missing-and-co2-engine-size-issue

Article Name

P11D and PT- Car make/model missing and CO2/engine size issue

Created Date

13th September 2021

Product

IRIS P11D

Problem

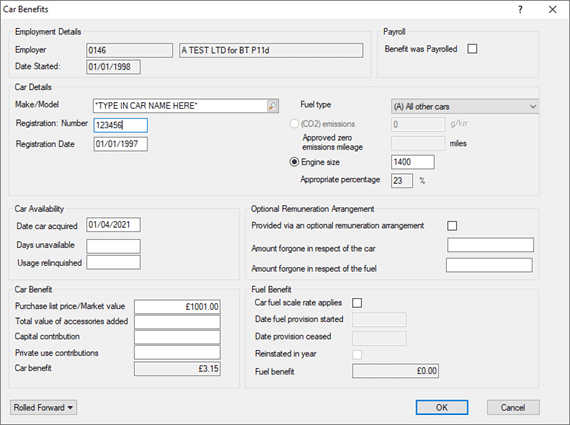

IRIS P11D and PT - when creating a new car benefit the car make/model missing from list and CO2/engine size issue. Hybrid cars and Approved Zero emissions mileage boxes.

Resolution

The Car benefit % value is calculated using 3 factors:

a.Car Registration Date (as it uses either the NEDC or WLTP tables)

b. Fuel Type

c. CO2 emissions /Approved zero emissions OR Engine Size.

Car Make and Model is missing/incorrect

The car list is provided by HMRC and is never 100% complete. There will be car models/makes missing or has incorrect values every year. You can select the closest type and save it. Once saved, you can edit/correct the name of the car and enter in the correct Co2 and Engine size etc. See the entry below in *TYPE IN CAR NAME HERE*. Do NOT use special characters in the car name.

‘Electric’ option not listed

Due to the increase of new electric designs, HMRC will miss a electric car option. If a car make has no electric option then select another car make and choose its electric option. Edit the name in the Make/Model field and then edit the CO2 values etc. (see below).

The Co2 and Engine Size values are incorrect – when I selected the car make/model, the details are pulled from the HMRC site: https://carfueldata.vehicle-certification-agency.gov.uk/. If you find any issues with the car Co2 etc. then you will need to contact vehicle certification agency.

The P11D uses the HMRC table to calculate the % – https://www.gov.uk/guidance/company-car-benefit-the-appropriate-percentage-480-appendix-2

You can still manually edit the Co2 and engine size values which adjusts the % calculation.

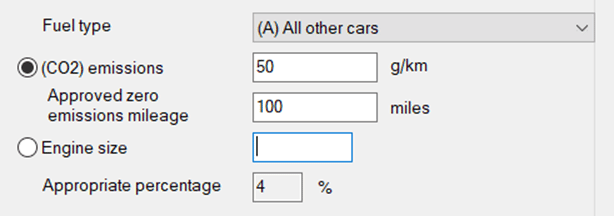

If its a electric/hybrid car then fill in the Approved Zero emissions mileage box as well. If the Zero emissions box is greyed out then enter 1+ value in the Co2 box. If the Co2 is 0 value then there is no need to enter a Zero emission value as the HMRC table will explain.

Note: if the CC/CO2 value is too high (eg over 50) it will always use the CC/CO2 value and will not allow any value under Approved Zero emissions mileage. You can test it by changing the CC to 50 and also 51 and see the change.

NEDC and WLTP – if a car was registered between March 2001 and April 2017, it will be based on its NEDC carbon dioxide emissions and not WLTP. If you need WLTP column of % then you need to test it by changing the the car registration date eg 2021 and onwards to see the change.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.