Personal Tax - How to edit NIC Class 2 and 4?

Article ID

personal-tax-how-to-edit-nic-class-2-and-4

Article Name

Personal Tax - How to edit NIC Class 2 and 4?

Created Date

4th October 2021

Product

Problem

IRIS Personal Tax-How to edit NIC class 2 and 4 on SA100 and voluntary pay NIC2 (with Post 2023 HMRC rules)

Resolution

Breakdown of the NIC2/4 value: Run the ‘Trade Computation’ to see how PT is calculating the NIC2 and NIC4 or if it is below income threshold/exempt

How to Voluntary pay NIC4? There is no function to voluntary pay NIC class 4 into Personal Tax. It is auto calculated based on the clients income.

2024/2025 year on IRIS version 24.1.0: The 8% change to 6% rate was only just announced in the Budget (this paragraph is dated 6/4/2024) therefore could not be included in the April release 24.1.0, thus this will be released in version 24.2. Also note this applies for Tax Year 2025 onwards (as it starts on 06/04/24)

1. There is no direct override the NIC4 values – you only have two options: If the client has Employment income – Income, Employment, Earnings/Foreign earnings, Open the employment and enter in ‘Class 1 earnings from P60’ at the bottom. This may adjust the NIC4 calc if it first meets HMRC rules (eg Class 1 NI Primary Threshold (PT), Reg100 calculation etc), if not met then it will show as ‘NIL’ adjustment on the trade comp.

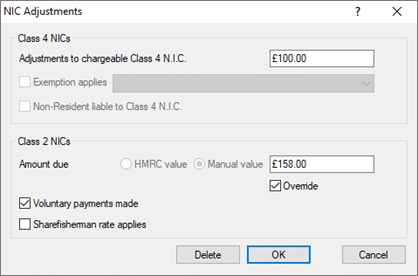

2. Manual adjustment to reduce NIC4– go to TPV, NIC adjustment, make changes to the top for Class 4. This NIC4 adjustment option is to reduce the profits only, as per HMRC guidance. If you make this adjustment, it only reduces the NIC4 by an apportioned amount (Run the TRADE comp to see the exact calculation). If you need to reduce it further, then increase the value. Add a note – under Reliefs/Misc/ Additional info SA100

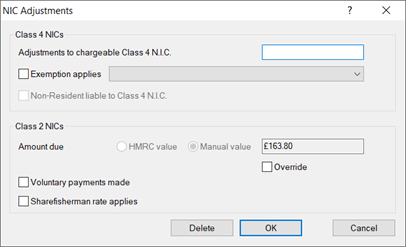

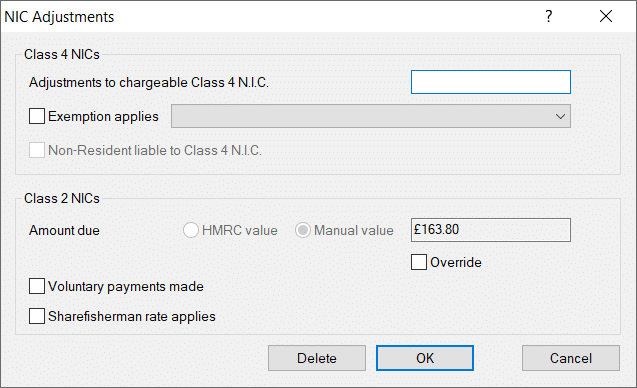

How to edit Class NIC2

1.TPV, NIC adjustment, make changes to the bottom for Class 2 and tick Override and Voluntary payments. Do not use ‘negative’ values as they are ignored on the Tax comp. Please read the post 2023 NIC2 below which changes the rules.

2. Note: If the Class 2 is missing on the Tax comp then untick ‘Voluntary payments made’ and check the Tax comp again.

How to voluntary pay NIC2 (Pre 2023)

Iris automatically calculates the Class 2 NIC. If you need to force the Voluntary payments please; 1) Expand Trade, Profession or vocation 2) NIC Adjustments 3) Tick ‘Voluntary Payments’ and enter the value. Please READ the post 2023 NIC2 rules below as well.

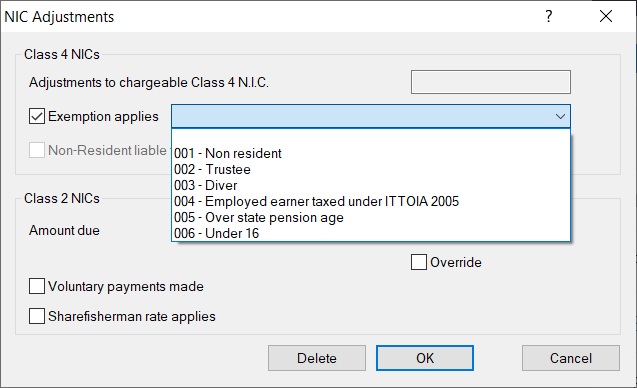

How to get Exemption for NIC4?

TPV, NIC adjustment, there is a option to be ticked ‘Exemption applies’ OR PT will automatically apply this if the client meets the exemption rules. For example if client under 16 years old this will be auto ticked and greyed out and no NIC4 will be calculated.

How is NIC2 and NIC4 Calculated?

Go to Report, Trading computation – run this and it shows the NIC calc at the bottom.

Post 2023 rules: No Voluntary NIC2 shows and missing from Tax comp – shows as ‘Tax Paid /Treated as paid’

The Example below is for 2022/2023 period and HMRC will change the threshold rules for 2024 and onwards.

HMRC have changed the NIC2 rules. Class 2 NIC is now longer appearing in the tax calculation summary, even if the box has been ticked to pay voluntarily, if the profit level is between the Small Profits Threshold of £6725 and the Lower Profits Threshold of £11908 (these are 2022/2023 rules).

HMRC have advised the following in their SA103S/SA103F/SA104S/SA104F notes: If your taxable profits are less than £6,725 or you made a loss, you can choose to pay Class 2 NICs voluntarily to protect your entitlement to State Pension and certain benefits. You must be registered as self-employed to pay Class 2 NICs or to pay voluntarily.If your taxable profits are from £6,725 to £11,908 you will not need to pay Class 2 NICs, your contributions are treated as having been paid to protect your entitlement to State Pension and certain benefits.If your taxable profits are more than £11,908 you must pay Class 2 NICs (£3.15 a week).

Why is the Trade comp showing the NIC adjustment but not the Tax comp?

The Trade computation simply takes the value that is entered in the adjustment field and applies it in the report, it does not verify it onto the Tax comp.

Also the Tax Computation is an independent calculation that is based on the HMRC calculation.

Why the Trade and Tax comp not showing the Class 2/4 NIC calculation etc?

Run the ‘NIC Adjustments’- at the top next to Exemption applies: it may state its over pension age, under NIC age or non resident etc. If its greyed out then its because PT will check the age of the client and if the non resident questionnaire is ticked and auto complete this box for you. The Trade comp will not show this breakdown on why its not being calculated.

NIC2 is missing from the payments on account? The Class 2 NIC does not get included in the payments on account as per HMRC’s guidelines. From 6 April 2024, self-employed people with profits above £12,570 will no longer be required to pay Class 2 NICs but will continue to receive access to contributory benefits including the State Pension. This is a tax simplification that effectively abolishes Class 2 NICs by removing the requirement for self-employed people to pay.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.