Personal Tax- Other or Private pension incorrect/missing on Tax comp. HMRC or Manual values

Article ID

personal-tax-other-private-pension-missing-from-tax-comp

Article Name

Personal Tax- Other or Private pension incorrect/missing on Tax comp. HMRC or Manual values

Created Date

9th August 2021

Product

Problem

IRIS Personal Tax- Other/private pension entry is incorrect or missing from Tax comp yet it appears on the Schedules of Data report. HMRC or Manual values

Resolution

This is related to the ‘HMRC or Manual’ values linked to pensions. You get an issue for Pensions in FOUR different ways:

- Pension entry or tax deduction is missing or is a different value on the Tax comp

- Pension entry only appears on Schedules of Data but is missing on the Tax comp, SA100 etc .

- Pension entry is missing from Schedules of Data and Checklist

- An ‘Unknown pension income/benefit’ showing on the Tax comp/smarttax etc.

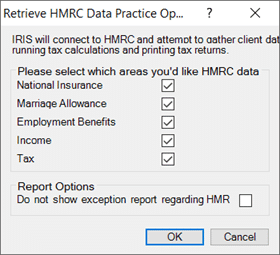

a.Load the Client and select the relevant year, go to Setup, ‘Retrieve HMRC data practice options’ and tick on all 5 tick boxes and OK

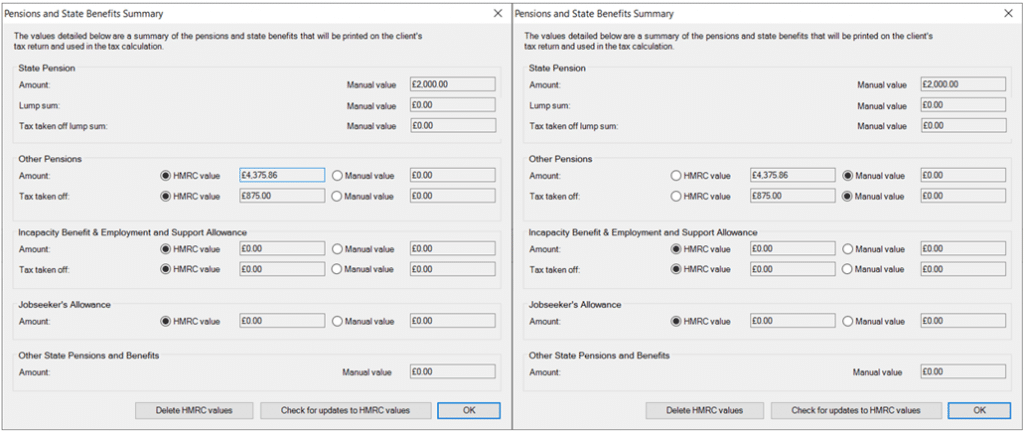

b. Go to Pensions and State benefits, Other Pensions. On bottom right – ‘View pension and state benefit summary‘ – this may show values from HMRC. If this button is missing, open a different income section eg Employment and then go back to pensions

c. Tick ‘Manual value’ (not HMRC value) so it picks up your manual entry, now check the Schedules, Tax comp and SA100.

d. OR if you want to use the HMRC value then tick that instead. If there is a HMRC value (if ticked) here then it will not show on the summary screen or on the schedules and only appears here on the above entry screen. The HMRC value (if ticked) will now appear on the Tax computation etc (Warning: If the HMRC value is £0 then nothing will show on the Tax comp/SA100 etc).

NOTE: If you switch on ‘HMRC data retrieval’ function – PT will automatically use the ‘HMRC value’ over any of your manual entries (even if its a 0 or a Value). Even if you then switch retrieval off it will still keep using the HMRC value, unless you switch it to ‘Manual value’. There is no feature to default this function to only pick up manual values and ignore HMRC values.

PT E-checklist is not picking up any HMRC value data from prior year – For example Employment and Pension HMRC income is missing on the e-checklist. HMRC values have never been used for e-checklists as these values have been amalgamated and any clients affected would require individual values therefore ‘manual values’ will be picked when using e-checklist. If you want to run 2022 e-checklist, follow these steps:

a) Go back to 2021 and open the HMRC value. Switch to Manual values and enter the same income values.

b) Change to 2022. Edit and Bring forward. Then delete the old e-checklist.

c) Generate a new checklist and it will pick up the Manual values.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.