Personal Tax: Property Capital gain is giving 18/28% showing instead of 10/20%? New 2024/25 18/24% rate?

Article ID

personal-tax-property-capital-gain-is-giving-18-28-showing-instead-of-10-20

Article Name

Personal Tax: Property Capital gain is giving 18/28% showing instead of 10/20%? New 2024/25 18/24% rate?

Created Date

11th August 2022

Product

IRIS Personal Tax

Problem

IRIS Personal Tax: Property Capital gain is giving 18/28% showing instead of 10/20%. New 2024/25 rates of 18/24%?

Resolution

2024/2025 New HMRC 18/24 from 10/20%. The IRIS Development team have confirmed that the new HMRC 18/24% rates is planned for future release version 25.1.0 in April 2025. Why not release earlier?: HMRC may have stated the changes in early 2023/2024 however we are dependent upon the HMRC calculation for 2024/2025 to be sent to our Development team and we only received these instructions late 2024 and we will need time to design it into PT.

1.Load the client in PT and select relevant year

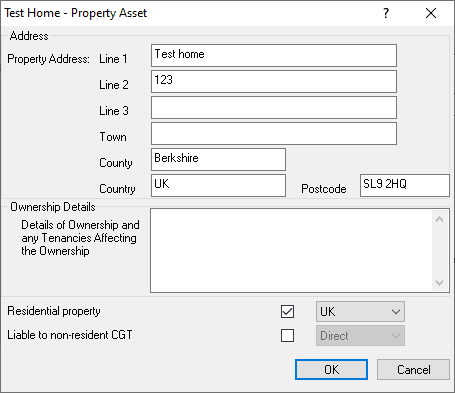

2. Dividends, Capital assets, Assets, Open the asset, Then click on ‘Land and property’. If already selected, then click on the magnifying glass:

3. If you want the 18/28% calc then ‘tick’ the Residential property at the bottom.

4. If you want the 10/20% calc then ‘untick’ the Residential property at the bottom.

5. If you have already done one of the options above but it still calculates at the other %. Open the asset and reverse the tick/untick. Run the CG Comp next and then go back to asset and tick or untick it again and now run the CG Comp again.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.