Trust Tax- 3001 4020 4065 Error ‘Number of Other Trust rate Trusts’ OR Missing information (Special ID11)

Article ID

trust-tax-3001-4020-4065-error-number-of-other-trust-rate-trusts

Article Name

Trust Tax- 3001 4020 4065 Error ‘Number of Other Trust rate Trusts’ OR Missing information (Special ID11)

Created Date

23rd May 2025

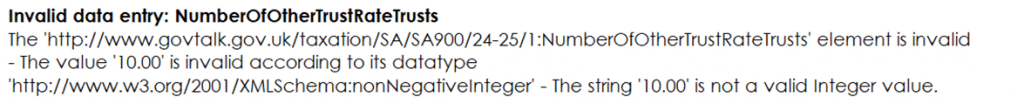

Problem

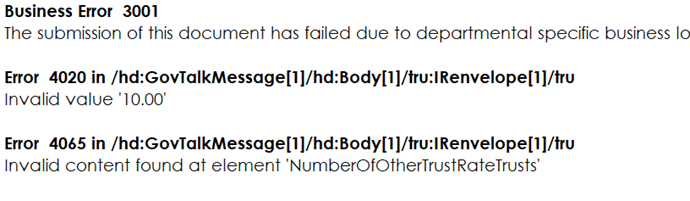

IRIS Trust Tax- 3001 4020 4065 Error 'Number of Other Trust rate Trusts'

Resolution

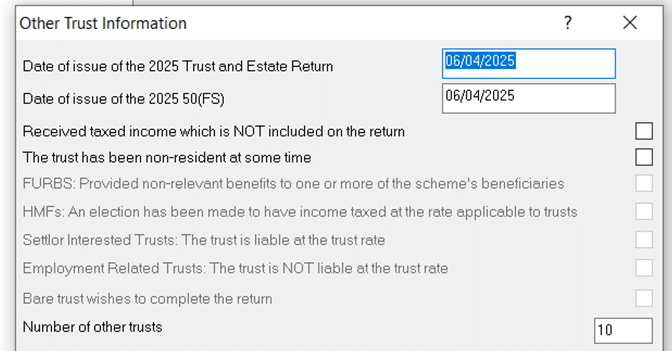

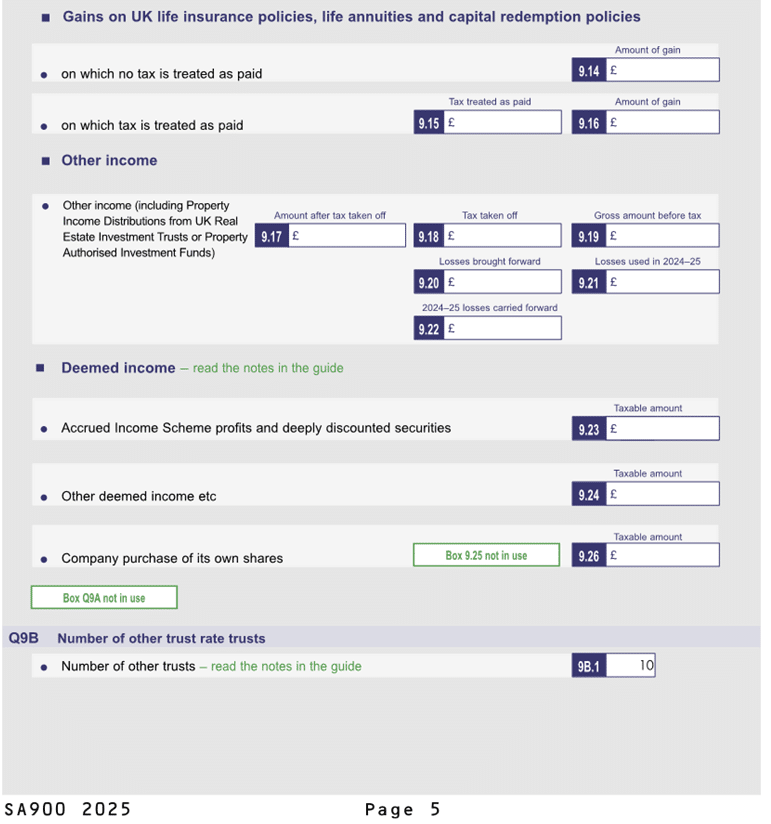

Entered a value in Page 5 Box 9B.1 (Go to Data Entry/Trusts/Other Trust information/’Number of other trusts’ field) but when you generate you get error ‘Number of Other Trust rate Trusts = XX’ and if you try and submit you then get the 3001 4020 4065 with same warning. This is a DEFECT and is fixed with the IRIS version 25.1.4.42.

NOTE: If you enter a 0/ZERO value then box 9B.1 will remain empty or null and cannot be forced to show ‘0’. This empty/null box counts as ‘0’ – it will only pick up 1+ value entries. This can be linked to the Special case ID11 below.

Special ID11 –HMRC Missing information If you are on version 25.1.4 and may get a Special ID11 warning when generating etc. If you bypass the warning and submit it successfully (accepted) but then you note from the HMRC side its not processed with missing information then this is a new 2025 HMRC Special ID where there is a schema issue from the HMRC side (not from IRIS). HMRC have just provided the rules to fix this in version 25.3.0 later in 2025. The KB on Special IDs.

If you urgently need to submit it then remove the value in box 9B.1, and check the Tax comp and Tax return. If the tax calculation is what you still expected then add a NOTE to the tax return to state box 9B.1 should be populated with XX and you plan to submit an amended return once a fix is released. If the Tax calculation changes by removing the entry in 9B.1 then please await further news.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.