Error 1046: Sender ID / Password are incorrect for the Tax District Number and Reference you are submitting.

Article ID

11597

Article Name

Error 1046: Sender ID / Password are incorrect for the Tax District Number and Reference you are submitting.

Created Date

1st May 2019

Product

IRIS PAYE-Master, IRIS Payroll Business, IRIS Bureau Payroll, IRIS GP Payroll, IRIS Payroll Professional, Earnie, IRIS Earnie IQ

Problem

RTI Submissions are rejected with the error:

Error Number 1046

Authentication Failure. The supplied user credentials failed validation for the requested service.

Resolution

HMRC can refuse to authenticate submissions for the following reasons

Incorrect credentials

When filing online using your payroll product your Gateway User ID, Password and PAYE-Reference (tax district and reference number) are checked against the records held on the HMRC systems. If one or more of these do not match you will receive an Error 1046.

Incorrect User ID & Password

This is the most common reason for receiving an Error 1046. A good way to check the user ID and password is to go to the HMRC login website and try to log in by copying and pasting the User ID and password.

When entering the password into the HMRC website, only the first 12 digits are accepted. When entering them into the software it recognises all digits so would deem anything after the first 12 as being incorrect causing the Error 1046. If your password is longer than 12 digits, only use the first 12 within the payroll software.

If you are unsure of these details contact HMRC Online services helpdesk on 0300 200 3600. Alternatively, you could work through the password reset process here.

Please note : A security feature employed by HMRC means if you enter the wrong User ID or password three times or more when trying to log on to the HMRC website, your account will be locked and you won’t be able to use HMRC Online Services for the next two hours. You will be able to try again after the 2 hour period has expired.

Incorrect PAYE-Reference

Log on to the HMRC website using your User ID and Password.

Click on “Your Services“

Check the companies “Tax District” and “Reference” are registered and activated for you to file RTI submissions online.

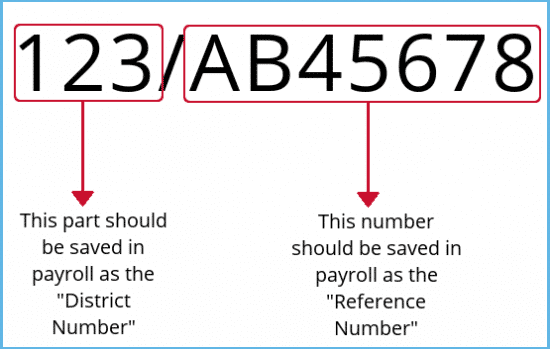

The Tax District field should contain 3 numbers (example : 123). The Tax Reference field should contain the other details (example : AB45678). You should not enter a forward slash into the fields. This will cause the submission to fail.

Incorrect District Name

We have had instances of the submission failing due to an incorrect tax district name.

Check the district name with HMRC to make sure the correct details are used in your payroll software.

If the user ID, password, district number and reference number are all shown to be correct check HMRC are expecting PAYE submissions on this account.

Not registered for the service

If PAYE for Employers is not listed under “Your Services” you will need to register for this before you are able to file online.

Not activated for the service

After registering for a service you should receive an activation code. The activation code will be issued within seven days – use it once then throw it away. It will expire if you don’t use it within 28 days of the date on the letter, you will have to request a new one.

You will not be able to file online unless you have registered for PAYE for Employers and activated this service.

Sending Submissions to the old HMRC service

HMRC recently changed the web address (URL) you use to send your RTI submissions. It is possible this change was not reflected in your local security set up.

You may need to amend your security software (anti-virus/firewall) to allow all communication to the following addresses:

https://transaction-engine.tax.service.gov.uk/poll

https://transaction-engine.tax.service.gov.uk/submission

To continue to receive email communications from HMRC you may need to add the following addresses to your email whitelist, safe list, not spam:

gateway.confirmation@gateway.gov.uk

no.reply@confirmation.tax.service.gov.uk

Please refer to your IT support or security software or email provider for assistance.

If all of the above have been checked and you are still getting the error you can force the software to recreate the connection details used to make your submissions.

Browse to your payroll software installation folder. If you are not sure where this is located, right-click on your payroll short-cut and select the option “Open file location“.

If the list of files and folders you’re presented with, look through the list for the file RTI.CONFIG. (The exception to this is GP Payroll. For GP Payroll, open the folder DLLs, you will find the file RTI.CONFIG in here.)

Delete the file RTI.CONFIG.

Go back to your payroll software and send the submission again. This will force the software to create a new copy of the file RTI.CONFIG

Web Browser Auto Complete

In a very small number of circumstance, this error has been seen to be caused by web browser auto complete setting filling in the wrong details on forms.

Click here for details on auto complete.

Click here for further assistance with other online filing issues.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.