Posting Journal File

Article ID

11958

Article Name

Posting Journal File

Created Date

6th April 2018

Product

IRIS Payroll Business, IRIS Bureau Payroll

Problem

How do I post a journal file for import into my accounts software?

Resolution

Note: if you have not configured an Accounts Link yet, you cannot use this screen.

Use the Configure Accounts Link screen to create a file of accounts information that can be imported into your accounts package. Click here for details.

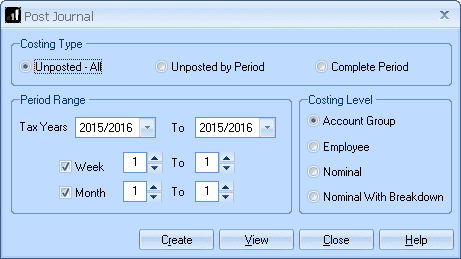

To open the “Post Journal” screen, click on the “Pay” tab then click “Post Journal“:

Costing Type

The option you choose here determines which information is included in the accounts file:

• Unposted All – the file will include all accounts information that has not yet been included in a previous accounts file (i.e. all new accounts information).

• Unposted by Period – the file will include all accounts information from the specified Pay Period(s) that has not yet been included in a previous accounts file.

• Complete Period – the file will include all accounts information from the specified Pay Period(s) regardless of whether the information has already been included in a previous accounts file.

Using either of the Unposted options ensures that the accounts file does not include any information that has already been imported into your accounts package, which means there will be no duplicated entries.

The Complete Period option is useful if you know that no data has yet been imported into your accounts package for the Pay Period(s) concerned.

Period Range

If you choose Unposted All as the Costing Type, the Period Range fields are disabled.

Tax Years

If you have been using IRIS Payroll for several years, you can select previous tax years to include in the accounts file. This might be useful, for example, if you have lost your accounts data and you need to re-construct it.

Week & Month

If you are running a payroll which includes both weekly-paid and monthly-paid employees, you can include both weekly and monthly information in the accounts file. If you want to create a file that contains only weekly information, for example, you should un-tick the Month box.

You can select a range of weeks (or months) by entering the start and end periods in the boxes provided, or you can specify a single week (or month) by entering the same pay period in both boxes.

Costing Level

The Costing Level has no effect on the information in the accounts file; it is only used in the View Journal screen which is displayed if you click View.

View

Click the View button to display the View Journal screen. This does not create the file, it just allows you to see what information would be included in the file if you were to create it.

Create

Click the Create button to display the Enter Account Details screen which allows you to create the file of accounts information.

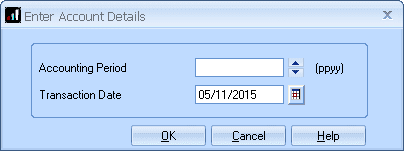

When you click on Create you will be taken to the enter account details screen:

Some accounting packages require additional information to be included in the Journal File so they can import it successfully.

Use the Enter Account Details screen to specify additional information for the Journal File.

Accounting Period

Enter the Accounting Period to match what is required by your accounts software.

Transaction Date

The default Transaction Date is the current date but you can amend this if you prefer.

Click “OK” and the journal file will be created. This file will be created your payroll program folder, you will then need to import this into your accounts software.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.